Smart Money Concepts focus on identifying the activities of institutional traders by analyzing order flow and market structure, providing insights into market manipulation and liquidity zones. Price Action Trading relies on reading candlestick patterns, support and resistance levels, and price movements to predict market direction without indicators. Explore deeper to understand which strategy aligns best with your trading goals.

Why it is important

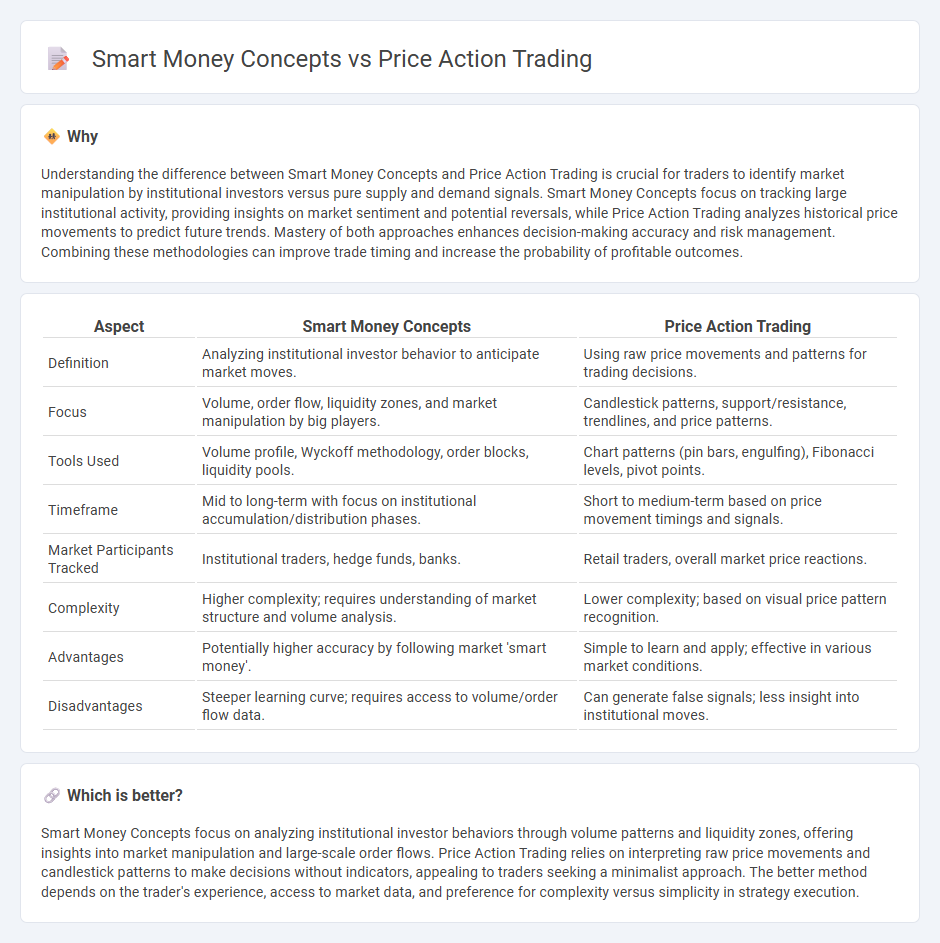

Understanding the difference between Smart Money Concepts and Price Action Trading is crucial for traders to identify market manipulation by institutional investors versus pure supply and demand signals. Smart Money Concepts focus on tracking large institutional activity, providing insights on market sentiment and potential reversals, while Price Action Trading analyzes historical price movements to predict future trends. Mastery of both approaches enhances decision-making accuracy and risk management. Combining these methodologies can improve trade timing and increase the probability of profitable outcomes.

Comparison Table

| Aspect | Smart Money Concepts | Price Action Trading |

|---|---|---|

| Definition | Analyzing institutional investor behavior to anticipate market moves. | Using raw price movements and patterns for trading decisions. |

| Focus | Volume, order flow, liquidity zones, and market manipulation by big players. | Candlestick patterns, support/resistance, trendlines, and price patterns. |

| Tools Used | Volume profile, Wyckoff methodology, order blocks, liquidity pools. | Chart patterns (pin bars, engulfing), Fibonacci levels, pivot points. |

| Timeframe | Mid to long-term with focus on institutional accumulation/distribution phases. | Short to medium-term based on price movement timings and signals. |

| Market Participants Tracked | Institutional traders, hedge funds, banks. | Retail traders, overall market price reactions. |

| Complexity | Higher complexity; requires understanding of market structure and volume analysis. | Lower complexity; based on visual price pattern recognition. |

| Advantages | Potentially higher accuracy by following market 'smart money'. | Simple to learn and apply; effective in various market conditions. |

| Disadvantages | Steeper learning curve; requires access to volume/order flow data. | Can generate false signals; less insight into institutional moves. |

Which is better?

Smart Money Concepts focus on analyzing institutional investor behaviors through volume patterns and liquidity zones, offering insights into market manipulation and large-scale order flows. Price Action Trading relies on interpreting raw price movements and candlestick patterns to make decisions without indicators, appealing to traders seeking a minimalist approach. The better method depends on the trader's experience, access to market data, and preference for complexity versus simplicity in strategy execution.

Connection

Smart money concepts focus on tracking institutional investors' market behavior, which aligns closely with price action trading that analyzes raw price movements without relying on indicators. By interpreting order flow, supply and demand zones, and market structure, traders can identify manipulation and true market sentiment. Combining smart money concepts with price action strategies enhances decision-making by revealing high-probability entry and exit points driven by professional participation.

Key Terms

**Price Action Trading:**

Price Action Trading relies on analyzing historical price movements and patterns, such as candlestick formations and support-resistance levels, to make informed trading decisions without relying on indicators. It emphasizes reading raw market data to identify trends, reversals, and key entry or exit points, enhancing adaptability across different market conditions. Explore deeper insights into Price Action Trading strategies and techniques for improved market analysis and execution.

Candlestick Patterns

Price action trading relies heavily on interpreting candlestick patterns such as pin bars, engulfing candles, and doji formations to identify potential market reversals and continuations. Smart money concepts emphasize the analysis of institutional order flow, liquidity zones, and market manipulation, often using candlestick patterns within the context of volume and price structure to gauge market sentiment. Explore the interplay between candlestick patterns and smart money strategies to enhance your trading decisions.

Support and Resistance

Price Action Trading relies heavily on identifying key support and resistance levels through historical price patterns, enabling traders to anticipate reversals and continuations based on market behavior. Smart Money Concepts integrate order flow and institutional activity, emphasizing supply and demand zones where large players accumulate or distribute positions, often revealing more precise and influential support and resistance areas. Explore deeper to understand how combining these approaches can enhance your trading strategies.

Source and External Links

Price Action Trading Explained - Learn To Trade The Market - Price Action Trading is the discipline of making all trading decisions from a "naked" price chart without relying on lagging indicators; it focuses purely on the movement of price itself, which reflects all market factors and trader beliefs, enabling development of high-probability trading strategies based solely on price signals.

What Is Price Action? - Price Action Trading Introduction - Price action trading is a 'pure' technical analysis methodology that studies basic price movement over time to predict future market direction, ignoring fundamental factors and focusing only on actual price behavior to guide trading decisions.

Price Action Trading: Meaning, Benefits and Strategies - Price action trading involves making decisions based on price movements using strategies such as support and resistance trading, breakout trading, trendline trading, and candlestick pattern analysis to find entry and exit points while reducing risk.

dowidth.com

dowidth.com