Smart Money Concepts focus on analyzing the actions of institutional investors to predict market movements by identifying liquidity zones and order blocks. Momentum Trading relies on capitalizing on the strength and speed of price trends, using indicators such as moving averages and the Relative Strength Index (RSI). Explore the distinct strategies and benefits of each approach to enhance your trading performance.

Why it is important

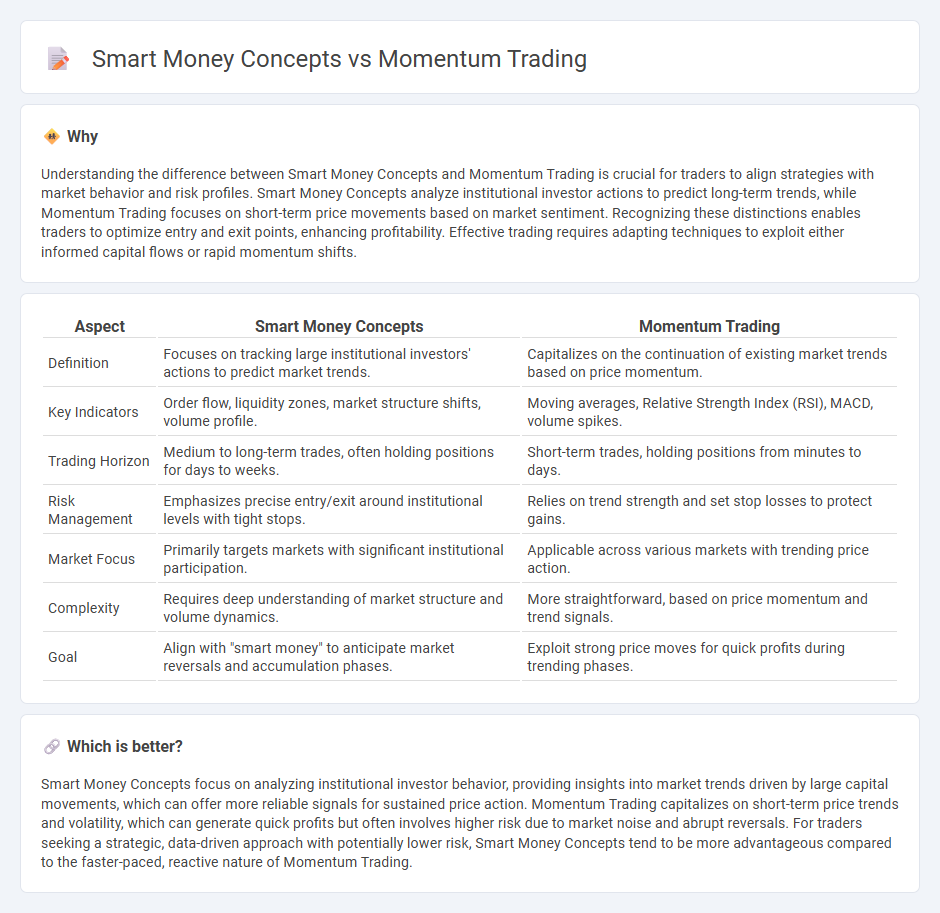

Understanding the difference between Smart Money Concepts and Momentum Trading is crucial for traders to align strategies with market behavior and risk profiles. Smart Money Concepts analyze institutional investor actions to predict long-term trends, while Momentum Trading focuses on short-term price movements based on market sentiment. Recognizing these distinctions enables traders to optimize entry and exit points, enhancing profitability. Effective trading requires adapting techniques to exploit either informed capital flows or rapid momentum shifts.

Comparison Table

| Aspect | Smart Money Concepts | Momentum Trading |

|---|---|---|

| Definition | Focuses on tracking large institutional investors' actions to predict market trends. | Capitalizes on the continuation of existing market trends based on price momentum. |

| Key Indicators | Order flow, liquidity zones, market structure shifts, volume profile. | Moving averages, Relative Strength Index (RSI), MACD, volume spikes. |

| Trading Horizon | Medium to long-term trades, often holding positions for days to weeks. | Short-term trades, holding positions from minutes to days. |

| Risk Management | Emphasizes precise entry/exit around institutional levels with tight stops. | Relies on trend strength and set stop losses to protect gains. |

| Market Focus | Primarily targets markets with significant institutional participation. | Applicable across various markets with trending price action. |

| Complexity | Requires deep understanding of market structure and volume dynamics. | More straightforward, based on price momentum and trend signals. |

| Goal | Align with "smart money" to anticipate market reversals and accumulation phases. | Exploit strong price moves for quick profits during trending phases. |

Which is better?

Smart Money Concepts focus on analyzing institutional investor behavior, providing insights into market trends driven by large capital movements, which can offer more reliable signals for sustained price action. Momentum Trading capitalizes on short-term price trends and volatility, which can generate quick profits but often involves higher risk due to market noise and abrupt reversals. For traders seeking a strategic, data-driven approach with potentially lower risk, Smart Money Concepts tend to be more advantageous compared to the faster-paced, reactive nature of Momentum Trading.

Connection

Smart money concepts focus on the buying and selling activities of institutional investors, which often precede significant market moves, while momentum trading capitalizes on these trends once they gain strength. Identifying smart money footprints through volume spikes, accumulation patterns, and price action helps momentum traders enter trades aligned with strong directional moves. Combining smart money analysis with momentum trading enhances trade timing and risk management by leveraging insights from market leaders and sustained price momentum.

Key Terms

Momentum Trading:

Momentum trading capitalizes on price trends and market momentum by buying assets showing upward price movement and selling those with downward momentum, leveraging technical indicators like Moving Averages and Relative Strength Index (RSI). This approach contrasts with smart money concepts, which analyze institutional trading patterns and market manipulation to predict price shifts. Explore further to understand how momentum trading strategies can enhance your market timing and profit potential.

Relative Strength Index (RSI)

Momentum trading leverages the Relative Strength Index (RSI) to identify overbought or oversold market conditions, signaling potential trend reversals or continuations. Smart Money Concepts integrate RSI within broader institutional trading patterns, emphasizing divergence and confluence zones to anticipate significant market moves. Explore deeper insights into how RSI dynamically informs both strategies for enhanced trading accuracy.

Breakout

Momentum trading capitalizes on price surges and volume spikes to enter trades during breakouts, targeting swift gains as market momentum builds. Smart Money Concepts emphasize volume profile, order flow, and institutional activity to identify genuine breakout points driven by informed capital movements. Explore these strategies in-depth to master breakout trading dynamics effectively.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends, with two main types: time-series momentum, which focuses on an asset's own past performance, and cross-sectional momentum, which compares assets against each other to identify the strongest performers for trading.

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - Momentum trading strategies center on capitalizing on continuing price trends, distinguishing between time-series momentum that monitors individual asset trends over time and cross-sectional momentum that ranks assets relative to each other within a group.

Momentum Trading for Beginners (What They Don't Teach You) - This video explains momentum trading as a method of trading with strength by riding strong price moves, discussing key signals like volume and volatility, practical strategies, risk management, and trading tools such as RSI and MACD for various markets including stocks and crypto.

dowidth.com

dowidth.com