Front running involves executing orders ahead of known pending trades to capitalize on anticipated price movements, often leveraging access to insider market information. Back running, by contrast, entails placing trades immediately after significant transactions to benefit from the market impact those trades generate. Explore the strategic differences and implications of front running versus back running in trading to enhance your market insight.

Why it is important

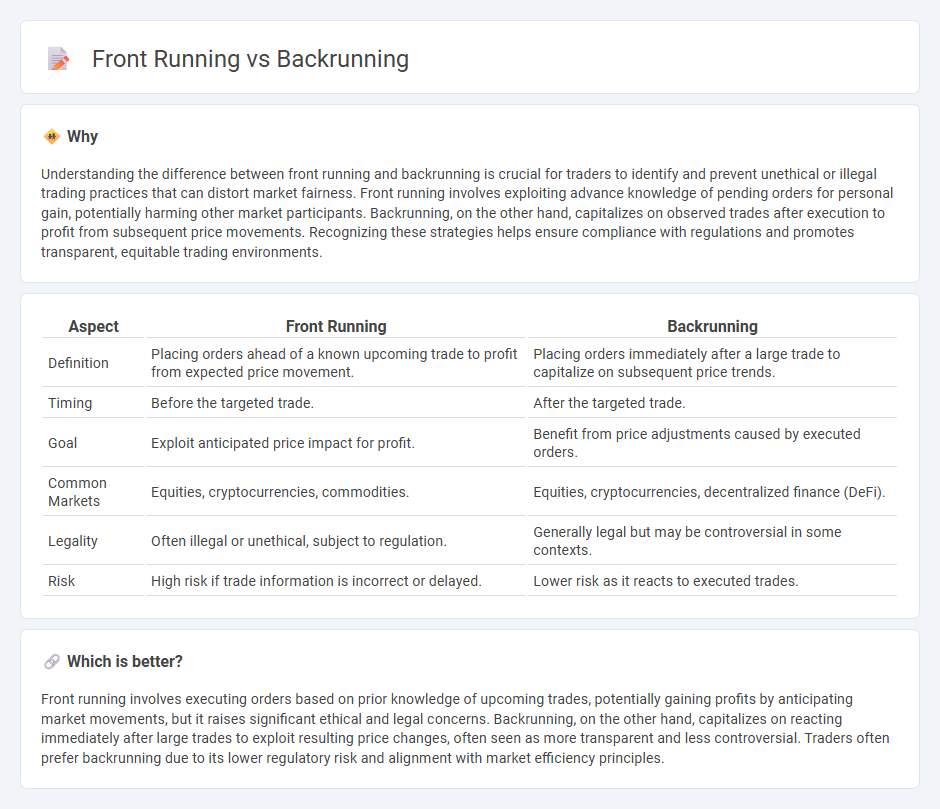

Understanding the difference between front running and backrunning is crucial for traders to identify and prevent unethical or illegal trading practices that can distort market fairness. Front running involves exploiting advance knowledge of pending orders for personal gain, potentially harming other market participants. Backrunning, on the other hand, capitalizes on observed trades after execution to profit from subsequent price movements. Recognizing these strategies helps ensure compliance with regulations and promotes transparent, equitable trading environments.

Comparison Table

| Aspect | Front Running | Backrunning |

|---|---|---|

| Definition | Placing orders ahead of a known upcoming trade to profit from expected price movement. | Placing orders immediately after a large trade to capitalize on subsequent price trends. |

| Timing | Before the targeted trade. | After the targeted trade. |

| Goal | Exploit anticipated price impact for profit. | Benefit from price adjustments caused by executed orders. |

| Common Markets | Equities, cryptocurrencies, commodities. | Equities, cryptocurrencies, decentralized finance (DeFi). |

| Legality | Often illegal or unethical, subject to regulation. | Generally legal but may be controversial in some contexts. |

| Risk | High risk if trade information is incorrect or delayed. | Lower risk as it reacts to executed trades. |

Which is better?

Front running involves executing orders based on prior knowledge of upcoming trades, potentially gaining profits by anticipating market movements, but it raises significant ethical and legal concerns. Backrunning, on the other hand, capitalizes on reacting immediately after large trades to exploit resulting price changes, often seen as more transparent and less controversial. Traders often prefer backrunning due to its lower regulatory risk and alignment with market efficiency principles.

Connection

Front running and backrunning are trading strategies that exploit the timing of market orders to gain an advantage. Front running involves placing a trade ahead of a known large order to profit from the price movement that the order will likely cause. Backrunning, on the other hand, involves placing trades immediately after such orders, capitalizing on the price trends initiated by the front-runners or large institutional trades.

Key Terms

Order Flow

Backrunning exploits observing a large, impactful trade to place orders immediately after it, capitalizing on predicted price movements. Front running involves placing orders ahead of a known or anticipated large trade to benefit from the price change it will trigger. Explore these strategies in depth to understand their implications on order flow and market dynamics.

Latency

Latency plays a crucial role in differentiating backrunning and front running within trading strategies. Front running exploits low latency to execute trades milliseconds ahead of large orders, capitalizing on anticipated price movements. Explore more on how latency impacts these strategies and their implications in high-frequency trading.

Market Manipulation

Backrunning exploits knowledge of executed large trades by placing orders immediately after to profit from expected price movements, often leading to market inefficiencies and manipulation allegations. Front running involves acting on confidential information about pending large orders before they execute, undermining fair market conditions and violating securities laws. Explore detailed strategies and regulatory responses to market manipulation for deeper understanding.

Source and External Links

How do Arbitrage Bots use Frontrunning and Backrunning? - Backrunning is a strategy where an arbitrage bot places an order immediately after a large order is executed to capitalize on the price momentum created by that initial trade, allowing for momentum trading and reduced risk compared to frontrunning, though it can be perceived as manipulative and subject to regulatory scrutiny.

Back-running - MEV Wiki - Backrunning involves sending a transaction to be mined immediately after a specific unconfirmed transaction, often monitored in the mempool, to buy tokens right after liquidity is added and then profit from the subsequent price increase.

What is Backrunning? - CoW Protocol Documentation - Backrunning is a type of MEV where a transaction is strategically executed immediately after a high-value transaction to capture arbitrage opportunities left by the initial trade's price impact without affecting the original trade itself, making it less harmful than other MEV types like frontrunning or sandwich attacks.

dowidth.com

dowidth.com