Dark pool prints reveal large-volume trades executed privately within non-exchange trading venues, offering anonymity and reducing market impact. Block trades are sizable transactions negotiated directly between parties, often facilitated by brokers to minimize price disruption on public exchanges. Explore the differences and implications of dark pool prints versus block trades to enhance your trading strategy.

Why it is important

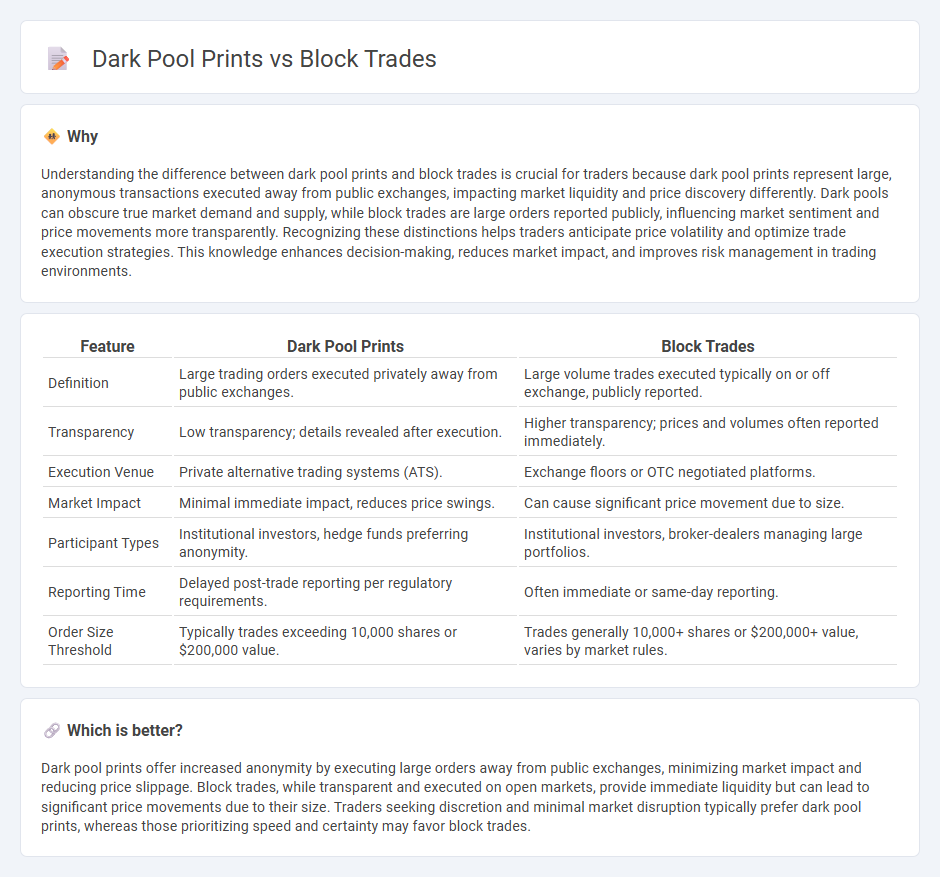

Understanding the difference between dark pool prints and block trades is crucial for traders because dark pool prints represent large, anonymous transactions executed away from public exchanges, impacting market liquidity and price discovery differently. Dark pools can obscure true market demand and supply, while block trades are large orders reported publicly, influencing market sentiment and price movements more transparently. Recognizing these distinctions helps traders anticipate price volatility and optimize trade execution strategies. This knowledge enhances decision-making, reduces market impact, and improves risk management in trading environments.

Comparison Table

| Feature | Dark Pool Prints | Block Trades |

|---|---|---|

| Definition | Large trading orders executed privately away from public exchanges. | Large volume trades executed typically on or off exchange, publicly reported. |

| Transparency | Low transparency; details revealed after execution. | Higher transparency; prices and volumes often reported immediately. |

| Execution Venue | Private alternative trading systems (ATS). | Exchange floors or OTC negotiated platforms. |

| Market Impact | Minimal immediate impact, reduces price swings. | Can cause significant price movement due to size. |

| Participant Types | Institutional investors, hedge funds preferring anonymity. | Institutional investors, broker-dealers managing large portfolios. |

| Reporting Time | Delayed post-trade reporting per regulatory requirements. | Often immediate or same-day reporting. |

| Order Size Threshold | Typically trades exceeding 10,000 shares or $200,000 value. | Trades generally 10,000+ shares or $200,000+ value, varies by market rules. |

Which is better?

Dark pool prints offer increased anonymity by executing large orders away from public exchanges, minimizing market impact and reducing price slippage. Block trades, while transparent and executed on open markets, provide immediate liquidity but can lead to significant price movements due to their size. Traders seeking discretion and minimal market disruption typically prefer dark pool prints, whereas those prioritizing speed and certainty may favor block trades.

Connection

Dark pool prints represent large volume trades executed privately away from public exchanges, often reflecting institutional investor activity. These prints frequently correspond to block trades, which involve the purchase or sale of substantial asset quantities, minimizing market impact and preserving price stability. Analyzing the relationship between dark pool prints and block trades provides insights into market liquidity and institutional trading strategies.

Key Terms

Trade Size

Block trades typically involve large trade sizes exceeding 10,000 shares or $200,000 in value, providing significant liquidity outside public exchanges, whereas dark pool prints represent smaller, discreet transactions within private exchanges to minimize market impact. Trade size is crucial in distinguishing block trades, which move substantial volumes at once, from dark pool prints that often slice larger orders into smaller, anonymous executions. Explore deeper insights on how trade size influences market dynamics between block trades and dark pool prints.

Anonymity

Block trades offer large-volume transactions typically executed off-exchange with some level of transparency, whereas dark pool prints occur in private, non-public markets emphasizing strict anonymity to minimize market impact. Unlike block trades where counterparties may be identified post-trade, dark pool prints conceal trader identities until after transactions settle, preserving confidentiality in institutional trading. Explore the distinctions further to understand how anonymity shapes modern trading strategies.

Market Impact

Block trades involve large-volume transactions executed off-exchange to minimize immediate price disruption, often reported post-trade to maintain market stability. Dark pool prints occur within private trading venues where orders are matched anonymously, reducing market impact by concealing trade size and intent from public order books. Explore in-depth strategies to analyze how block trades and dark pool prints influence price movements and liquidity dynamics.

Source and External Links

Block Trades - What is a Block Trade? - CME Group - Block trades are privately and bilaterally negotiated large futures, options, or combination transactions executed apart from the public auction market and must meet specific quantity thresholds under Rule 526.

Guide to Block Trades - SoFi - Block trades are large-volume purchases or sales of financial assets, mainly by institutional investors, done privately to avoid market disruption and often executed through block houses, block trade facilities, or dark pools.

ICE FUTURES U.S. BLOCK TRADE - FAQs - Block trades are noncompetitive, privately negotiated transactions meeting minimum size thresholds, executed at fair and reasonable prices adhering to exchange rules, and reported through specified block trade systems like ICEBlock or TIPS(r).

dowidth.com

dowidth.com