High-frequency trading (HFT) leverages complex algorithms and ultra-low latency systems to execute numerous trades within milliseconds, aiming to capitalize on minute price discrepancies. Market making involves continuously providing buy and sell quotes to maintain liquidity and facilitate smoother trading, profiting primarily from the bid-ask spread. Explore the detailed differences and strategies behind these trading approaches to enhance market insight.

Why it is important

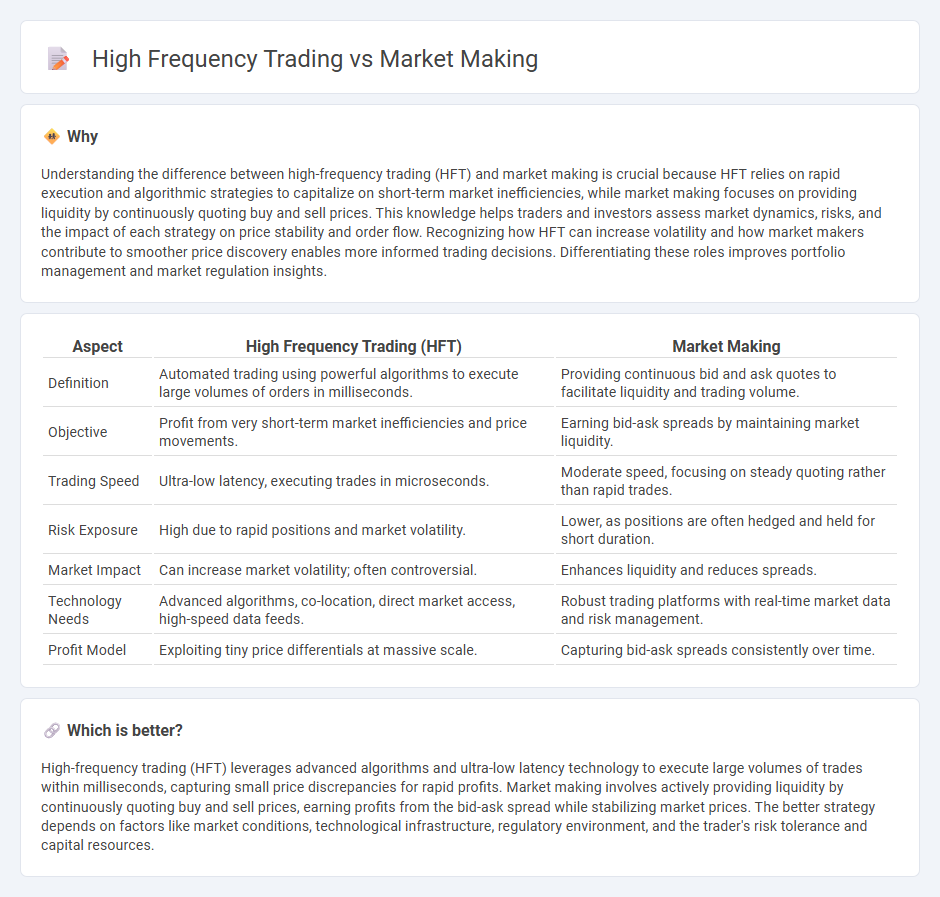

Understanding the difference between high-frequency trading (HFT) and market making is crucial because HFT relies on rapid execution and algorithmic strategies to capitalize on short-term market inefficiencies, while market making focuses on providing liquidity by continuously quoting buy and sell prices. This knowledge helps traders and investors assess market dynamics, risks, and the impact of each strategy on price stability and order flow. Recognizing how HFT can increase volatility and how market makers contribute to smoother price discovery enables more informed trading decisions. Differentiating these roles improves portfolio management and market regulation insights.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Market Making |

|---|---|---|

| Definition | Automated trading using powerful algorithms to execute large volumes of orders in milliseconds. | Providing continuous bid and ask quotes to facilitate liquidity and trading volume. |

| Objective | Profit from very short-term market inefficiencies and price movements. | Earning bid-ask spreads by maintaining market liquidity. |

| Trading Speed | Ultra-low latency, executing trades in microseconds. | Moderate speed, focusing on steady quoting rather than rapid trades. |

| Risk Exposure | High due to rapid positions and market volatility. | Lower, as positions are often hedged and held for short duration. |

| Market Impact | Can increase market volatility; often controversial. | Enhances liquidity and reduces spreads. |

| Technology Needs | Advanced algorithms, co-location, direct market access, high-speed data feeds. | Robust trading platforms with real-time market data and risk management. |

| Profit Model | Exploiting tiny price differentials at massive scale. | Capturing bid-ask spreads consistently over time. |

Which is better?

High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency technology to execute large volumes of trades within milliseconds, capturing small price discrepancies for rapid profits. Market making involves actively providing liquidity by continuously quoting buy and sell prices, earning profits from the bid-ask spread while stabilizing market prices. The better strategy depends on factors like market conditions, technological infrastructure, regulatory environment, and the trader's risk tolerance and capital resources.

Connection

High frequency trading (HFT) and market making are intertwined through their reliance on speed and liquidity provision in financial markets. HFT firms often engage in market making by submitting a large volume of buy and sell orders to profit from bid-ask spreads while maintaining tight inventory control. This symbiotic relationship enhances market efficiency by increasing order flow and reducing price volatility.

Key Terms

Liquidity Provision

Market making involves continuously quoting buy and sell prices to provide liquidity and facilitate smoother trading in financial markets. High frequency trading exploits technological speed to execute numerous trades rapidly, often leveraging market inefficiencies without necessarily providing sustained liquidity. Discover detailed insights into how each strategy shapes market liquidity and trading dynamics.

Bid-Ask Spread

Market making involves continuously quoting bid and ask prices to provide liquidity, profiting primarily from the bid-ask spread by capturing the difference between buy and sell orders. High-frequency trading (HFT) exploits advanced algorithms and ultra-low latency systems to execute large volumes of trades rapidly, often aiming to capitalize on small price discrepancies within the bid-ask spread. Discover how these strategies impact market efficiency and trading dynamics by exploring their detailed mechanisms.

Latency

Market making in high-frequency trading relies heavily on ultra-low latency to continuously update bid and ask prices, ensuring liquidity while managing risk dynamically. High-frequency trading strategies exploiting latency advantages execute multiple trades within milliseconds, capitalizing on fleeting price discrepancies and market inefficiencies. Explore how cutting-edge technologies and infrastructure advancements minimize latency to enhance market making and high-frequency trading outcomes.

Source and External Links

Mastering the Market Maker Trading Strategy | EPAM SolutionsHub - Market makers earn profits primarily through the bid-ask spread, managing inventory to buy low and sell high, and analyzing order flow to anticipate market movements, while providing liquidity and adhering to regulations.

Market Making and Mean Reversion - CIS UPenn - Market making is a strategy where firms or individuals continuously quote buy and sell prices to provide liquidity and profit from the spread without accumulating a large net position.

Market Maker - Definition, Role, How They Work - A market maker is an entity that simultaneously offers bids and asks for securities, profiting from the bid-ask spread and assuming inventory risk to maintain market liquidity.

dowidth.com

dowidth.com