Synthetic positions replicate the payoff of a stock or option by combining options and underlying assets, offering strategic flexibility and risk management opportunities in trading. Naked options involve selling options without holding the underlying asset, exposing traders to higher risk due to unlimited potential losses. Explore the advantages and risks of synthetic positions versus naked options to enhance your trading strategy.

Why it is important

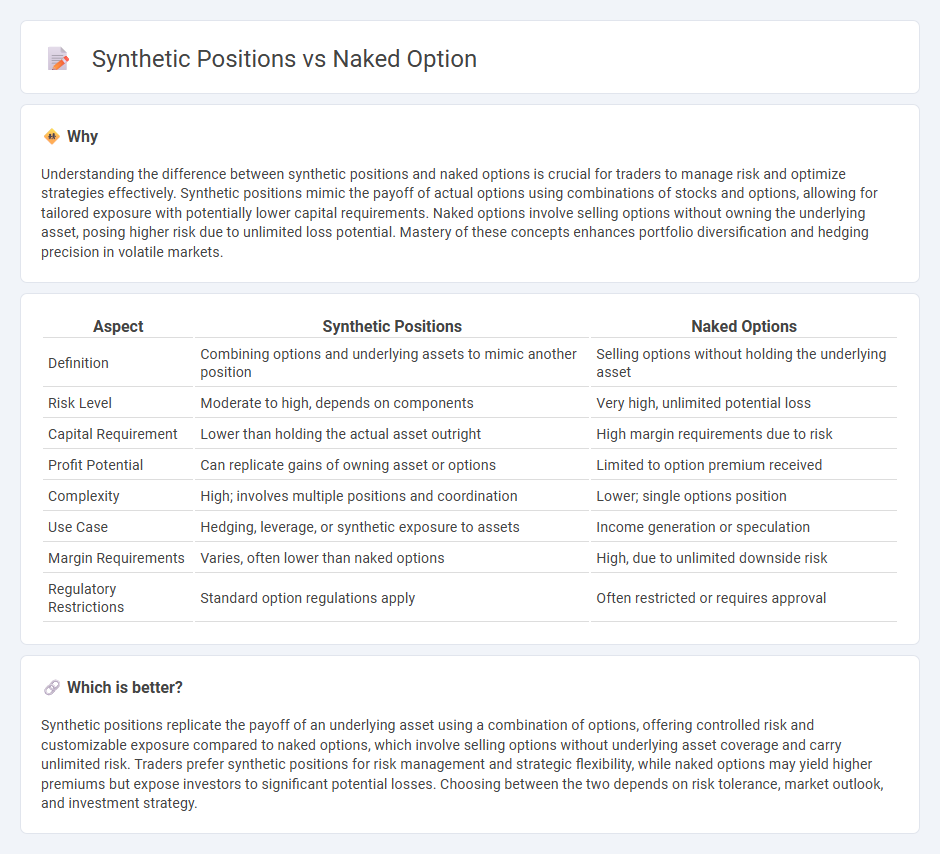

Understanding the difference between synthetic positions and naked options is crucial for traders to manage risk and optimize strategies effectively. Synthetic positions mimic the payoff of actual options using combinations of stocks and options, allowing for tailored exposure with potentially lower capital requirements. Naked options involve selling options without owning the underlying asset, posing higher risk due to unlimited loss potential. Mastery of these concepts enhances portfolio diversification and hedging precision in volatile markets.

Comparison Table

| Aspect | Synthetic Positions | Naked Options |

|---|---|---|

| Definition | Combining options and underlying assets to mimic another position | Selling options without holding the underlying asset |

| Risk Level | Moderate to high, depends on components | Very high, unlimited potential loss |

| Capital Requirement | Lower than holding the actual asset outright | High margin requirements due to risk |

| Profit Potential | Can replicate gains of owning asset or options | Limited to option premium received |

| Complexity | High; involves multiple positions and coordination | Lower; single options position |

| Use Case | Hedging, leverage, or synthetic exposure to assets | Income generation or speculation |

| Margin Requirements | Varies, often lower than naked options | High, due to unlimited downside risk |

| Regulatory Restrictions | Standard option regulations apply | Often restricted or requires approval |

Which is better?

Synthetic positions replicate the payoff of an underlying asset using a combination of options, offering controlled risk and customizable exposure compared to naked options, which involve selling options without underlying asset coverage and carry unlimited risk. Traders prefer synthetic positions for risk management and strategic flexibility, while naked options may yield higher premiums but expose investors to significant potential losses. Choosing between the two depends on risk tolerance, market outlook, and investment strategy.

Connection

Synthetic positions replicate the payoff of a particular asset by combining options, such as calls and puts, to mimic long or short stock exposure. Naked options involve selling options without holding the underlying asset, increasing risk and potential reward. Both strategies rely on options pricing dynamics and market volatility, making them interconnected tools for sophisticated trading and hedging approaches.

Key Terms

Delta

Naked options involve holding an option position without owning the underlying asset, resulting in a Delta that reflects pure option sensitivity and can be highly volatile. Synthetic positions combine options and the underlying asset to replicate desired Delta exposure, allowing traders to manage risk and leverage more precisely. Explore how Delta impacts risk profiles and hedging strategies in both naked and synthetic positions to enhance your trading approach.

Margin

Naked options require significantly higher margin due to their unlimited risk profile, as the seller is exposed to potentially substantial losses without a hedge. Synthetic positions, created by combining options and underlying assets, often demand lower margin since they mimic the risk and payoff of owning the underlying security with more controlled exposure. Explore detailed margin requirements and risk management strategies to understand how these positions impact capital efficiency.

Payoff

Naked options involve selling options without holding the underlying asset, exposing traders to unlimited risk and potentially high reward, while synthetic positions combine options and the underlying asset to replicate the payoff of another financial instrument with controlled risk. Payoff profiles of naked options are typically asymmetric with unlimited loss potential, whereas synthetic positions offer more balanced risk-reward characteristics by mimicking stock ownership or other strategies. Explore detailed examples and strategies to understand the nuances of these approaches in options trading.

Source and External Links

naked option | Wex | US Law | LII / Legal Information Institute - A naked option, or uncovered option, is when the seller does not own the underlying stock, risking large losses if the price changes drastically, and includes naked call and naked put options.

Naked Option - Overview, Naked Calls and Puts, Covered Options - Selling a naked option means selling an option without owning the underlying security, which is high-risk but can be profitable since many options expire worthless.

What Are Naked Options: Naked Calls & Puts Explained - tastylive - Naked options are option positions not hedged by owning the underlying asset, exposing sellers to significant risk and requiring careful management and experience before live trading.

dowidth.com

dowidth.com