Market making involves providing liquidity by continuously quoting bid and ask prices, aiming to profit from the spread. Mean reversion strategies capitalize on the tendency of asset prices to return to their historical average after deviations. Explore more to understand how these distinct approaches shape trading dynamics and profitability.

Why it is important

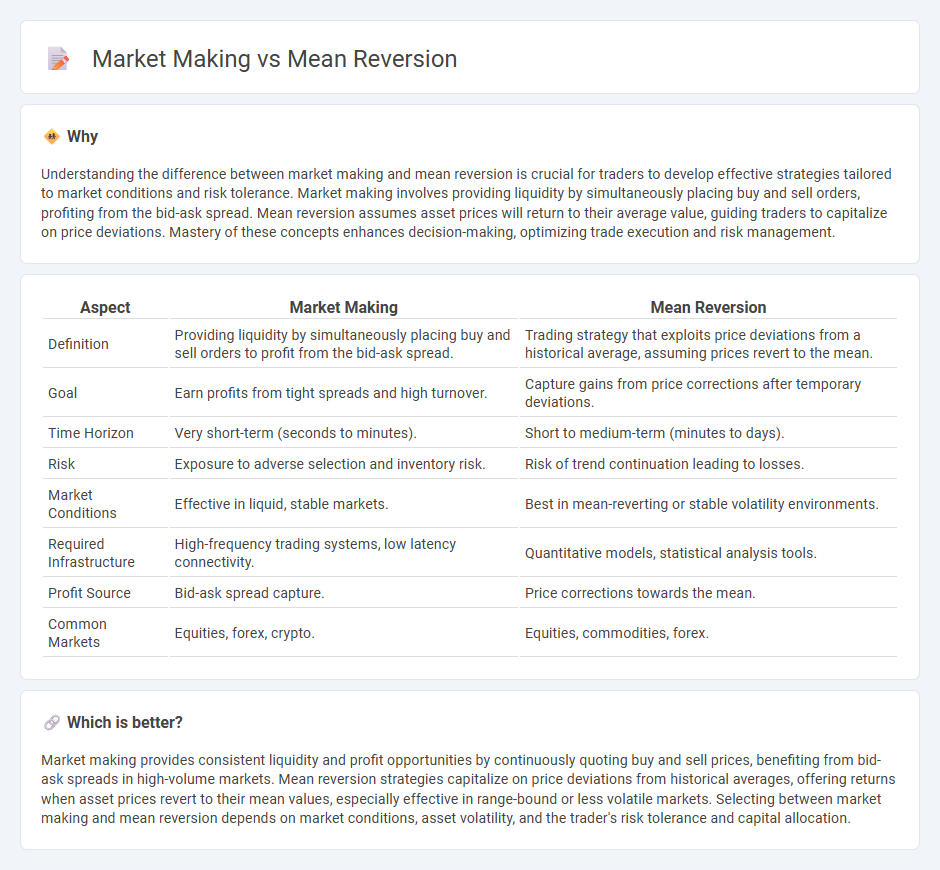

Understanding the difference between market making and mean reversion is crucial for traders to develop effective strategies tailored to market conditions and risk tolerance. Market making involves providing liquidity by simultaneously placing buy and sell orders, profiting from the bid-ask spread. Mean reversion assumes asset prices will return to their average value, guiding traders to capitalize on price deviations. Mastery of these concepts enhances decision-making, optimizing trade execution and risk management.

Comparison Table

| Aspect | Market Making | Mean Reversion |

|---|---|---|

| Definition | Providing liquidity by simultaneously placing buy and sell orders to profit from the bid-ask spread. | Trading strategy that exploits price deviations from a historical average, assuming prices revert to the mean. |

| Goal | Earn profits from tight spreads and high turnover. | Capture gains from price corrections after temporary deviations. |

| Time Horizon | Very short-term (seconds to minutes). | Short to medium-term (minutes to days). |

| Risk | Exposure to adverse selection and inventory risk. | Risk of trend continuation leading to losses. |

| Market Conditions | Effective in liquid, stable markets. | Best in mean-reverting or stable volatility environments. |

| Required Infrastructure | High-frequency trading systems, low latency connectivity. | Quantitative models, statistical analysis tools. |

| Profit Source | Bid-ask spread capture. | Price corrections towards the mean. |

| Common Markets | Equities, forex, crypto. | Equities, commodities, forex. |

Which is better?

Market making provides consistent liquidity and profit opportunities by continuously quoting buy and sell prices, benefiting from bid-ask spreads in high-volume markets. Mean reversion strategies capitalize on price deviations from historical averages, offering returns when asset prices revert to their mean values, especially effective in range-bound or less volatile markets. Selecting between market making and mean reversion depends on market conditions, asset volatility, and the trader's risk tolerance and capital allocation.

Connection

Market making and mean reversion are connected through their shared reliance on price equilibrium concepts in trading. Market makers provide liquidity by continuously quoting buy and sell prices, profiting from bid-ask spreads, while mean reversion strategies exploit price deviations returning to average levels. Both approaches benefit from volatility and market inefficiencies, facilitating profitable trades as prices oscillate around a central value.

Key Terms

Price Deviation

Mean reversion strategies capitalize on price deviations by predicting that asset prices will return to their historical average, exploiting temporary mispricings for profit. Market making involves continuously quoting buy and sell prices while managing inventory risk, profiting from the bid-ask spread rather than relying solely on price deviation. Explore detailed comparisons and practical applications to enhance your trading strategies.

Bid-Ask Spread

Mean reversion strategies capitalize on price corrections by betting that asset prices will revert to their historical average, often trading around identifiable support and resistance levels. Market making profits primarily from the bid-ask spread by providing liquidity, continuously quoting buy and sell prices to capture small but consistent gains from each transaction. Explore how these approaches differ in exploiting market inefficiencies and the role of bid-ask spreads in trading strategies.

Inventory Management

Mean reversion strategies rely on statistical models to predict asset prices returning to their historical averages, impacting inventory by requiring traders to hold positions expecting price corrections. Market making focuses on providing liquidity by continuously quoting bid and ask prices, necessitating careful inventory management to balance exposure and minimize risk from price volatility. Explore deeper insights into inventory management techniques in both approaches to enhance trading efficiency.

Source and External Links

Mean Reversion Strategies: Introduction, Trading ... - Mean reversion is a financial theory positing that asset prices and returns tend to revert to their long-term average, with traders identifying historical averages to buy when prices fall below and sell when prices rise above this mean.

Mean reversion (finance) - Mean reversion is the assumption that asset prices tend to converge back to their historical average over time, forming a basis for trading strategies that capitalize on price deviations above or below this average.

Mean Reversion - Overview, Trading, Impact of Catalysts - Mean reversion theory implies asset prices gradually return to a long-term mean, and traders use this concept statistically to buy undervalued securities and sell overvalued ones, often reacting to market catalysts that affect price action.

dowidth.com

dowidth.com