Market microstructure examines the processes and mechanisms underlying the trading of securities, focusing on how orders are matched, price formation occurs, and information is disseminated. Market fragmentation refers to the division of trading activity across multiple venues or exchanges, which can impact liquidity, price discovery, and execution quality. Explore the differences between these concepts to better understand trading dynamics and optimize strategies.

Why it is important

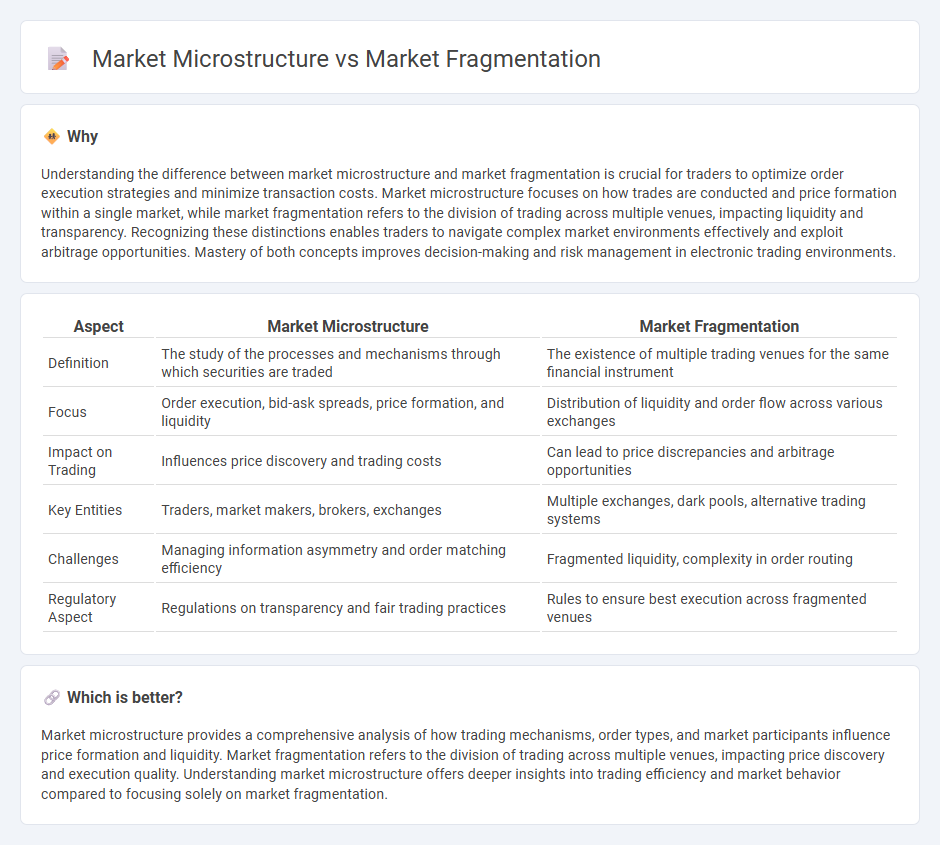

Understanding the difference between market microstructure and market fragmentation is crucial for traders to optimize order execution strategies and minimize transaction costs. Market microstructure focuses on how trades are conducted and price formation within a single market, while market fragmentation refers to the division of trading across multiple venues, impacting liquidity and transparency. Recognizing these distinctions enables traders to navigate complex market environments effectively and exploit arbitrage opportunities. Mastery of both concepts improves decision-making and risk management in electronic trading environments.

Comparison Table

| Aspect | Market Microstructure | Market Fragmentation |

|---|---|---|

| Definition | The study of the processes and mechanisms through which securities are traded | The existence of multiple trading venues for the same financial instrument |

| Focus | Order execution, bid-ask spreads, price formation, and liquidity | Distribution of liquidity and order flow across various exchanges |

| Impact on Trading | Influences price discovery and trading costs | Can lead to price discrepancies and arbitrage opportunities |

| Key Entities | Traders, market makers, brokers, exchanges | Multiple exchanges, dark pools, alternative trading systems |

| Challenges | Managing information asymmetry and order matching efficiency | Fragmented liquidity, complexity in order routing |

| Regulatory Aspect | Regulations on transparency and fair trading practices | Rules to ensure best execution across fragmented venues |

Which is better?

Market microstructure provides a comprehensive analysis of how trading mechanisms, order types, and market participants influence price formation and liquidity. Market fragmentation refers to the division of trading across multiple venues, impacting price discovery and execution quality. Understanding market microstructure offers deeper insights into trading efficiency and market behavior compared to focusing solely on market fragmentation.

Connection

Market microstructure analyzes the processes and mechanisms through which securities are traded, focusing on the roles of market participants, order types, and price formation. Market fragmentation refers to the dispersion of trading activity across multiple venues, which influences liquidity and price discovery within microstructure. The interaction between microstructure and fragmentation shapes transaction costs, bid-ask spreads, and market efficiency in modern financial markets.

Key Terms

**Market Fragmentation:**

Market fragmentation refers to the division of a market into multiple trading venues or platforms, which can lead to varied liquidity, price discrepancies, and increased complexity for market participants. This phenomenon significantly impacts order execution, as traders must navigate multiple venues to achieve best prices and optimal trade fulfillment. Explore more about how market fragmentation shapes trading strategies and market efficiency.

Liquidity Pools

Market fragmentation refers to the dispersion of trading activity across multiple trading venues, impacting overall market liquidity by creating numerous liquidity pools with varying depth and access costs. Market microstructure studies the mechanisms and processes within these trading venues, including order types, price formation, and the behavior of liquidity providers and takers within individual liquidity pools. Explore the interplay between fragmentation and microstructure to understand how liquidity pools influence trade execution and market efficiency.

Order Routing

Market fragmentation refers to the division of trading activity across multiple venues, which affects order routing by requiring sophisticated algorithms to navigate different liquidity pools and pricing disparities. Market microstructure examines the processes and mechanisms within individual trading venues, emphasizing order flow, bid-ask spreads, and execution quality that directly influence the effectiveness of order routing strategies. Explore deeper insights into how order routing adapts to both market fragmentation and microstructure dynamics to enhance trading performance.

Source and External Links

What Is a Fragmented Market? - A fragmented market is one where no single company has enough influence to dominate, often forming as diverse customer needs create distinct sub-markets with different product or service offerings, driven by factors like strong competition, diverse demand, or lower-cost alternatives.

What is Market Fragmentation? - Market fragmentation occurs when a marketplace splits into many smaller markets catering to customers with distinct preferences, often caused by evolving consumer trends, technological changes, or niche specialization, exemplified by industries like coffee shops and electric vehicles.

Market fragmentation - In technology markets, fragmentation happens when multiple incompatible technologies or platforms exist, forcing customers to commit to particular ecosystems and leading to vendor lock-in, which contrasts with market standardization.

dowidth.com

dowidth.com