Risk reversal strategies involve simultaneously buying out-of-the-money call options while selling out-of-the-money put options to hedge or speculate on bullish market moves with limited capital outlay. Protective puts consist of holding a long position in the underlying asset combined with purchasing put options to limit downside risk without sacrificing upside potential. Explore more to understand which strategy aligns best with your trading goals and risk tolerance.

Why it is important

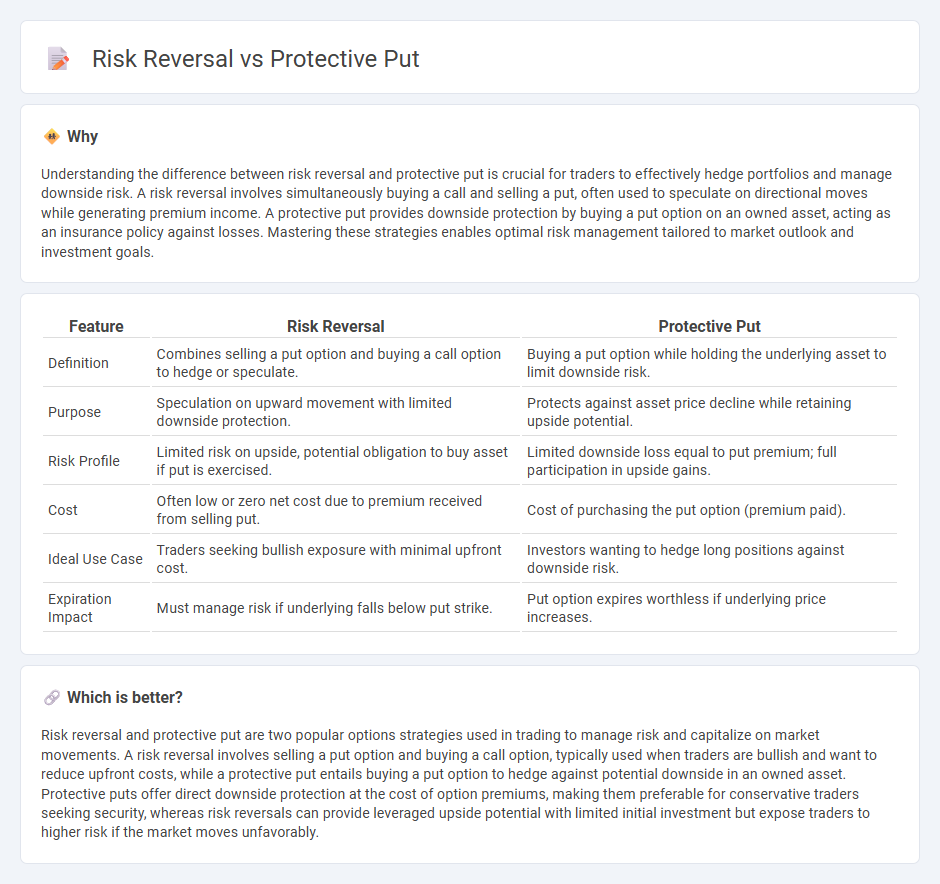

Understanding the difference between risk reversal and protective put is crucial for traders to effectively hedge portfolios and manage downside risk. A risk reversal involves simultaneously buying a call and selling a put, often used to speculate on directional moves while generating premium income. A protective put provides downside protection by buying a put option on an owned asset, acting as an insurance policy against losses. Mastering these strategies enables optimal risk management tailored to market outlook and investment goals.

Comparison Table

| Feature | Risk Reversal | Protective Put |

|---|---|---|

| Definition | Combines selling a put option and buying a call option to hedge or speculate. | Buying a put option while holding the underlying asset to limit downside risk. |

| Purpose | Speculation on upward movement with limited downside protection. | Protects against asset price decline while retaining upside potential. |

| Risk Profile | Limited risk on upside, potential obligation to buy asset if put is exercised. | Limited downside loss equal to put premium; full participation in upside gains. |

| Cost | Often low or zero net cost due to premium received from selling put. | Cost of purchasing the put option (premium paid). |

| Ideal Use Case | Traders seeking bullish exposure with minimal upfront cost. | Investors wanting to hedge long positions against downside risk. |

| Expiration Impact | Must manage risk if underlying falls below put strike. | Put option expires worthless if underlying price increases. |

Which is better?

Risk reversal and protective put are two popular options strategies used in trading to manage risk and capitalize on market movements. A risk reversal involves selling a put option and buying a call option, typically used when traders are bullish and want to reduce upfront costs, while a protective put entails buying a put option to hedge against potential downside in an owned asset. Protective puts offer direct downside protection at the cost of option premiums, making them preferable for conservative traders seeking security, whereas risk reversals can provide leveraged upside potential with limited initial investment but expose traders to higher risk if the market moves unfavorably.

Connection

Risk reversal and protective put strategies both serve to manage downside risk in trading by utilizing options. A protective put involves purchasing a put option to hedge against potential declines in an underlying asset, while risk reversal combines selling a put option and buying a call option to create a directional hedge with limited risk. Traders use these techniques to balance exposure, enhance returns, and tailor risk profiles to market expectations.

Key Terms

Downside Protection

A protective put involves purchasing a put option to hedge against potential declines in an underlying asset, offering direct downside protection with limited risk. Risk reversal combines selling a put option while buying a call option, providing a strategic hedge that reduces upfront costs but may expose investors to higher risk if the asset falls sharply. Explore these strategies further to optimize your downside protection approach.

Option Premium

A protective put involves buying a put option to hedge against potential downside risk, requiring the payment of a premium as insurance. Risk reversal combines selling a put and buying a call option, aiming to offset premiums and reduce overall cost but introducing directional exposure. Explore more to understand how option premiums influence your strategic risk management choices.

Hedging Strategy

Protective puts involve purchasing put options to hedge against potential downside risk of an owned asset, providing a floor price while maintaining upside potential. Risk reversal combines selling a put option and buying a call option, offering a cost-effective hedge by offsetting premiums but exposing the investor to assignment risk on the short put. Explore deeper insights into these hedging strategies to optimize your portfolio risk management.

Source and External Links

Protective Put - Definition, Example, Scenarios - A protective put is a risk management strategy where an investor holds a long stock position and buys a put option to limit potential losses from a price drop while retaining upside profit potential, acting like an insurance for the stock.

Protective Put Strategy: Definition, How It Works & Examples - This strategy allows investors to protect their stocks from decline by buying a put option, which lets them sell at the strike price if the stock falls, minimizing losses at the cost of the premium paid for the put.

Protective Put (Married Put) - The Options Industry Council - The protective put, or married put, hedges against temporary stock price declines by establishing a floor price, allowing investors to benefit from upside gains while limiting downside risk during uncertain periods.

dowidth.com

dowidth.com