Gamma scalping involves adjusting option positions to capture profits from fluctuations in an underlying asset's volatility, focusing on managing the gamma risk for optimal returns. Momentum trading capitalizes on the continuation of existing price trends, leveraging market momentum to enter and exit trades efficiently. Explore the nuances of gamma scalping and momentum trading to enhance your trading strategy.

Why it is important

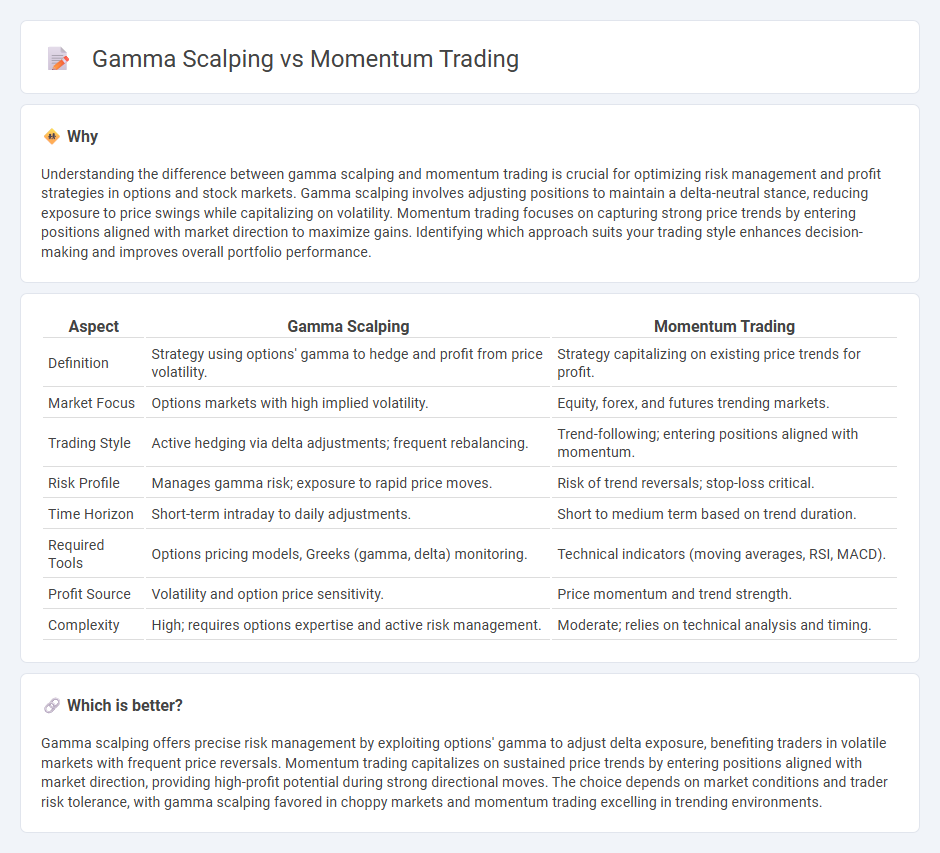

Understanding the difference between gamma scalping and momentum trading is crucial for optimizing risk management and profit strategies in options and stock markets. Gamma scalping involves adjusting positions to maintain a delta-neutral stance, reducing exposure to price swings while capitalizing on volatility. Momentum trading focuses on capturing strong price trends by entering positions aligned with market direction to maximize gains. Identifying which approach suits your trading style enhances decision-making and improves overall portfolio performance.

Comparison Table

| Aspect | Gamma Scalping | Momentum Trading |

|---|---|---|

| Definition | Strategy using options' gamma to hedge and profit from price volatility. | Strategy capitalizing on existing price trends for profit. |

| Market Focus | Options markets with high implied volatility. | Equity, forex, and futures trending markets. |

| Trading Style | Active hedging via delta adjustments; frequent rebalancing. | Trend-following; entering positions aligned with momentum. |

| Risk Profile | Manages gamma risk; exposure to rapid price moves. | Risk of trend reversals; stop-loss critical. |

| Time Horizon | Short-term intraday to daily adjustments. | Short to medium term based on trend duration. |

| Required Tools | Options pricing models, Greeks (gamma, delta) monitoring. | Technical indicators (moving averages, RSI, MACD). |

| Profit Source | Volatility and option price sensitivity. | Price momentum and trend strength. |

| Complexity | High; requires options expertise and active risk management. | Moderate; relies on technical analysis and timing. |

Which is better?

Gamma scalping offers precise risk management by exploiting options' gamma to adjust delta exposure, benefiting traders in volatile markets with frequent price reversals. Momentum trading capitalizes on sustained price trends by entering positions aligned with market direction, providing high-profit potential during strong directional moves. The choice depends on market conditions and trader risk tolerance, with gamma scalping favored in choppy markets and momentum trading excelling in trending environments.

Connection

Gamma scalping and momentum trading both leverage price volatility to maximize profits, with gamma scalping focusing on managing option Greeks to capture gains from underlying price fluctuations, while momentum trading seeks to exploit trending market movements by buying assets showing strong directional momentum. Gamma scalpers adjust their delta hedges dynamically as the underlying asset moves, capitalizing on changing gamma, which aligns with momentum traders' strategy of riding sustained price trends. By integrating gamma scalping's volatility sensitivity with momentum trading's directional bias, traders enhance their ability to respond effectively to market dynamics.

Key Terms

**Momentum Trading:**

Momentum trading capitalizes on the continuation of existing market trends by identifying assets with strong price movement and high trading volume, aiming to enter positions that will ride the momentum for short- to medium-term gains. Traders utilize technical indicators such as moving averages, Relative Strength Index (RSI), and volume spikes to time entry and exit points effectively. Explore deeper insights into momentum trading strategies and risk management techniques to optimize your trading performance.

Relative Strength Index (RSI)

Momentum trading leverages the Relative Strength Index (RSI) to identify overbought or oversold conditions, signaling potential trend continuations for timely entries and exits. Gamma scalping, on the other hand, uses RSI to gauge market velocity while managing option delta exposure, aiming to profit from price oscillations rather than directional moves. Explore in-depth strategies and RSI interpretations to master momentum trading and gamma scalping techniques.

Breakout

Momentum trading focuses on capitalizing on strong price trends during breakouts by entering positions as the asset price surges beyond resistance levels, aiming to ride the sustained velocity. Gamma scalping, often used by options traders, involves adjusting hedge positions dynamically to profit from price volatility near the breakout zone, leveraging the gamma of options to manage risk and capture incremental gains. Explore detailed strategies and risk metrics to understand how momentum trading and gamma scalping optimize breakout opportunities.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading is a strategy based on buying or selling assets according to recent price trends, involving two main types: time-series momentum, which focuses on an asset's performance relative to its own past, and cross-sectional momentum, which ranks assets against each other to identify the strongest performers for buying or selling.

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - This resource explains momentum trading as a method where traders capitalize on assets with strong upward or downward price momentum, emphasizing the distinction between time-series momentum (individual asset performance over time) and cross-sectional momentum (ranking assets relative to peers).

Momentum Trading for Beginners (What They Don't Teach You) - A practical video guide teaching how momentum trading works by following strong price moves using indicators like RSI and MACD, managing risk effectively, and applying strategies across various markets such as stocks, crypto, and forex for trading with trend strength rather than against it.

dowidth.com

dowidth.com