Options flow analysis reveals real-time market sentiment by tracking large trades and unusual activity in option contracts, providing insights into investor behavior often missed by traditional methods. Fundamental analysis evaluates a company's financial health, earnings, and economic factors to determine its intrinsic value, guiding long-term investment decisions. Explore how combining options flow with fundamental analysis can enhance your trading strategy.

Why it is important

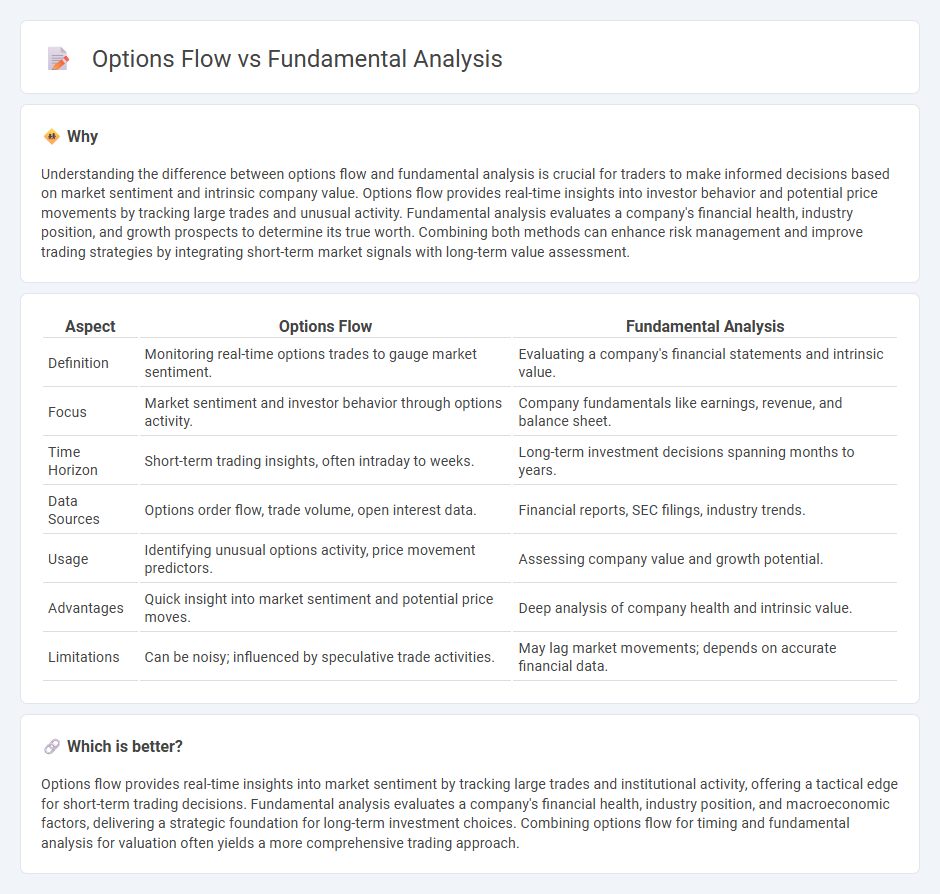

Understanding the difference between options flow and fundamental analysis is crucial for traders to make informed decisions based on market sentiment and intrinsic company value. Options flow provides real-time insights into investor behavior and potential price movements by tracking large trades and unusual activity. Fundamental analysis evaluates a company's financial health, industry position, and growth prospects to determine its true worth. Combining both methods can enhance risk management and improve trading strategies by integrating short-term market signals with long-term value assessment.

Comparison Table

| Aspect | Options Flow | Fundamental Analysis |

|---|---|---|

| Definition | Monitoring real-time options trades to gauge market sentiment. | Evaluating a company's financial statements and intrinsic value. |

| Focus | Market sentiment and investor behavior through options activity. | Company fundamentals like earnings, revenue, and balance sheet. |

| Time Horizon | Short-term trading insights, often intraday to weeks. | Long-term investment decisions spanning months to years. |

| Data Sources | Options order flow, trade volume, open interest data. | Financial reports, SEC filings, industry trends. |

| Usage | Identifying unusual options activity, price movement predictors. | Assessing company value and growth potential. |

| Advantages | Quick insight into market sentiment and potential price moves. | Deep analysis of company health and intrinsic value. |

| Limitations | Can be noisy; influenced by speculative trade activities. | May lag market movements; depends on accurate financial data. |

Which is better?

Options flow provides real-time insights into market sentiment by tracking large trades and institutional activity, offering a tactical edge for short-term trading decisions. Fundamental analysis evaluates a company's financial health, industry position, and macroeconomic factors, delivering a strategic foundation for long-term investment choices. Combining options flow for timing and fundamental analysis for valuation often yields a more comprehensive trading approach.

Connection

Options flow reveals real-time market sentiment by tracking large trades and unusual activity, providing insights into investor expectations. Fundamental analysis evaluates a company's financial health and intrinsic value through metrics like earnings, revenue, and cash flow. Combining options flow with fundamental analysis enhances trading decisions by aligning market sentiment with underlying asset valuation, improving risk assessment and timing.

Key Terms

**Fundamental Analysis:**

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, economic indicators, and industry trends to determine stock price potential. Key metrics include earnings per share (EPS), price-to-earnings (P/E) ratio, and revenue growth, which help investors assess long-term profitability and risk. Explore how fundamental analysis forms the foundation for smart investment decisions and complements other market strategies.

Earnings Reports

Earnings reports provide critical insights into a company's financial health, making them a cornerstone of fundamental analysis for evaluating stock value. Options flow reveals market sentiment and expectations by tracking large trades and unusual options activity around earnings announcements. Explore how combining earnings fundamentals with options flow can enhance your trading strategies.

Price-to-Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio is a key metric in fundamental analysis, used to assess a company's valuation by comparing its current share price to its per-share earnings, revealing potential overvaluation or undervaluation. Options flow analysis, however, focuses on real-time market sentiment by tracking the volume and type of options contracts traded, which can indicate investor expectations and potential price movements before they reflect in fundamentals. Explore detailed comparisons and practical applications of P/E ratio and options flow analysis to enhance your investment strategy.

Source and External Links

Fundamental Analysis - Corporate Finance Institute - Fundamental analysis is a method of assessing the intrinsic value of a security by analyzing various macroeconomic and microeconomic factors to determine if the security is overvalued, undervalued, or fairly valued, guiding investment decisions.

What is fundamental analysis? How to assess value in trading | Saxo - Fundamental analysis evaluates an asset's intrinsic value by examining its core aspects and industry context, disregarding market sentiment and price patterns, to identify whether the asset is over or undervalued.

Fundamental analysis - Wikipedia - Fundamental analysis involves economic, industry, and company analysis to estimate a stock's intrinsic value, recommending buying if the intrinsic value exceeds the market price, holding if equal, and selling if below market price.

dowidth.com

dowidth.com