Liquidity mining involves providing assets to decentralized exchanges or protocols to earn token rewards, whereas yield farming focuses on strategically moving assets across multiple platforms to maximize returns through interest, fees, or incentives. Both strategies depend on smart contract interactions within the decentralized finance (DeFi) ecosystem, but yield farming often requires more active management and risk assessment due to its complexity. Explore in-depth comparisons and best practices to enhance your DeFi trading strategies.

Why it is important

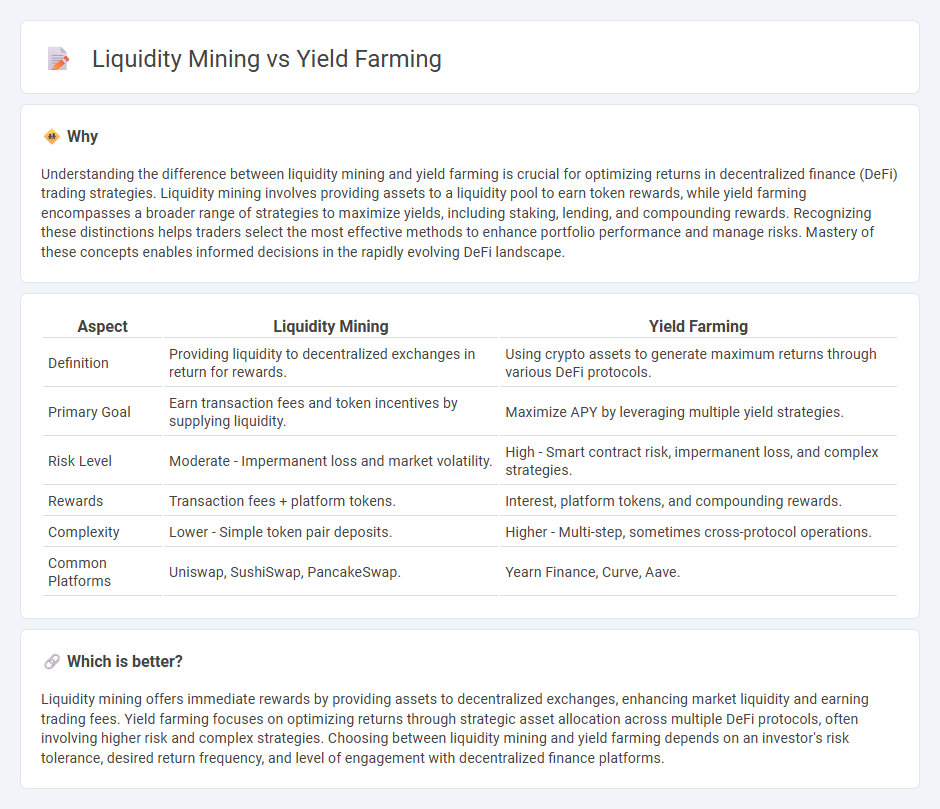

Understanding the difference between liquidity mining and yield farming is crucial for optimizing returns in decentralized finance (DeFi) trading strategies. Liquidity mining involves providing assets to a liquidity pool to earn token rewards, while yield farming encompasses a broader range of strategies to maximize yields, including staking, lending, and compounding rewards. Recognizing these distinctions helps traders select the most effective methods to enhance portfolio performance and manage risks. Mastery of these concepts enables informed decisions in the rapidly evolving DeFi landscape.

Comparison Table

| Aspect | Liquidity Mining | Yield Farming |

|---|---|---|

| Definition | Providing liquidity to decentralized exchanges in return for rewards. | Using crypto assets to generate maximum returns through various DeFi protocols. |

| Primary Goal | Earn transaction fees and token incentives by supplying liquidity. | Maximize APY by leveraging multiple yield strategies. |

| Risk Level | Moderate - Impermanent loss and market volatility. | High - Smart contract risk, impermanent loss, and complex strategies. |

| Rewards | Transaction fees + platform tokens. | Interest, platform tokens, and compounding rewards. |

| Complexity | Lower - Simple token pair deposits. | Higher - Multi-step, sometimes cross-protocol operations. |

| Common Platforms | Uniswap, SushiSwap, PancakeSwap. | Yearn Finance, Curve, Aave. |

Which is better?

Liquidity mining offers immediate rewards by providing assets to decentralized exchanges, enhancing market liquidity and earning trading fees. Yield farming focuses on optimizing returns through strategic asset allocation across multiple DeFi protocols, often involving higher risk and complex strategies. Choosing between liquidity mining and yield farming depends on an investor's risk tolerance, desired return frequency, and level of engagement with decentralized finance platforms.

Connection

Liquidity mining and yield farming are interconnected strategies in decentralized finance (DeFi) that incentivize users to provide liquidity to cryptocurrency pools by rewarding them with tokens. Both practices enhance liquidity on platforms like Uniswap and SushiSwap, increasing trading efficiency and reducing slippage. Yield farming expands on liquidity mining by allowing users to stake or lend their rewards across multiple protocols, maximizing overall returns.

Key Terms

APY (Annual Percentage Yield)

Yield farming and liquidity mining both aim to maximize APY by leveraging crypto assets, with yield farming often involving multiple DeFi protocols to optimize returns, while liquidity mining rewards users primarily through native tokens for providing liquidity on a specific platform. APY in yield farming may vary significantly due to compounding strategies and market conditions, whereas liquidity mining's APY is directly tied to the asset's reward structure and trading volume incentives. Explore the nuances and latest trends in yield farming and liquidity mining APY to enhance your DeFi investment strategy.

Liquidity Pool

Yield farming maximizes returns by staking or lending crypto assets, while liquidity mining rewards users for providing assets to liquidity pools on decentralized exchanges. Liquidity pools aggregate funds to facilitate token swaps, with rewards often distributed in governance tokens or fees proportional to contributions. Explore the mechanisms behind liquidity pools to optimize your decentralized finance strategy and enhance asset growth.

Reward Tokens

Reward tokens in yield farming typically come from staking assets in DeFi protocols, offering participants returns based on the interest or fees generated. Liquidity mining specifically incentivizes users to provide liquidity to decentralized exchanges by distributing native governance tokens as rewards. Explore the unique tokenomics and advantages of each method to maximize your DeFi earnings.

Source and External Links

What is yield farming and how does it work? - Coinbase - Yield farming is a DeFi practice where users lock digital assets into protocols to earn rewards, typically paid in governance tokens, incentivizing liquidity provision crucial for DeFi platforms' operation.

What Is Yield Farming? Meaning and Definition - Chainlink - Yield farming rewards users for providing liquidity or value-adding services to DeFi protocols, helping bootstrap liquidity and fairly distributing native tokens to incentivize participation.

Yield Farming Explained: Your Complete Beginner's Guide - Kraken - Yield farming is a strategy to earn rewards by providing liquidity to decentralized exchanges or lending protocols, receiving transaction fees and governance tokens but bearing risks like impermanent loss and smart contract flaws.

dowidth.com

dowidth.com