Altcoin sniping involves strategically purchasing undervalued altcoins immediately after listing to capitalize on early price surges, contrasting with pump and dump schemes where orchestrated hype artificially inflates prices before a rapid sell-off. Sniping relies on market timing and liquidity analysis, while pump and dump exploits social manipulation and false demand. Explore the key differences to enhance your trading strategy and risk management.

Why it is important

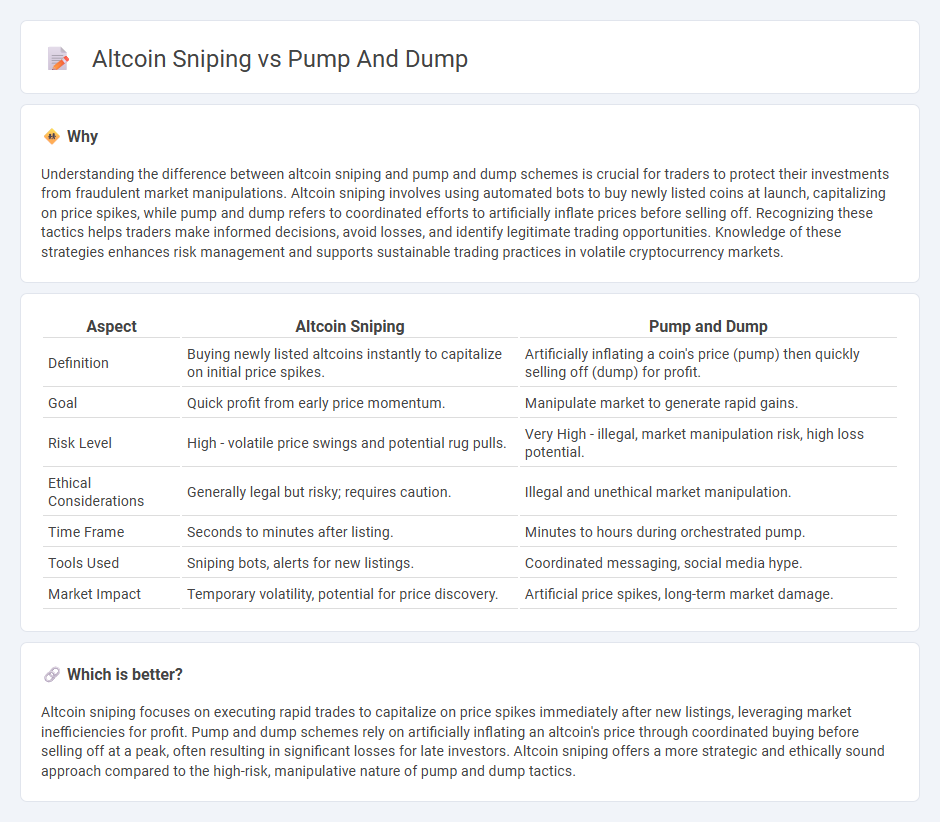

Understanding the difference between altcoin sniping and pump and dump schemes is crucial for traders to protect their investments from fraudulent market manipulations. Altcoin sniping involves using automated bots to buy newly listed coins at launch, capitalizing on price spikes, while pump and dump refers to coordinated efforts to artificially inflate prices before selling off. Recognizing these tactics helps traders make informed decisions, avoid losses, and identify legitimate trading opportunities. Knowledge of these strategies enhances risk management and supports sustainable trading practices in volatile cryptocurrency markets.

Comparison Table

| Aspect | Altcoin Sniping | Pump and Dump |

|---|---|---|

| Definition | Buying newly listed altcoins instantly to capitalize on initial price spikes. | Artificially inflating a coin's price (pump) then quickly selling off (dump) for profit. |

| Goal | Quick profit from early price momentum. | Manipulate market to generate rapid gains. |

| Risk Level | High - volatile price swings and potential rug pulls. | Very High - illegal, market manipulation risk, high loss potential. |

| Ethical Considerations | Generally legal but risky; requires caution. | Illegal and unethical market manipulation. |

| Time Frame | Seconds to minutes after listing. | Minutes to hours during orchestrated pump. |

| Tools Used | Sniping bots, alerts for new listings. | Coordinated messaging, social media hype. |

| Market Impact | Temporary volatility, potential for price discovery. | Artificial price spikes, long-term market damage. |

Which is better?

Altcoin sniping focuses on executing rapid trades to capitalize on price spikes immediately after new listings, leveraging market inefficiencies for profit. Pump and dump schemes rely on artificially inflating an altcoin's price through coordinated buying before selling off at a peak, often resulting in significant losses for late investors. Altcoin sniping offers a more strategic and ethically sound approach compared to the high-risk, manipulative nature of pump and dump tactics.

Connection

Altcoin sniping exploits rapid price spikes caused by pump and dump schemes, targeting newly launched or low-liquidity tokens to maximize quick profits. Pump and dump orchestrators artificially inflate altcoin prices through coordinated buying, creating volatile price movements that snipers capitalize on by swiftly buying and selling. This connection intensifies market manipulation, increasing risks and unpredictability for regular traders.

Key Terms

Market Manipulation

Pump and dump schemes exploit rapid price inflations by coordinated buying and quick sell-offs to manipulate altcoin markets, causing significant investor losses. Altcoin sniping capitalizes on real-time trades during token launches or liquidity additions but can also border on manipulative tactics by prioritizing speed over market fundamentals. Explore deeper insights into how these practices distort market integrity and investor trust.

Liquidity

Pump and dump schemes exploit low liquidity altcoins by artificially inflating prices for quick profit before a rapid decline, leaving unsuspecting investors with losses. In contrast, altcoin sniping capitalizes on identifying tokens with improving liquidity and strong order books to secure advantageous entry points ahead of price surges. Explore detailed strategies and liquidity metrics to effectively differentiate and navigate these high-risk market phenomena.

Entry/Exit Timing

Pump and dump schemes involve artificially inflating an altcoin's price through coordinated buying before rapidly selling off to profit, causing sharp price declines. Altcoin sniping focuses on precise entry and exit timing based on real-time market signals or bot automation to capture early gains from sudden price movements without manipulation. Explore strategies to optimize your trade timing for maximum returns in volatile altcoin markets.

Source and External Links

Pump and dump - Wikipedia - Pump and dump is a securities fraud scheme where fraudsters artificially inflate a stock's price with false positive statements ("pump") to sell their shares at a high price ("dump"), commonly affecting small-cap cryptocurrencies and microcap stocks.

What is Pump and Dump? - NICE Actimize - Pump and Dump involves manipulative traders boosting a security's price via false information to profit by selling at inflated prices, often seen in small cryptocurrencies, leaving other investors with losses.

Avoiding Pump-and-Dump Scams | FINRA.org - Pump-and-dump schemes typically target low-priced "penny" or microcap stocks, where fraudsters accumulate shares, spread false positive news to inflate price, then sell their shares, causing the price to crash.

dowidth.com

dowidth.com