Market making involves continuously quoting buy and sell prices to provide liquidity and capture the bid-ask spread, requiring rapid execution and risk management in volatile markets. Position trading focuses on holding assets for extended periods, leveraging fundamental analysis and market trends to capitalize on long-term price movements. Explore the nuances of market making versus position trading to optimize your trading strategy.

Why it is important

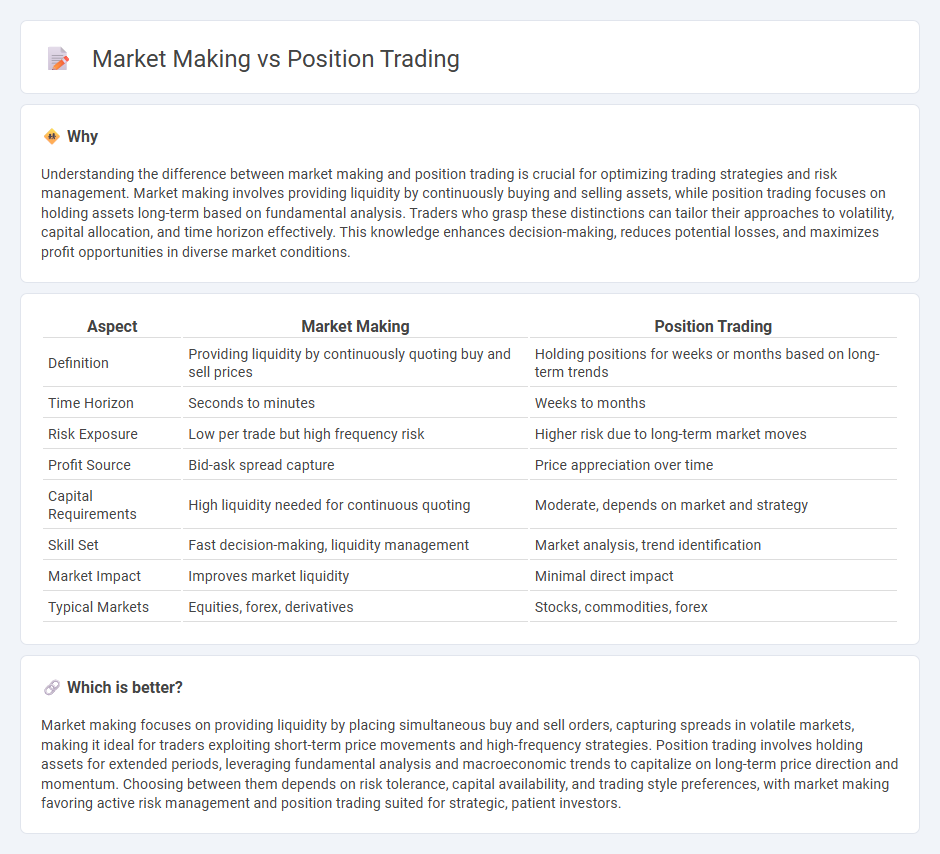

Understanding the difference between market making and position trading is crucial for optimizing trading strategies and risk management. Market making involves providing liquidity by continuously buying and selling assets, while position trading focuses on holding assets long-term based on fundamental analysis. Traders who grasp these distinctions can tailor their approaches to volatility, capital allocation, and time horizon effectively. This knowledge enhances decision-making, reduces potential losses, and maximizes profit opportunities in diverse market conditions.

Comparison Table

| Aspect | Market Making | Position Trading |

|---|---|---|

| Definition | Providing liquidity by continuously quoting buy and sell prices | Holding positions for weeks or months based on long-term trends |

| Time Horizon | Seconds to minutes | Weeks to months |

| Risk Exposure | Low per trade but high frequency risk | Higher risk due to long-term market moves |

| Profit Source | Bid-ask spread capture | Price appreciation over time |

| Capital Requirements | High liquidity needed for continuous quoting | Moderate, depends on market and strategy |

| Skill Set | Fast decision-making, liquidity management | Market analysis, trend identification |

| Market Impact | Improves market liquidity | Minimal direct impact |

| Typical Markets | Equities, forex, derivatives | Stocks, commodities, forex |

Which is better?

Market making focuses on providing liquidity by placing simultaneous buy and sell orders, capturing spreads in volatile markets, making it ideal for traders exploiting short-term price movements and high-frequency strategies. Position trading involves holding assets for extended periods, leveraging fundamental analysis and macroeconomic trends to capitalize on long-term price direction and momentum. Choosing between them depends on risk tolerance, capital availability, and trading style preferences, with market making favoring active risk management and position trading suited for strategic, patient investors.

Connection

Market making and position trading are connected through their roles in providing liquidity and influencing price stability in financial markets. Market makers continuously quote buy and sell prices, facilitating smooth trades, while position traders hold assets for extended periods, relying on market makers to execute transactions efficiently without significant price disruptions. This interplay supports market depth and helps position traders capitalize on long-term trends with reduced transaction costs.

Key Terms

Holding Period

Position trading involves holding assets for weeks to months to capitalize on long-term market trends, while market making focuses on providing liquidity with very short holding periods, typically seconds to minutes. Position traders rely on fundamental and technical analysis to determine entry and exit points over an extended timeframe, whereas market makers execute numerous trades daily to profit from bid-ask spreads and maintain market efficiency. Explore the distinct strategies of position trading and market making to optimize your trading approach.

Liquidity Provision

Position trading involves holding securities over extended periods to capitalize on long-term market trends, while market making focuses on liquidity provision by continuously quoting buy and sell prices to facilitate smoother transactions. Market makers play a crucial role in reducing bid-ask spreads and enhancing market efficiency, benefiting both traders and investors. Explore more about how these strategies impact liquidity and market dynamics.

Bid-Ask Spread

Position trading involves holding securities for extended periods to capitalize on long-term price movements, while market making focuses on profiting from the bid-ask spread by continuously buying and selling assets to provide liquidity. Market makers earn the bid-ask spread as compensation for the risk of holding inventory and facilitating market efficiency, whereas position traders rely on directional price changes over time. Discover the nuances of bid-ask spreads and their impact on trading strategies to enhance your market insight.

Source and External Links

A guide to position trading: definition, examples and strategies - Position trading is a style that aims to identify and profit from a long-term trend, typically holding positions for weeks to months and using strategies like trend trading, breakout trading, and pullback trading.

Position Trading 101: A Beginner's Guide With Examples - Position trading involves buying and selling financial products over weeks to months, riding both upward and downward trends, with a goal to generate substantial profits by timing entry and exit points.

Position Trading Strategy: How To Use It | Capital.com - Position trading is a long-term trading strategy that typically holds trades for months to years, aiming to profit from major market moves while reducing trading frequency and transaction costs compared to shorter-term trading styles.

dowidth.com

dowidth.com