Copy trading allows investors to replicate the exact trades of experienced traders automatically, while social trading emphasizes community interaction, strategy sharing, and collaborative decision-making among traders. Both methods offer unique advantages for diversifying portfolios and minimizing risk through collective intelligence. Explore how copy trading and social trading can enhance your investment strategy with tailored insights and real-time social feedback.

Why it is important

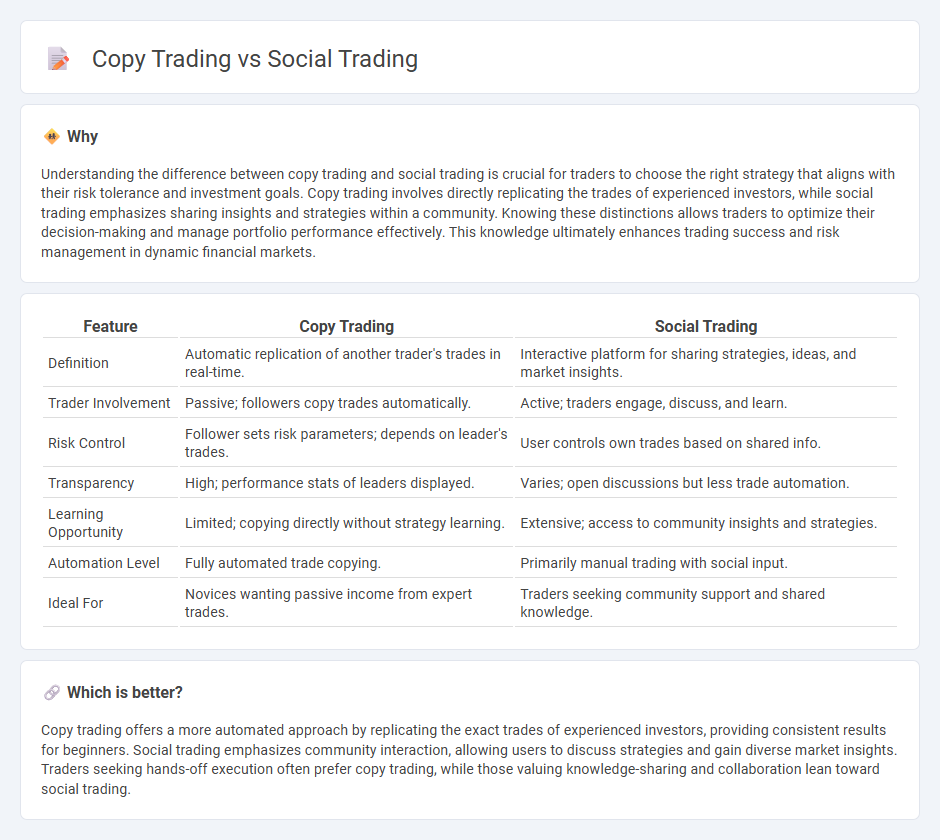

Understanding the difference between copy trading and social trading is crucial for traders to choose the right strategy that aligns with their risk tolerance and investment goals. Copy trading involves directly replicating the trades of experienced investors, while social trading emphasizes sharing insights and strategies within a community. Knowing these distinctions allows traders to optimize their decision-making and manage portfolio performance effectively. This knowledge ultimately enhances trading success and risk management in dynamic financial markets.

Comparison Table

| Feature | Copy Trading | Social Trading |

|---|---|---|

| Definition | Automatic replication of another trader's trades in real-time. | Interactive platform for sharing strategies, ideas, and market insights. |

| Trader Involvement | Passive; followers copy trades automatically. | Active; traders engage, discuss, and learn. |

| Risk Control | Follower sets risk parameters; depends on leader's trades. | User controls own trades based on shared info. |

| Transparency | High; performance stats of leaders displayed. | Varies; open discussions but less trade automation. |

| Learning Opportunity | Limited; copying directly without strategy learning. | Extensive; access to community insights and strategies. |

| Automation Level | Fully automated trade copying. | Primarily manual trading with social input. |

| Ideal For | Novices wanting passive income from expert trades. | Traders seeking community support and shared knowledge. |

Which is better?

Copy trading offers a more automated approach by replicating the exact trades of experienced investors, providing consistent results for beginners. Social trading emphasizes community interaction, allowing users to discuss strategies and gain diverse market insights. Traders seeking hands-off execution often prefer copy trading, while those valuing knowledge-sharing and collaboration lean toward social trading.

Connection

Copy trading and social trading are interconnected as both involve leveraging the insights and strategies of experienced traders within a community. Copy trading allows investors to automatically replicate the trades of successful traders, while social trading provides a platform for sharing information, discussions, and real-time market analysis. Together, they create a collaborative environment that enhances decision-making and investment performance by combining transparency, social interaction, and automated execution.

Key Terms

Signal Provider

Social trading platforms enable users to interact and share market insights, while copy trading specifically allows investors to replicate trades from selected signal providers in real-time. Signal providers are experienced traders whose strategies and performance are transparently displayed, allowing followers to make informed decisions based on their track records and risk profiles. Explore the nuances of signal provider roles to optimize your investment strategy and enhance your trading success.

Followers

Social trading involves following multiple traders and engaging with their strategies and market insights, fostering a community-driven trading experience. Copy trading allows followers to automatically replicate the trades of selected expert traders, providing a hands-off investment approach. Explore the differences further to decide which method suits your trading style best.

Automated Execution

Social trading involves sharing trading ideas and strategies within a community, allowing users to learn and engage with other traders. Copy trading, by contrast, automates the execution process by replicating trades of selected experts in real-time, eliminating manual intervention. Explore the nuances of automated execution in both methods to optimize your trading strategy.

Source and External Links

Social trading - Social trading is a form of investing that allows investors to observe and replicate the trading behavior of peers and expert traders, aiming to leverage expert insights while maintaining control over one's own investments.

Social Trading Explained for Beginners at JustMarkets - Social trading enables traders, especially beginners, to follow and copy the strategies of successful peers, combining online communication and trading to learn and potentially increase returns while retaining full control over investments.

Social Trading: Everything You Need To Know - Social trading platforms let users copy trades of experienced traders automatically or manually, with the ability to monitor and adjust strategies, but carry risks especially with leveraged products like CFDs.

dowidth.com

dowidth.com