Trade journaling software offers detailed analytics and personalized performance tracking to enhance trading strategies by recording every transaction and market condition. News aggregators provide real-time, curated market news and sentiment analysis to inform timely decision-making. Discover how combining both tools can optimize your trading approach.

Why it is important

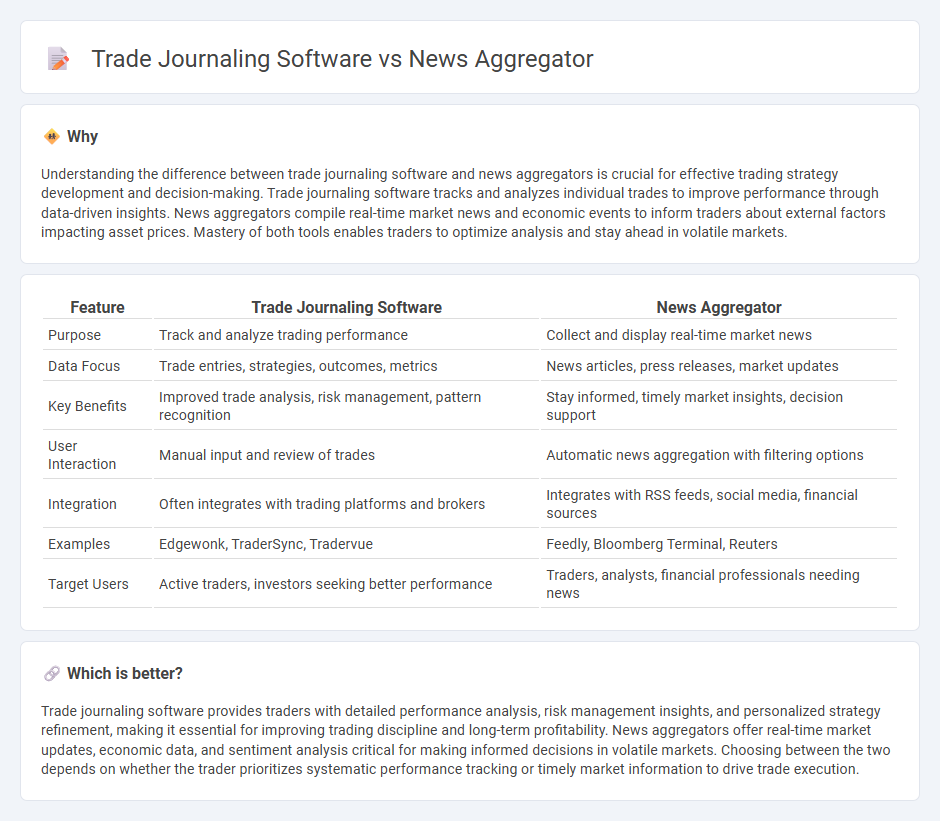

Understanding the difference between trade journaling software and news aggregators is crucial for effective trading strategy development and decision-making. Trade journaling software tracks and analyzes individual trades to improve performance through data-driven insights. News aggregators compile real-time market news and economic events to inform traders about external factors impacting asset prices. Mastery of both tools enables traders to optimize analysis and stay ahead in volatile markets.

Comparison Table

| Feature | Trade Journaling Software | News Aggregator |

|---|---|---|

| Purpose | Track and analyze trading performance | Collect and display real-time market news |

| Data Focus | Trade entries, strategies, outcomes, metrics | News articles, press releases, market updates |

| Key Benefits | Improved trade analysis, risk management, pattern recognition | Stay informed, timely market insights, decision support |

| User Interaction | Manual input and review of trades | Automatic news aggregation with filtering options |

| Integration | Often integrates with trading platforms and brokers | Integrates with RSS feeds, social media, financial sources |

| Examples | Edgewonk, TraderSync, Tradervue | Feedly, Bloomberg Terminal, Reuters |

| Target Users | Active traders, investors seeking better performance | Traders, analysts, financial professionals needing news |

Which is better?

Trade journaling software provides traders with detailed performance analysis, risk management insights, and personalized strategy refinement, making it essential for improving trading discipline and long-term profitability. News aggregators offer real-time market updates, economic data, and sentiment analysis critical for making informed decisions in volatile markets. Choosing between the two depends on whether the trader prioritizes systematic performance tracking or timely market information to drive trade execution.

Connection

Trade journaling software and news aggregators are connected through their ability to enhance trading performance by providing comprehensive data analysis and real-time market insights. Trade journaling software captures and analyzes historical trade data, while news aggregators supply timely financial news, economic reports, and market sentiment updates crucial for informed decision-making. Integrating these tools supports traders in identifying patterns, adjusting strategies, and responding swiftly to market events for improved profitability.

Key Terms

**News Aggregator:**

News aggregators efficiently compile and organize content from multiple news sources, enabling users to stay informed with real-time updates and personalized feeds. These platforms leverage AI algorithms to filter relevant news based on user preferences, enhancing content discovery and engagement. Explore the latest advancements in news aggregators to optimize your information consumption.

Real-time Alerts

Real-time alerts in news aggregators provide instant updates from multiple sources, crucial for staying ahead in fast-paced markets by delivering breaking news and market-moving events as they happen. Trade journaling software with real-time alerts enhances decision-making by notifying traders about specific trade outcomes, risk thresholds, and performance metrics in real time, allowing for immediate adjustments to strategies. Explore the distinct advantages of real-time alert features in both tools to optimize your trading efficiency.

Sentiment Analysis

Sentiment analysis in news aggregator software offers real-time tracking of market sentiment by analyzing headlines and articles to inform trading decisions, whereas trade journaling software focuses on evaluating trader emotions and decision-making patterns through post-trade sentiment tagging. News aggregators leverage natural language processing algorithms to classify sentiment from diverse financial news sources, optimizing traders' market sentiment awareness. Explore how integrating sentiment analysis in both tools can enhance trading strategies and emotional insights.

Source and External Links

Top 12 News Aggregator Websites for 2025 - A detailed list of top news aggregator sites like Feedly, Google News, and Flipboard, describing their features, user cases, and monetization models for convenient, personalized news curation.

News aggregator - Wikipedia - Explains that news aggregators are software or web applications collecting digital content from various online sources into one location, with examples and evolution from human selection to automated algorithms.

News Aggregators - Privacy Guides - Describes various news aggregator clients like Akregator, NewsFlash, and NetNewsWire, focusing on software options for aggregating news content across platforms and devices.

dowidth.com

dowidth.com