Flash loans enable traders to borrow large sums of capital instantly without collateral, facilitating high-speed, short-term trades. Arbitrage exploits price differences across markets to generate profit by simultaneously buying low and selling high, often leveraging tools like flash loans to maximize gains. Explore how combining flash loans with arbitrage strategies can amplify trading opportunities.

Why it is important

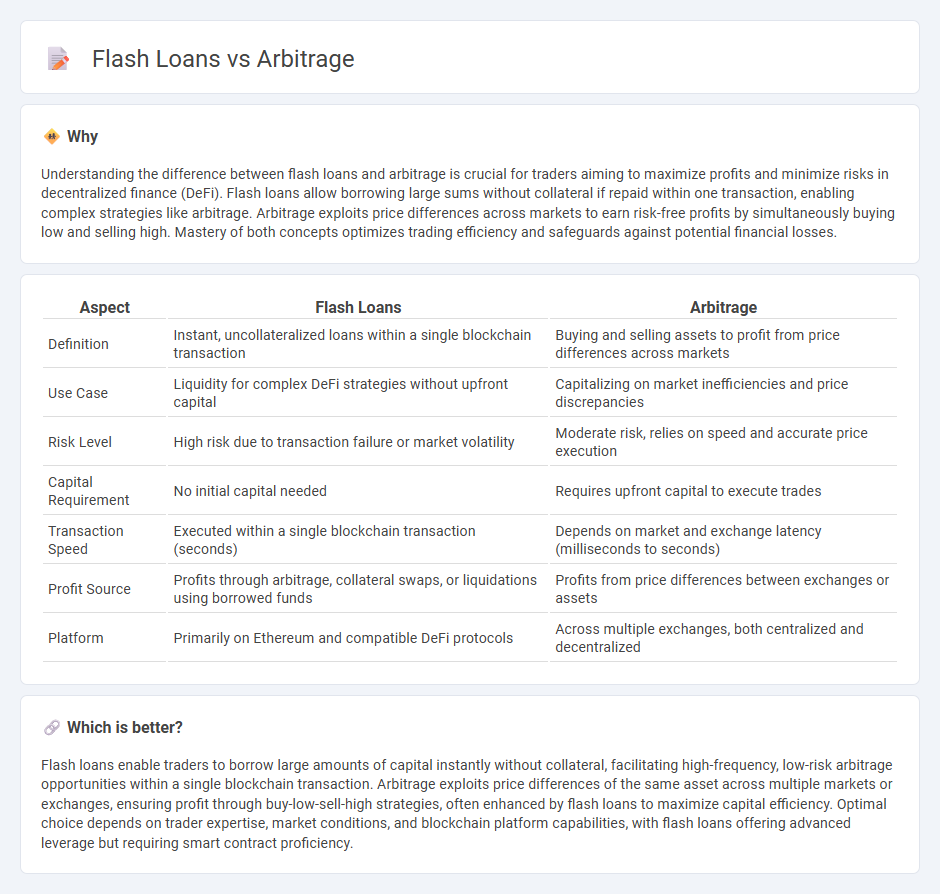

Understanding the difference between flash loans and arbitrage is crucial for traders aiming to maximize profits and minimize risks in decentralized finance (DeFi). Flash loans allow borrowing large sums without collateral if repaid within one transaction, enabling complex strategies like arbitrage. Arbitrage exploits price differences across markets to earn risk-free profits by simultaneously buying low and selling high. Mastery of both concepts optimizes trading efficiency and safeguards against potential financial losses.

Comparison Table

| Aspect | Flash Loans | Arbitrage |

|---|---|---|

| Definition | Instant, uncollateralized loans within a single blockchain transaction | Buying and selling assets to profit from price differences across markets |

| Use Case | Liquidity for complex DeFi strategies without upfront capital | Capitalizing on market inefficiencies and price discrepancies |

| Risk Level | High risk due to transaction failure or market volatility | Moderate risk, relies on speed and accurate price execution |

| Capital Requirement | No initial capital needed | Requires upfront capital to execute trades |

| Transaction Speed | Executed within a single blockchain transaction (seconds) | Depends on market and exchange latency (milliseconds to seconds) |

| Profit Source | Profits through arbitrage, collateral swaps, or liquidations using borrowed funds | Profits from price differences between exchanges or assets |

| Platform | Primarily on Ethereum and compatible DeFi protocols | Across multiple exchanges, both centralized and decentralized |

Which is better?

Flash loans enable traders to borrow large amounts of capital instantly without collateral, facilitating high-frequency, low-risk arbitrage opportunities within a single blockchain transaction. Arbitrage exploits price differences of the same asset across multiple markets or exchanges, ensuring profit through buy-low-sell-high strategies, often enhanced by flash loans to maximize capital efficiency. Optimal choice depends on trader expertise, market conditions, and blockchain platform capabilities, with flash loans offering advanced leverage but requiring smart contract proficiency.

Connection

Flash loans enable traders to borrow large amounts of capital instantly without collateral, facilitating arbitrage opportunities by exploiting price discrepancies across different markets. These loans allow for rapid execution of multiple trades within a single transaction, ensuring profits from arbitrage are realized before loan repayment is required. The integration of flash loans with decentralized exchanges significantly enhances liquidity and market efficiency in trading ecosystems.

Key Terms

Price Discrepancy

Arbitrage exploits price discrepancies across different markets or exchanges to generate risk-free profits by simultaneously buying low and selling high. Flash loans provide instant, uncollateralized capital that can be utilized within a single transaction to capitalize on these price inefficiencies without upfront investment. Explore how combining flash loans with arbitrage strategies can amplify trading opportunities and profits.

Risk-Free Profit

Arbitrage exploits price differences across multiple markets to generate risk-free profit by buying low and selling high, while flash loans enable traders to borrow large sums instantly and execute complex arbitrage strategies within a single transaction without upfront capital. Unlike traditional arbitrage, flash loans carry smart contract risk and require precise execution to avoid loss, making them innovative tools in decentralized finance (DeFi). Explore deeper insights into how these mechanisms maximize profit opportunities with minimal risk in crypto trading.

Instantaneous Settlement

Arbitrage exploits price differences across markets to generate risk-free profit, often requiring immediate transaction execution to lock in gains. Flash loans provide instant, uncollateralized liquidity within a single blockchain transaction, enabling complex arbitrage strategies with zero upfront capital and instantaneous settlement. Discover how these mechanisms revolutionize decentralized finance and unlock novel trading opportunities.

Source and External Links

Arbitrage - Wikipedia - Arbitrage is the practice of profiting from price differences of the same or similar assets in two or more markets by simultaneously buying and selling, aiming for risk-free profit, often performed by arbitrageurs.

What Is Arbitrage? 3 Strategies to Know - Harvard Business School Online - Arbitrage is an investment strategy involving simultaneous purchase and sale of an asset in different markets to capitalize on price differences, including types like pure arbitrage, merger arbitrage, and convertible arbitrage.

What is arbitrage and how does it work in financial markets - StoneX - Arbitrage involves trading strategies such as pure arbitrage, merger arbitrage, and triangular arbitrage, exploiting price differences in the same asset across markets or currencies to potentially earn profits.

dowidth.com

dowidth.com