Grid trading involves placing buy and sell orders at predefined intervals around a set price, aiming to profit from market fluctuations without predicting direction. Copy trading allows investors to replicate the trades of experienced traders automatically, leveraging their expertise for potentially quicker gains and reduced time commitment. Explore more to understand which trading strategy aligns with your financial goals.

Why it is important

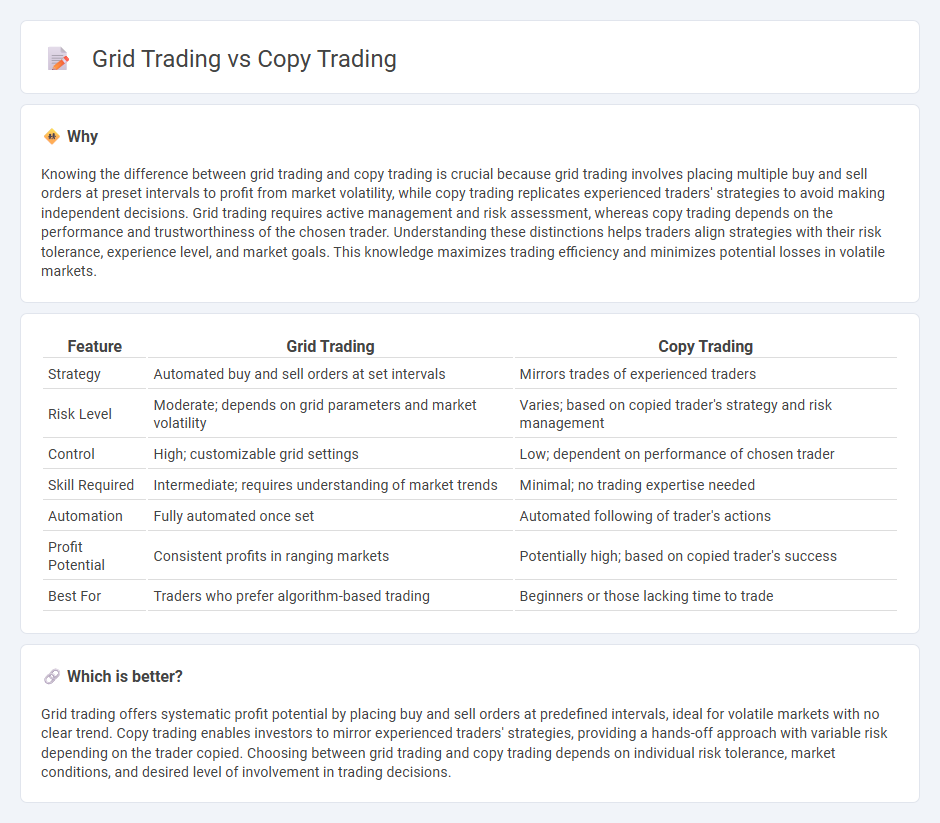

Knowing the difference between grid trading and copy trading is crucial because grid trading involves placing multiple buy and sell orders at preset intervals to profit from market volatility, while copy trading replicates experienced traders' strategies to avoid making independent decisions. Grid trading requires active management and risk assessment, whereas copy trading depends on the performance and trustworthiness of the chosen trader. Understanding these distinctions helps traders align strategies with their risk tolerance, experience level, and market goals. This knowledge maximizes trading efficiency and minimizes potential losses in volatile markets.

Comparison Table

| Feature | Grid Trading | Copy Trading |

|---|---|---|

| Strategy | Automated buy and sell orders at set intervals | Mirrors trades of experienced traders |

| Risk Level | Moderate; depends on grid parameters and market volatility | Varies; based on copied trader's strategy and risk management |

| Control | High; customizable grid settings | Low; dependent on performance of chosen trader |

| Skill Required | Intermediate; requires understanding of market trends | Minimal; no trading expertise needed |

| Automation | Fully automated once set | Automated following of trader's actions |

| Profit Potential | Consistent profits in ranging markets | Potentially high; based on copied trader's success |

| Best For | Traders who prefer algorithm-based trading | Beginners or those lacking time to trade |

Which is better?

Grid trading offers systematic profit potential by placing buy and sell orders at predefined intervals, ideal for volatile markets with no clear trend. Copy trading enables investors to mirror experienced traders' strategies, providing a hands-off approach with variable risk depending on the trader copied. Choosing between grid trading and copy trading depends on individual risk tolerance, market conditions, and desired level of involvement in trading decisions.

Connection

Grid trading and copy trading are connected through their shared goal of automating trading strategies to minimize manual intervention. Grid trading uses algorithmic orders placed at preset intervals to profit from market volatility, while copy trading replicates the trades of successful investors to leverage their expertise. Both methods enhance risk management and diversify investment approaches by enabling systematic execution and portfolio expansion.

Key Terms

Signal Provider (Copy Trading)

Signal providers in copy trading generate real-time market signals based on algorithmic strategies or expert analysis, enabling followers to replicate trades automatically. They typically offer performance metrics such as win rates, risk levels, and historical returns to help users select reliable providers with transparent trading patterns. Explore the key advantages and risks of relying on signal providers to enhance your trading strategy effectiveness.

Automated Orders (Grid Trading)

Grid trading employs automated orders placed at predetermined price intervals, creating a systematic approach that capitalizes on market volatility by buying low and selling high within a defined range. In contrast, copy trading mirrors another trader's actions, relying heavily on their skill and decision-making without automated entries or exits. Explore the mechanics and benefits of grid trading automation to refine your trading strategy effectively.

Risk Management

Copy trading allows investors to mirror the trades of experienced traders, potentially reducing risk through diversification and relying on proven strategies. Grid trading involves placing buy and sell orders at preset intervals around a fixed price, managing risk by capitalizing on market volatility within a controlled range. Explore the nuances and risk management techniques of both methods to optimize your trading strategy.

Source and External Links

Copy trading - Allows individuals to automatically mirror the trades of selected investors, linking a portion of their funds to the copied account so all subsequent actions by the copied trader are replicated proportionally in the copier's account.

Copy Trading | Copy the Best Traders in 2025 - Enables less experienced traders to automatically replicate the trades of more skilled traders, offering a hands-off, automated approach to participating in financial markets while benefiting from others' expertise.

What is Copy Trading, How Does it Work - Lets users copy the trades of experienced traders automatically without needing to analyze the market themselves, with platforms offering filtering tools to find traders matching your risk and style preferences.

dowidth.com

dowidth.com