Liquidity sweep refers to a strategic trading technique where a trader targets multiple price levels to quickly execute large orders and capture available liquidity across the order book. Fat finger errors occur when traders accidentally input incorrect order sizes or prices, leading to unintended large market impacts and potential financial losses. Explore the key distinctions between liquidity sweeps and fat finger errors to enhance your trading precision and risk management.

Why it is important

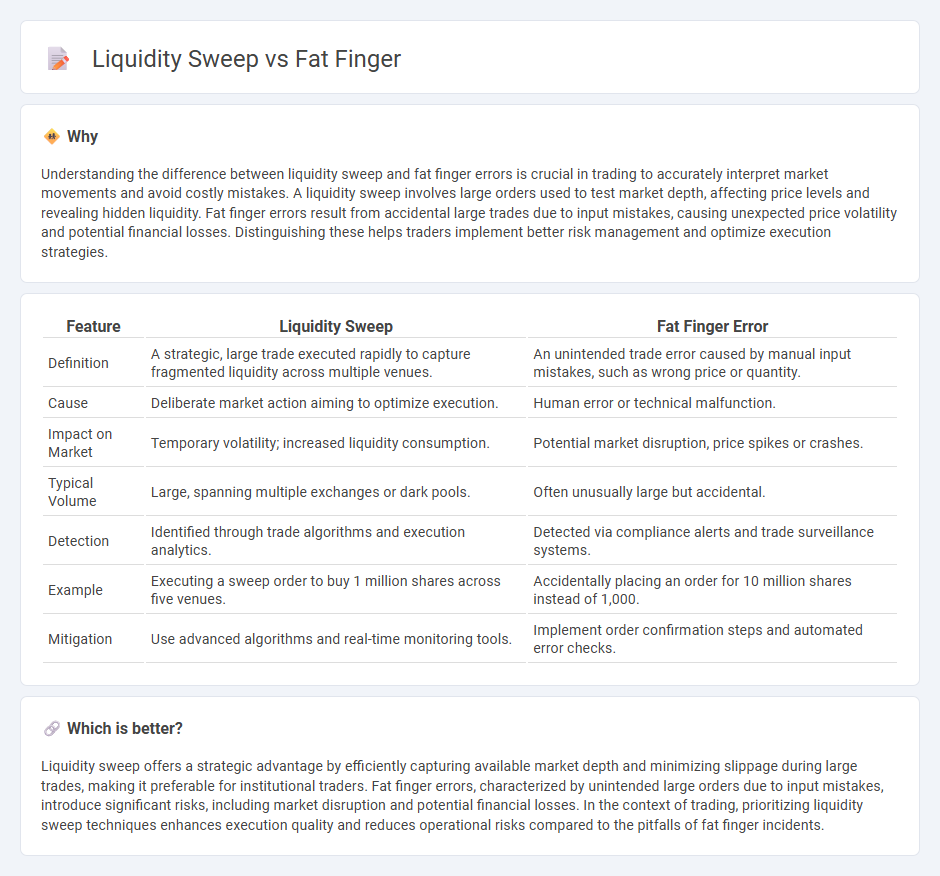

Understanding the difference between liquidity sweep and fat finger errors is crucial in trading to accurately interpret market movements and avoid costly mistakes. A liquidity sweep involves large orders used to test market depth, affecting price levels and revealing hidden liquidity. Fat finger errors result from accidental large trades due to input mistakes, causing unexpected price volatility and potential financial losses. Distinguishing these helps traders implement better risk management and optimize execution strategies.

Comparison Table

| Feature | Liquidity Sweep | Fat Finger Error |

|---|---|---|

| Definition | A strategic, large trade executed rapidly to capture fragmented liquidity across multiple venues. | An unintended trade error caused by manual input mistakes, such as wrong price or quantity. |

| Cause | Deliberate market action aiming to optimize execution. | Human error or technical malfunction. |

| Impact on Market | Temporary volatility; increased liquidity consumption. | Potential market disruption, price spikes or crashes. |

| Typical Volume | Large, spanning multiple exchanges or dark pools. | Often unusually large but accidental. |

| Detection | Identified through trade algorithms and execution analytics. | Detected via compliance alerts and trade surveillance systems. |

| Example | Executing a sweep order to buy 1 million shares across five venues. | Accidentally placing an order for 10 million shares instead of 1,000. |

| Mitigation | Use advanced algorithms and real-time monitoring tools. | Implement order confirmation steps and automated error checks. |

Which is better?

Liquidity sweep offers a strategic advantage by efficiently capturing available market depth and minimizing slippage during large trades, making it preferable for institutional traders. Fat finger errors, characterized by unintended large orders due to input mistakes, introduce significant risks, including market disruption and potential financial losses. In the context of trading, prioritizing liquidity sweep techniques enhances execution quality and reduces operational risks compared to the pitfalls of fat finger incidents.

Connection

Liquidity sweeps occur when large orders rapidly consume available market liquidity, often triggered by erroneous trades like fat finger errors, where traders mistakenly input incorrect trade sizes or prices. These fat finger mistakes can cause sudden market imbalances, leading to quick liquidity depletion and increased volatility. Understanding the interplay between fat finger errors and liquidity sweeps is essential for risk management and trading algorithm adjustments.

Key Terms

Fat Finger:

A Fat Finger error typically occurs in financial markets when a trader unintentionally places an excessively large or erroneous order, causing significant price disruption or volatile market fluctuations. This mistake contrasts with a liquidity sweep, where orders intentionally target available liquidity across price levels to fulfill large trades without causing undue market impact. Explore detailed scenarios and prevention techniques to better understand Fat Finger errors and their consequences.

Erroneous Order

Fat finger errors occur when traders input incorrect order quantities or prices, leading to large, unintended trades that can disrupt market prices. Liquidity sweeps involve quickly executing orders to consume available liquidity across multiple price levels, sometimes exploiting or causing market inefficiencies. Learn more about how these erroneous orders impact trading strategies and market stability.

Trade Cancellation

Fat finger errors occur when traders input incorrect trade details, leading to unintended large orders and potential market disruption. Liquidity sweeps involve aggressive order executions designed to quickly consume available liquidity, often triggering rapid price movements and requiring robust trade cancellation mechanisms to mitigate adverse effects. Explore the nuances of trade cancellation strategies to effectively manage risks associated with fat finger errors and liquidity sweeps.

Source and External Links

Fat-finger error - Wikipedia - A fat-finger error is a keyboard input mistake or mouse misclick causing unintended actions, commonly used in financial trading to describe wrongly entered buy or sell orders.

Fat-finger error: Explained | TIOmarkets - Fat-finger errors are caused primarily by human mistakes like typing the wrong key or technical problems like software glitches, leading to incorrect trade orders.

What is fat finger error and how to prevent it? | DLP - Egress - Fat finger errors, originating in trading, broadly refer to keyboard input mistakes that can cause serious consequences such as data breaches or financial loss due to incorrect information entry.

dowidth.com

dowidth.com