Microstructure modeling examines how individual order flows, bid-ask spreads, and market participants' behaviors influence price changes at the transaction level. Price formation modeling focuses on broader mechanisms driving asset price evolution, incorporating factors like supply-demand imbalances and market impact over time. Explore the distinctions to enhance your understanding of trading dynamics and strategy development.

Why it is important

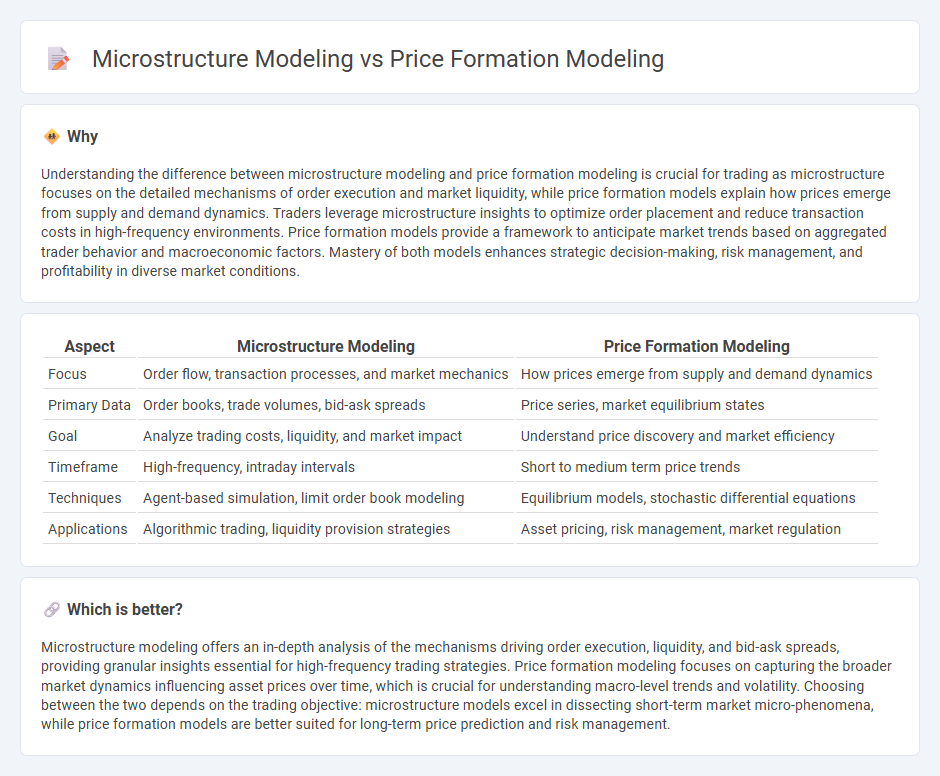

Understanding the difference between microstructure modeling and price formation modeling is crucial for trading as microstructure focuses on the detailed mechanisms of order execution and market liquidity, while price formation models explain how prices emerge from supply and demand dynamics. Traders leverage microstructure insights to optimize order placement and reduce transaction costs in high-frequency environments. Price formation models provide a framework to anticipate market trends based on aggregated trader behavior and macroeconomic factors. Mastery of both models enhances strategic decision-making, risk management, and profitability in diverse market conditions.

Comparison Table

| Aspect | Microstructure Modeling | Price Formation Modeling |

|---|---|---|

| Focus | Order flow, transaction processes, and market mechanics | How prices emerge from supply and demand dynamics |

| Primary Data | Order books, trade volumes, bid-ask spreads | Price series, market equilibrium states |

| Goal | Analyze trading costs, liquidity, and market impact | Understand price discovery and market efficiency |

| Timeframe | High-frequency, intraday intervals | Short to medium term price trends |

| Techniques | Agent-based simulation, limit order book modeling | Equilibrium models, stochastic differential equations |

| Applications | Algorithmic trading, liquidity provision strategies | Asset pricing, risk management, market regulation |

Which is better?

Microstructure modeling offers an in-depth analysis of the mechanisms driving order execution, liquidity, and bid-ask spreads, providing granular insights essential for high-frequency trading strategies. Price formation modeling focuses on capturing the broader market dynamics influencing asset prices over time, which is crucial for understanding macro-level trends and volatility. Choosing between the two depends on the trading objective: microstructure models excel in dissecting short-term market micro-phenomena, while price formation models are better suited for long-term price prediction and risk management.

Connection

Microstructure modeling analyzes the detailed processes and mechanisms within financial markets, such as order flow, bid-ask spreads, and liquidity, which directly influence price formation. Price formation modeling uses these microstructural insights to determine how trades, information asymmetry, and market participants' behavior impact asset prices over time. Understanding the link between microstructure and price formation enhances trading strategies by providing a more accurate depiction of market dynamics and price discovery.

Key Terms

Price formation modeling:

Price formation modeling examines the dynamic process through which asset prices are established by the interaction of supply and demand in financial markets. It incorporates factors such as order flow, information asymmetry, and trader behavior to predict price movements and market equilibrium. Explore the key methodologies and empirical findings in price formation modeling to better understand market efficiency and liquidity.

Supply and Demand

Price formation modeling analyzes how supply and demand dynamics determine asset prices by capturing equilibrium interactions between buyers and sellers. Microstructure modeling delves deeper into the mechanisms of order flow, trade execution, and liquidity provision that influence short-term price fluctuations and bid-ask spreads. Explore further to understand how these frameworks complement each other in explaining market behavior.

Equilibrium Price

Price formation modeling examines how market prices are established through the interaction of supply and demand, incorporating factors like order flow and trader behavior. Microstructure modeling delves into the detailed mechanisms of trading processes, such as order book dynamics and liquidity provision, to explain price discovery at the transaction level. Explore further to understand how equilibrium price emerges from the interplay between these modeling approaches.

Source and External Links

An empirical behavioral model of price formation - This study presents a model simulating price formation based on order placement and cancellation behaviors, using long-memory processes to describe market and limit orders, validated against data from the London Stock Exchange.

The Potential Method For Price-Formation Models - This paper introduces a mean-field game (MFG) model where agents trade commodities by maximizing profit considering supply, demand, and future prices, converted into a convex variational problem for efficient numerical and machine learning solutions.

On Price Formation Theory - Econlib - A mathematical theory of classical price formation illustrating how buyers' and sellers' reservation values determine dynamic price adjustments through market trial prices interacting with supply, demand, and rationing mechanisms.

dowidth.com

dowidth.com