Quantitative signals use mathematical models and algorithms to analyze market data and generate trading decisions based on statistical patterns, offering objective and systematic approaches to trading. Discretionary trading relies on the trader's experience, intuition, and judgment to make decisions, often incorporating qualitative factors and market sentiment. Explore the advantages and applications of both methods to enhance your trading strategies.

Why it is important

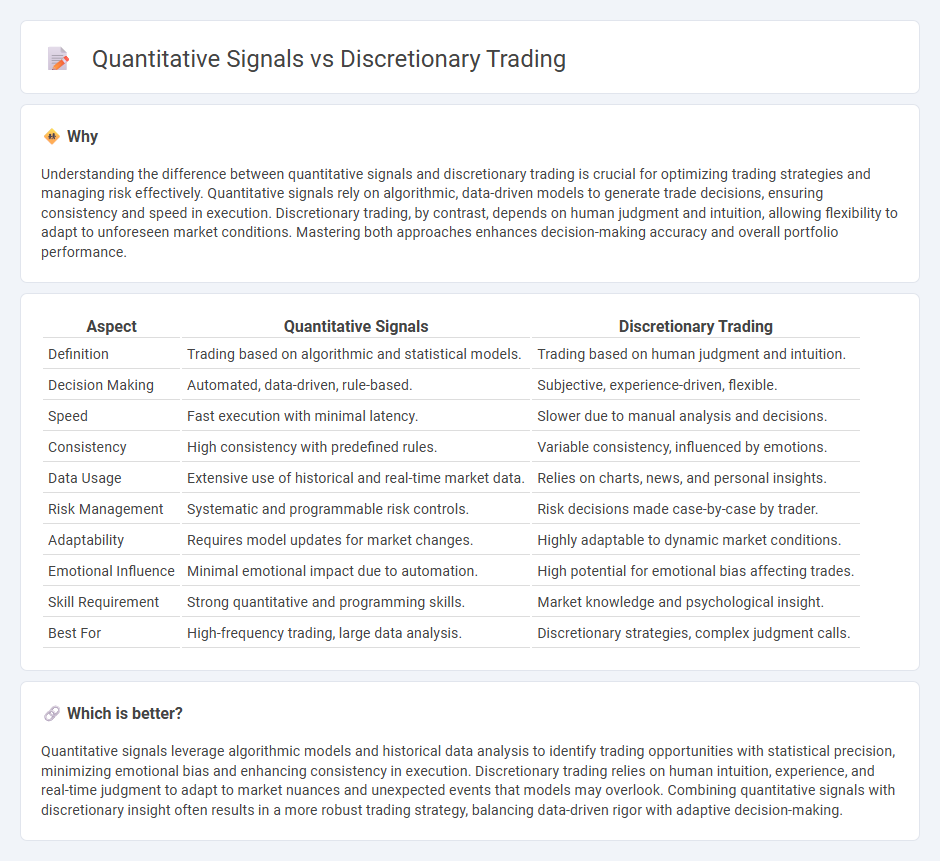

Understanding the difference between quantitative signals and discretionary trading is crucial for optimizing trading strategies and managing risk effectively. Quantitative signals rely on algorithmic, data-driven models to generate trade decisions, ensuring consistency and speed in execution. Discretionary trading, by contrast, depends on human judgment and intuition, allowing flexibility to adapt to unforeseen market conditions. Mastering both approaches enhances decision-making accuracy and overall portfolio performance.

Comparison Table

| Aspect | Quantitative Signals | Discretionary Trading |

|---|---|---|

| Definition | Trading based on algorithmic and statistical models. | Trading based on human judgment and intuition. |

| Decision Making | Automated, data-driven, rule-based. | Subjective, experience-driven, flexible. |

| Speed | Fast execution with minimal latency. | Slower due to manual analysis and decisions. |

| Consistency | High consistency with predefined rules. | Variable consistency, influenced by emotions. |

| Data Usage | Extensive use of historical and real-time market data. | Relies on charts, news, and personal insights. |

| Risk Management | Systematic and programmable risk controls. | Risk decisions made case-by-case by trader. |

| Adaptability | Requires model updates for market changes. | Highly adaptable to dynamic market conditions. |

| Emotional Influence | Minimal emotional impact due to automation. | High potential for emotional bias affecting trades. |

| Skill Requirement | Strong quantitative and programming skills. | Market knowledge and psychological insight. |

| Best For | High-frequency trading, large data analysis. | Discretionary strategies, complex judgment calls. |

Which is better?

Quantitative signals leverage algorithmic models and historical data analysis to identify trading opportunities with statistical precision, minimizing emotional bias and enhancing consistency in execution. Discretionary trading relies on human intuition, experience, and real-time judgment to adapt to market nuances and unexpected events that models may overlook. Combining quantitative signals with discretionary insight often results in a more robust trading strategy, balancing data-driven rigor with adaptive decision-making.

Connection

Quantitative signals leverage mathematical models and algorithmic analysis to identify trading opportunities based on historical data patterns and statistical indicators. Discretionary trading incorporates these signals by allowing traders to apply judgment and experience in interpreting algorithmic outputs, adjusting positions according to market nuances and real-time information. The integration of quantitative signals with discretionary trading enhances decision-making accuracy and risk management in dynamic market conditions.

Key Terms

Human Judgment

Discretionary trading relies heavily on human judgment, intuition, and experience to make investment decisions, incorporating qualitative factors like market sentiment and geopolitical events. Quantitative signals, by contrast, use algorithms and mathematical models to analyze large datasets and generate trade signals automatically, minimizing emotional bias. Explore deeper insights into how human judgment shapes trading strategies by learning more about discretionary trading nuances.

Algorithmic Strategies

Discretionary trading relies on human judgment and intuition to make decisions, whereas quantitative signals utilize algorithmic strategies driven by statistical models and data analysis for trade execution. Algorithmic strategies systematically analyze vast datasets, executing trades at optimal times to minimize emotional bias and enhance precision. Explore how integrating discretionary insights with quantitative algorithms can elevate your trading performance.

Systematic Rules

Discretionary trading relies on human judgment to make investment decisions, often influenced by market sentiment and experience, whereas quantitative signals utilize systematic rules derived from data-driven algorithms to execute trades with consistency and precision. Systematic trading strategies optimize performance by minimizing emotional bias and enhancing risk management through predefined rules based on statistical analysis. Explore how incorporating systematic rules can enhance trading efficiency and profitability.

Source and External Links

What is discretionary trading? | FBS Glossary - Discretionary trading involves traders making decisions based on their intuition and current market conditions, adapting rules to maximize profit but relying heavily on experience and judgment, which can be influenced by emotions.

Mechanical Trading Strategies Vs. Discretionary Trading Strategies - Discretionary trading strategies are decision-based methods where traders use their judgment and experience to decide trades, allowing flexibility to adjust parameters like profit targets depending on market volatility and conditions.

Discretionary Trading: Strategies for Savvy Investors - Discretionary trading combines market analysis with trader intuition, emphasizing the need to validate decisions through historical testing and balancing data-driven research with human insight for long-term success.

dowidth.com

dowidth.com