Quantitative sentiment analysis leverages natural language processing algorithms to evaluate market sentiment from news, social media, and financial reports, generating data-driven trade signals. High-frequency trading uses sophisticated algorithms to execute thousands of trades per second, capitalizing on minute price discrepancies for rapid profit generation. Explore how these advanced trading methodologies transform market dynamics and investment strategies.

Why it is important

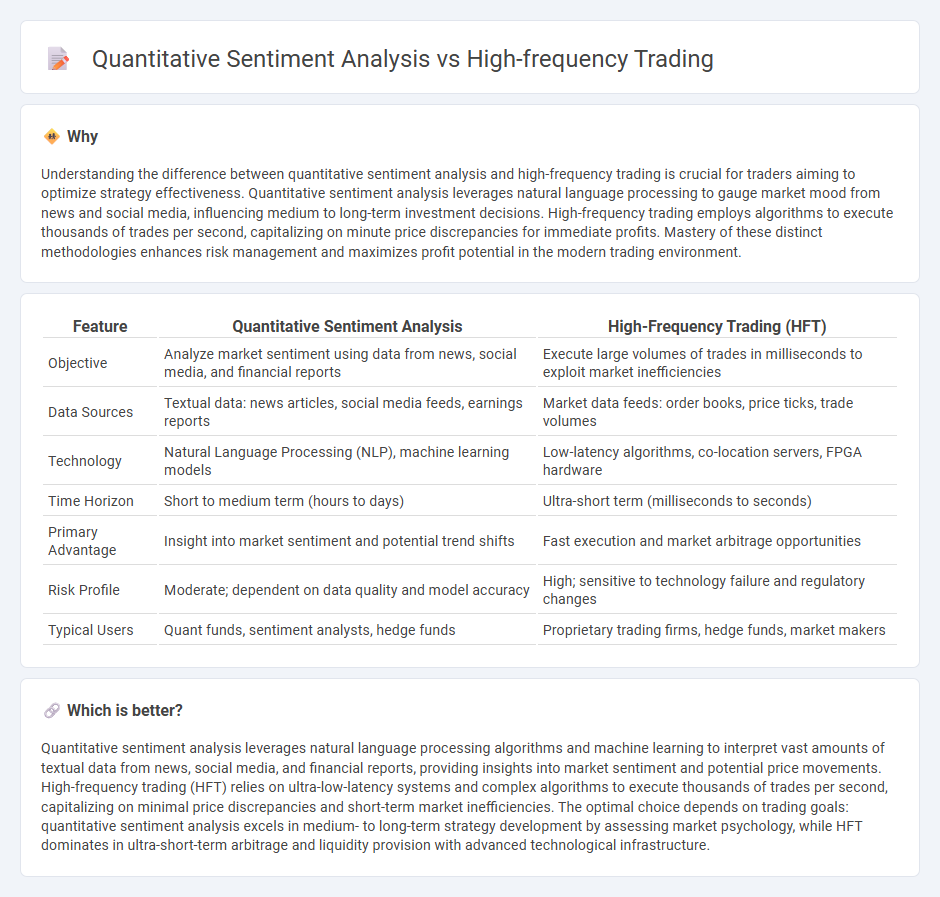

Understanding the difference between quantitative sentiment analysis and high-frequency trading is crucial for traders aiming to optimize strategy effectiveness. Quantitative sentiment analysis leverages natural language processing to gauge market mood from news and social media, influencing medium to long-term investment decisions. High-frequency trading employs algorithms to execute thousands of trades per second, capitalizing on minute price discrepancies for immediate profits. Mastery of these distinct methodologies enhances risk management and maximizes profit potential in the modern trading environment.

Comparison Table

| Feature | Quantitative Sentiment Analysis | High-Frequency Trading (HFT) |

|---|---|---|

| Objective | Analyze market sentiment using data from news, social media, and financial reports | Execute large volumes of trades in milliseconds to exploit market inefficiencies |

| Data Sources | Textual data: news articles, social media feeds, earnings reports | Market data feeds: order books, price ticks, trade volumes |

| Technology | Natural Language Processing (NLP), machine learning models | Low-latency algorithms, co-location servers, FPGA hardware |

| Time Horizon | Short to medium term (hours to days) | Ultra-short term (milliseconds to seconds) |

| Primary Advantage | Insight into market sentiment and potential trend shifts | Fast execution and market arbitrage opportunities |

| Risk Profile | Moderate; dependent on data quality and model accuracy | High; sensitive to technology failure and regulatory changes |

| Typical Users | Quant funds, sentiment analysts, hedge funds | Proprietary trading firms, hedge funds, market makers |

Which is better?

Quantitative sentiment analysis leverages natural language processing algorithms and machine learning to interpret vast amounts of textual data from news, social media, and financial reports, providing insights into market sentiment and potential price movements. High-frequency trading (HFT) relies on ultra-low-latency systems and complex algorithms to execute thousands of trades per second, capitalizing on minimal price discrepancies and short-term market inefficiencies. The optimal choice depends on trading goals: quantitative sentiment analysis excels in medium- to long-term strategy development by assessing market psychology, while HFT dominates in ultra-short-term arbitrage and liquidity provision with advanced technological infrastructure.

Connection

Quantitative sentiment analysis processes vast amounts of market data and social media feeds to gauge investor emotions, which high-frequency trading algorithms then utilize to execute rapid trades based on detected sentiment shifts. By integrating sentiment scores into their real-time models, high-frequency trading firms optimize decision-making and capitalize on fleeting market inefficiencies. This synergy enhances predictive accuracy and trading performance in milliseconds-driven financial environments.

Key Terms

Algorithmic Trading

High-frequency trading (HFT) emphasizes rapid order execution using advanced algorithms to capitalize on market inefficiencies within milliseconds, while quantitative sentiment analysis leverages natural language processing and machine learning to gauge market sentiment from news, social media, and other text sources. Algorithmic trading incorporates both HFT and sentiment analysis strategies to optimize decision-making and enhance trade performance through data-driven insights and automated execution. Explore how integrating high-frequency algorithms with sentiment analysis transforms modern algorithmic trading strategies.

Latency

High-frequency trading relies on ultra-low latency to execute trades within microseconds, leveraging speed advantages on market data and order execution. Quantitative sentiment analysis integrates real-time news and social media signals but faces challenges in minimizing latency while processing unstructured data for timely decision-making. Explore deeper insights into optimizing latency for both strategies to enhance trading performance.

Natural Language Processing (NLP)

High-frequency trading leverages algorithmic models to execute trades at millisecond speeds, optimizing for market microstructure and liquidity patterns. Quantitative sentiment analysis uses Natural Language Processing (NLP) techniques to extract and quantify emotional tone from financial news, social media, and earnings reports, influencing trading signals based on market sentiment. Explore how integrating NLP-driven sentiment analysis enhances predictive accuracy in high-frequency trading strategies.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) is an automated trading method using powerful computers and algorithms to execute a very large number of trades at extremely high speeds, capitalizing on tiny and fleeting price differences across markets to make profits.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT leverages complex algorithms and ultra-fast trade execution to analyze stocks and perform many trades in milliseconds, which increases market liquidity and competition while profiting from small price fluctuations.

High-frequency trading - Wikipedia - High-frequency trading is a form of quantitative algorithmic trading with short portfolio holding periods that exploits minor market inefficiencies and uses strategies like market-making and arbitrage, contributing to both market volatility and price efficiency during events like the 2010 Flash Crash.

dowidth.com

dowidth.com