Synthetic positions replicate stock ownership using options, enabling traders to mimic long or short stock exposure without directly buying or selling shares. Short stock involves borrowing shares to sell in anticipation of a price decline, while synthetic shorts use options strategies to achieve similar financial outcomes with potentially lower capital requirements and risk management benefits. Explore the differences further to understand which strategy aligns best with your trading goals.

Why it is important

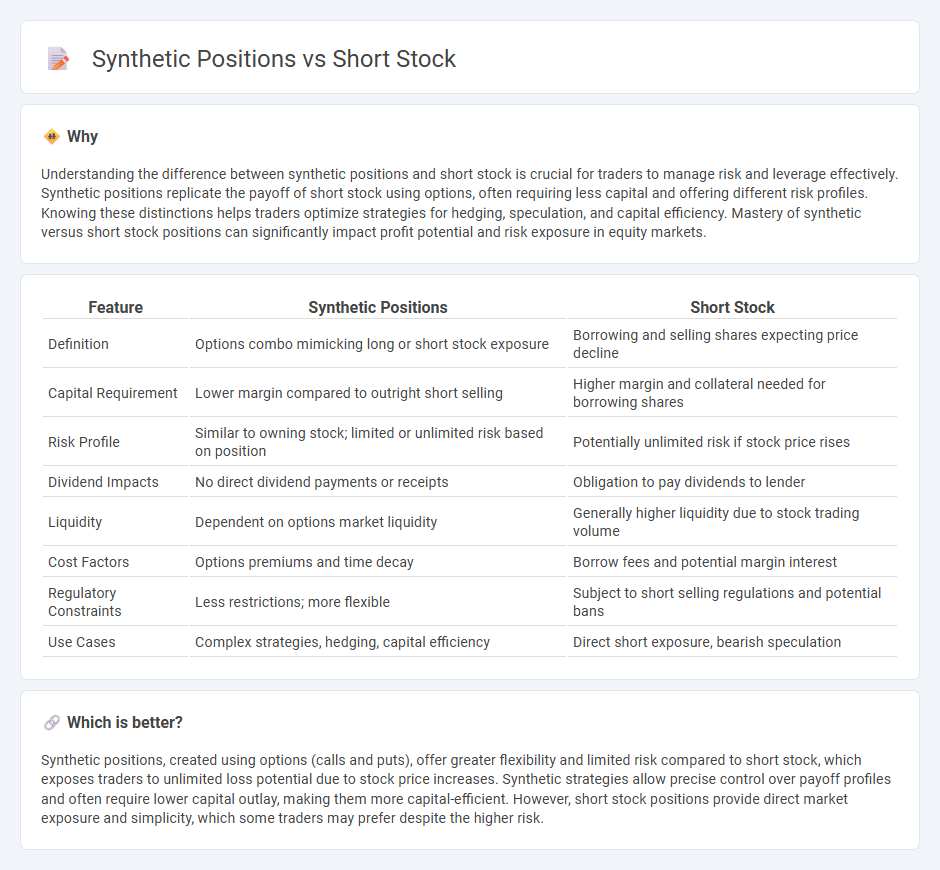

Understanding the difference between synthetic positions and short stock is crucial for traders to manage risk and leverage effectively. Synthetic positions replicate the payoff of short stock using options, often requiring less capital and offering different risk profiles. Knowing these distinctions helps traders optimize strategies for hedging, speculation, and capital efficiency. Mastery of synthetic versus short stock positions can significantly impact profit potential and risk exposure in equity markets.

Comparison Table

| Feature | Synthetic Positions | Short Stock |

|---|---|---|

| Definition | Options combo mimicking long or short stock exposure | Borrowing and selling shares expecting price decline |

| Capital Requirement | Lower margin compared to outright short selling | Higher margin and collateral needed for borrowing shares |

| Risk Profile | Similar to owning stock; limited or unlimited risk based on position | Potentially unlimited risk if stock price rises |

| Dividend Impacts | No direct dividend payments or receipts | Obligation to pay dividends to lender |

| Liquidity | Dependent on options market liquidity | Generally higher liquidity due to stock trading volume |

| Cost Factors | Options premiums and time decay | Borrow fees and potential margin interest |

| Regulatory Constraints | Less restrictions; more flexible | Subject to short selling regulations and potential bans |

| Use Cases | Complex strategies, hedging, capital efficiency | Direct short exposure, bearish speculation |

Which is better?

Synthetic positions, created using options (calls and puts), offer greater flexibility and limited risk compared to short stock, which exposes traders to unlimited loss potential due to stock price increases. Synthetic strategies allow precise control over payoff profiles and often require lower capital outlay, making them more capital-efficient. However, short stock positions provide direct market exposure and simplicity, which some traders may prefer despite the higher risk.

Connection

Synthetic positions in trading replicate the payoff of holding an actual stock using options strategies, often combining calls and puts to mimic long or short stock exposure. A short stock position involves borrowing shares to sell them, aiming to profit from a decline in the stock price, while a synthetic short stock position achieves the same risk profile without borrowing shares. Both strategies are used to manage risk, hedge portfolios, or speculate on declining stock prices with differing capital requirements and margin implications.

Key Terms

Short Selling

Short selling involves borrowing shares to sell them immediately, expecting a price drop to buy back at a lower cost and profit from the difference. Synthetic short positions use derivatives like options or futures to replicate short selling without borrowing shares, offering flexibility and often lower capital requirements. Explore detailed strategies and risk management techniques to optimize your short-selling approach.

Synthetic Short

Synthetic short positions mimic the payoff of traditional short selling by combining options strategies such as buying puts and selling calls on the same underlying asset. This approach allows traders to capitalize on downward price movements without the need to borrow shares, reducing shorting risks like margin calls or short squeezes. Explore more on how synthetic shorts optimize risk management and leverage opportunities.

Options (Put and Call)

Short stock positions involve selling borrowed shares to profit from a decline in the underlying stock's price, exposing traders to unlimited downside risk. Synthetic positions replicate stock exposure using options strategies, such as buying puts and selling calls to mimic a short stock, often requiring less capital and offering controlled risk. Explore detailed options strategies to master synthetic short positions and manage risk effectively.

Source and External Links

Short Selling: 5 Steps for Shorting a Stock - Short selling involves borrowing shares to sell them, hoping their price will drop so you can buy them back cheaper and profit from the difference, and it requires a margin account with collateral and ongoing maintenance of margin requirements.

Short (finance) - Being short in finance means profiting if the asset's value falls, involving borrowing shares, selling them, then buying them back at a lower price to return to the lender, with profit or loss based on price changes.

How to short stocks the right way: A step-by-step guide | Saxo - Short selling is an investment strategy that bets against a stock by borrowing and selling shares at the current price, commonly done via leveraged products like CFDs, but it carries significant risks and is unsuitable for inexperienced traders.

dowidth.com

dowidth.com