Order flow analysis focuses on monitoring and interpreting real-time trade data to predict market movements and improve trade execution strategies. High-frequency trading relies on advanced algorithms and extremely low latency systems to execute thousands of trades per second, capitalizing on minimal price discrepancies. Explore the distinctions and benefits of each approach to enhance your trading strategy.

Why it is important

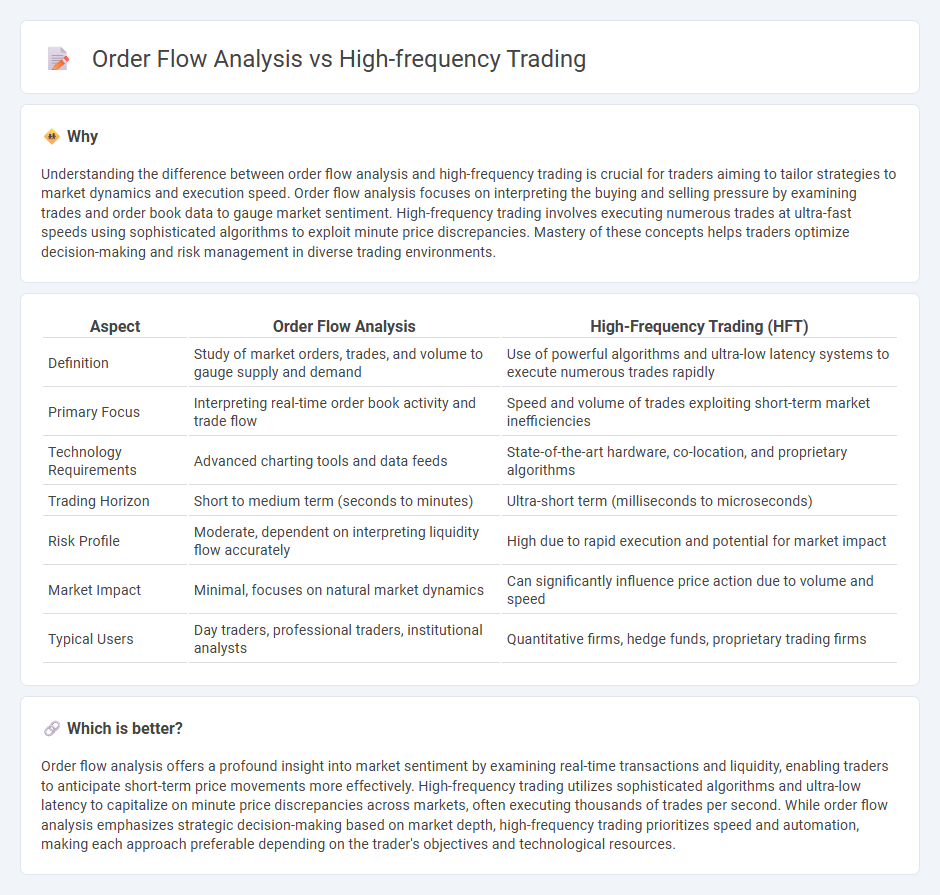

Understanding the difference between order flow analysis and high-frequency trading is crucial for traders aiming to tailor strategies to market dynamics and execution speed. Order flow analysis focuses on interpreting the buying and selling pressure by examining trades and order book data to gauge market sentiment. High-frequency trading involves executing numerous trades at ultra-fast speeds using sophisticated algorithms to exploit minute price discrepancies. Mastery of these concepts helps traders optimize decision-making and risk management in diverse trading environments.

Comparison Table

| Aspect | Order Flow Analysis | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Study of market orders, trades, and volume to gauge supply and demand | Use of powerful algorithms and ultra-low latency systems to execute numerous trades rapidly |

| Primary Focus | Interpreting real-time order book activity and trade flow | Speed and volume of trades exploiting short-term market inefficiencies |

| Technology Requirements | Advanced charting tools and data feeds | State-of-the-art hardware, co-location, and proprietary algorithms |

| Trading Horizon | Short to medium term (seconds to minutes) | Ultra-short term (milliseconds to microseconds) |

| Risk Profile | Moderate, dependent on interpreting liquidity flow accurately | High due to rapid execution and potential for market impact |

| Market Impact | Minimal, focuses on natural market dynamics | Can significantly influence price action due to volume and speed |

| Typical Users | Day traders, professional traders, institutional analysts | Quantitative firms, hedge funds, proprietary trading firms |

Which is better?

Order flow analysis offers a profound insight into market sentiment by examining real-time transactions and liquidity, enabling traders to anticipate short-term price movements more effectively. High-frequency trading utilizes sophisticated algorithms and ultra-low latency to capitalize on minute price discrepancies across markets, often executing thousands of trades per second. While order flow analysis emphasizes strategic decision-making based on market depth, high-frequency trading prioritizes speed and automation, making each approach preferable depending on the trader's objectives and technological resources.

Connection

Order flow analysis provides real-time data on the buying and selling pressure in the market, which is essential for high-frequency trading (HFT) algorithms to make swift and informed decisions. High-frequency trading leverages this granular order flow information to execute large volumes of trades at millisecond speeds, capitalizing on minor price discrepancies. By integrating order flow insights, HFT strategies enhance market liquidity and improve trade execution efficiency.

Key Terms

Latency

High-frequency trading (HFT) relies on ultra-low latency technology to execute trades within microseconds, using advanced algorithms to capitalize on minimal price discrepancies. Order flow analysis tracks market transactions in real-time, emphasizing the speed at which order book changes are detected and acted upon to predict short-term price movements. Explore detailed comparisons to understand how latency impacts the effectiveness of these trading strategies.

Market Microstructure

High-frequency trading (HFT) exploits market microstructure by executing trades at millisecond speeds to capitalize on small price discrepancies, relying heavily on advanced algorithms and low-latency data feeds. Order flow analysis examines the sequential buy and sell orders within the order book to understand supply and demand dynamics, providing insights into price movements and liquidity before trades occur. Discover more about how these strategies influence market behavior and trading efficiency.

Trade Execution

High-frequency trading leverages advanced algorithms and ultra-low latency systems to execute a massive number of trades within microseconds, prioritizing speed and precision to capitalize on fleeting market opportunities. Order flow analysis centers on interpreting the real-time stream of buy and sell orders to anticipate price movements and optimize trade execution strategies, enhancing decision-making based on market depth and liquidity. Explore the nuances of trade execution techniques in high-frequency trading and order flow analysis to enhance your trading strategy.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) is an automated trading strategy using powerful computers and algorithms to execute a huge number of trades extremely quickly, capturing small price differences across multiple venues for profit.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT leverages complex algorithms and ultra-fast execution to profit from tiny price fluctuations, enabling institutions like hedge funds to trade high volumes with very short holding periods, contributing to market liquidity and price efficiency.

High-frequency trading - Wikipedia - HFT is a form of quantitative trading characterized by very short portfolio holding periods and high turnover, using advanced automated systems to exploit small market inefficiencies via strategies like market-making and arbitrage.

dowidth.com

dowidth.com