Paper trading platforms provide a risk-free environment for users to practice trading strategies with virtual funds, enabling skill development without financial loss. Mobile trading apps offer real-time access to live markets, allowing users to execute trades quickly and manage portfolios on the go. Explore the differences between these tools to enhance your trading experience effectively.

Why it is important

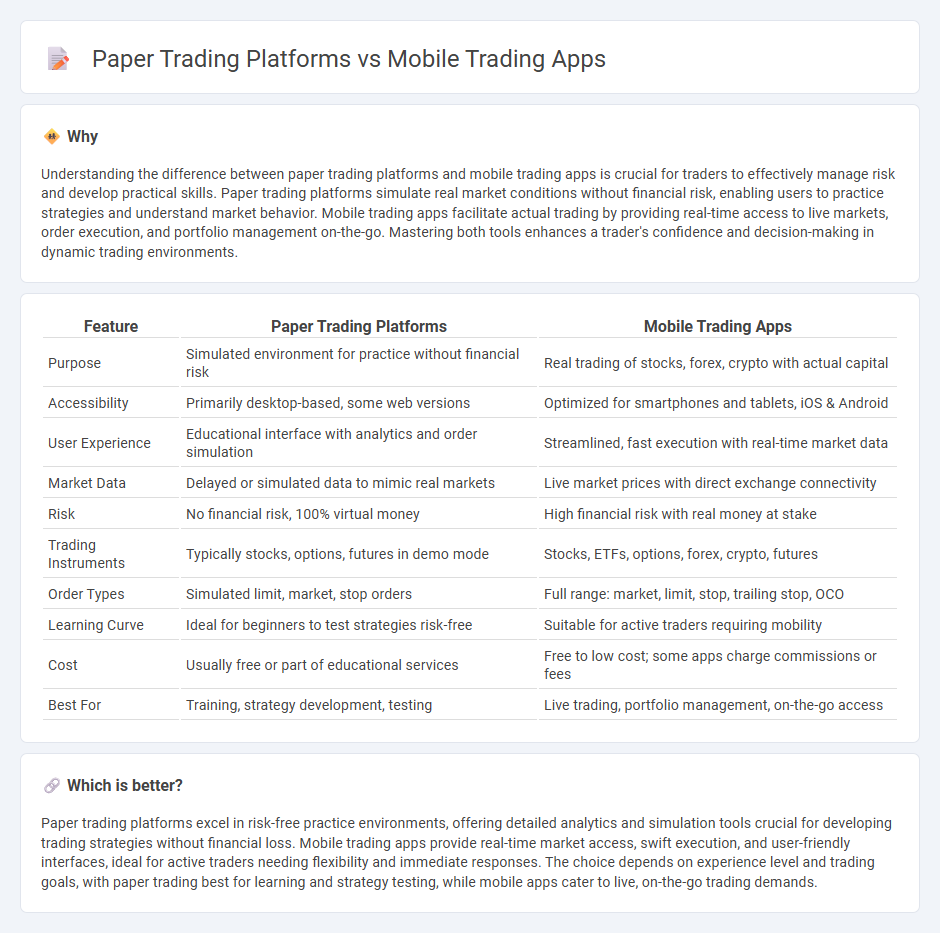

Understanding the difference between paper trading platforms and mobile trading apps is crucial for traders to effectively manage risk and develop practical skills. Paper trading platforms simulate real market conditions without financial risk, enabling users to practice strategies and understand market behavior. Mobile trading apps facilitate actual trading by providing real-time access to live markets, order execution, and portfolio management on-the-go. Mastering both tools enhances a trader's confidence and decision-making in dynamic trading environments.

Comparison Table

| Feature | Paper Trading Platforms | Mobile Trading Apps |

|---|---|---|

| Purpose | Simulated environment for practice without financial risk | Real trading of stocks, forex, crypto with actual capital |

| Accessibility | Primarily desktop-based, some web versions | Optimized for smartphones and tablets, iOS & Android |

| User Experience | Educational interface with analytics and order simulation | Streamlined, fast execution with real-time market data |

| Market Data | Delayed or simulated data to mimic real markets | Live market prices with direct exchange connectivity |

| Risk | No financial risk, 100% virtual money | High financial risk with real money at stake |

| Trading Instruments | Typically stocks, options, futures in demo mode | Stocks, ETFs, options, forex, crypto, futures |

| Order Types | Simulated limit, market, stop orders | Full range: market, limit, stop, trailing stop, OCO |

| Learning Curve | Ideal for beginners to test strategies risk-free | Suitable for active traders requiring mobility |

| Cost | Usually free or part of educational services | Free to low cost; some apps charge commissions or fees |

| Best For | Training, strategy development, testing | Live trading, portfolio management, on-the-go access |

Which is better?

Paper trading platforms excel in risk-free practice environments, offering detailed analytics and simulation tools crucial for developing trading strategies without financial loss. Mobile trading apps provide real-time market access, swift execution, and user-friendly interfaces, ideal for active traders needing flexibility and immediate responses. The choice depends on experience level and trading goals, with paper trading best for learning and strategy testing, while mobile apps cater to live, on-the-go trading demands.

Connection

Paper trading platforms and mobile trading apps are interconnected through real-time market data integration and user interface synchronization, enabling investors to practice strategies without financial risk on the go. These platforms utilize cloud-based technology to seamlessly update simulated portfolios across devices, ensuring consistency in trading experiences. The convergence of both tools enhances learning efficiency and decision-making accuracy for traders.

Key Terms

Real-time execution

Mobile trading apps provide real-time execution with instant order placement and immediate market data updates, crucial for active traders seeking rapid responses. Paper trading platforms simulate trades without actual market risk but often lack true real-time execution speed and live market conditions. Explore the differences further to optimize your trading strategy.

Simulated environment

Mobile trading apps provide real-time market data and interactive tools, enabling users to practice trading in a dynamic, simulated environment that closely mimics actual market conditions. Paper trading platforms offer a risk-free method to test strategies using virtual funds without financial consequences, ideal for beginners to gain confidence. Explore the differences and benefits of these platforms to enhance your trading skills effectively.

Order fulfillment

Mobile trading apps provide real-time order fulfillment with instant execution and market updates, enhancing responsiveness during volatile market conditions. Paper trading platforms simulate order placement without actual transaction execution, allowing users to practice strategies without financial risk. Explore detailed comparisons to understand how each platform impacts trading efficiency and decision-making.

Source and External Links

E*TRADE Mobile Platforms - Offers two full-featured mobile trading apps designed for traders and investors, supporting stocks, ETFs, mutual funds, options, with $0 commissions on US trades and advanced features like interactive charts and market insights.

Best Stock Trading Apps | 2025 Investing Guide - Highlights notable mobile trading apps like Webull, perfect for commission-free options trading, advanced analysis, and educational resources, featuring both basic and sophisticated tools for active investors.

Schwab Mobile Trading App - Enables secure stock, ETF, options, and mutual fund trading with features such as real-time market updates, multi-leg options strategies, and smartwatch integration, emphasizing user security and convenience.

dowidth.com

dowidth.com