Algorithmic arbitrage exploits price discrepancies across different markets or securities to generate risk-free profits through automated trading strategies. Mean reversion trading relies on statistical analysis to predict asset prices returning to their historical average, capitalizing on temporary deviations from this mean. Discover more about how these distinct algorithmic approaches optimize trading performance and risk management.

Why it is important

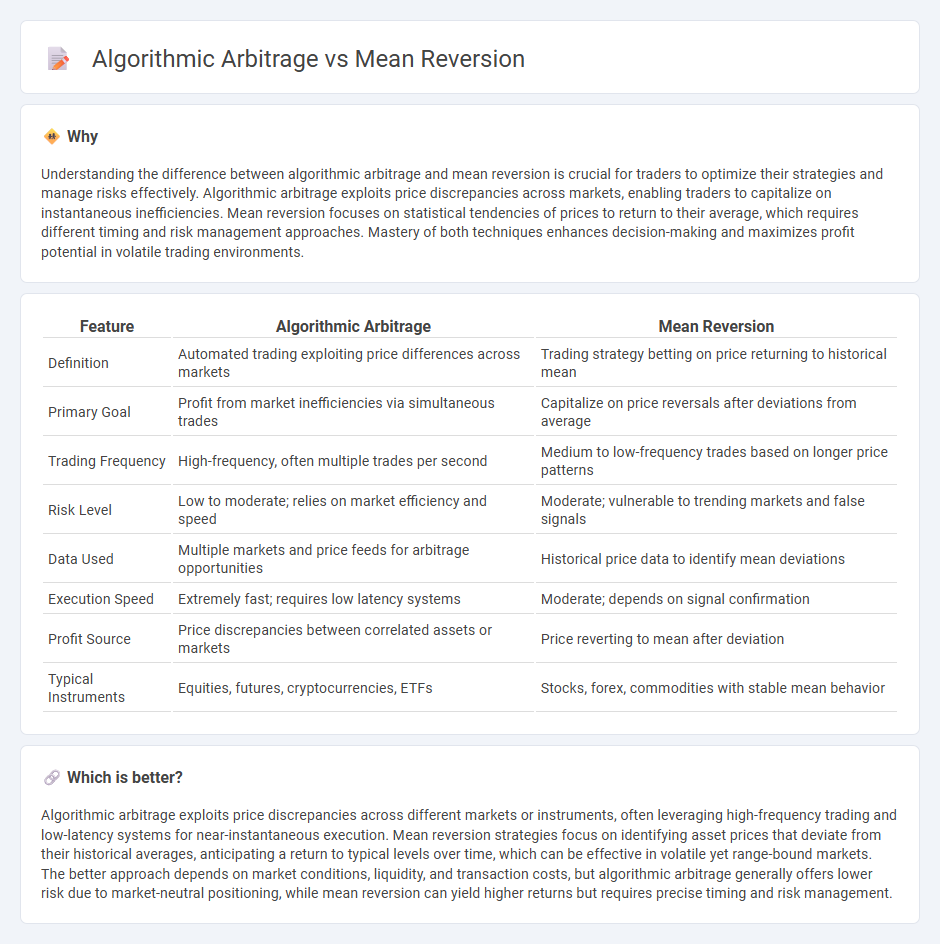

Understanding the difference between algorithmic arbitrage and mean reversion is crucial for traders to optimize their strategies and manage risks effectively. Algorithmic arbitrage exploits price discrepancies across markets, enabling traders to capitalize on instantaneous inefficiencies. Mean reversion focuses on statistical tendencies of prices to return to their average, which requires different timing and risk management approaches. Mastery of both techniques enhances decision-making and maximizes profit potential in volatile trading environments.

Comparison Table

| Feature | Algorithmic Arbitrage | Mean Reversion |

|---|---|---|

| Definition | Automated trading exploiting price differences across markets | Trading strategy betting on price returning to historical mean |

| Primary Goal | Profit from market inefficiencies via simultaneous trades | Capitalize on price reversals after deviations from average |

| Trading Frequency | High-frequency, often multiple trades per second | Medium to low-frequency trades based on longer price patterns |

| Risk Level | Low to moderate; relies on market efficiency and speed | Moderate; vulnerable to trending markets and false signals |

| Data Used | Multiple markets and price feeds for arbitrage opportunities | Historical price data to identify mean deviations |

| Execution Speed | Extremely fast; requires low latency systems | Moderate; depends on signal confirmation |

| Profit Source | Price discrepancies between correlated assets or markets | Price reverting to mean after deviation |

| Typical Instruments | Equities, futures, cryptocurrencies, ETFs | Stocks, forex, commodities with stable mean behavior |

Which is better?

Algorithmic arbitrage exploits price discrepancies across different markets or instruments, often leveraging high-frequency trading and low-latency systems for near-instantaneous execution. Mean reversion strategies focus on identifying asset prices that deviate from their historical averages, anticipating a return to typical levels over time, which can be effective in volatile yet range-bound markets. The better approach depends on market conditions, liquidity, and transaction costs, but algorithmic arbitrage generally offers lower risk due to market-neutral positioning, while mean reversion can yield higher returns but requires precise timing and risk management.

Connection

Algorithmic arbitrage exploits price discrepancies across markets to generate risk-free profits, while mean reversion strategies capitalize on asset prices reverting to their historical averages. Both approaches rely on quantitative models and statistical analysis to identify trading opportunities triggered by temporary price imbalances. Integrating mean reversion into algorithmic arbitrage enhances precision in timing trades, increasing profitability by anticipating price corrections.

Key Terms

Statistical Arbitrage

Statistical arbitrage employs mean reversion strategies by exploiting temporary price deviations from historical averages across correlated assets, using quantitative models to identify and capitalize on these mispricings. Algorithmic arbitrage leverages high-frequency trading algorithms to detect and execute trades based on statistical patterns, ensuring rapid response to market inefficiencies. Explore how integrated statistical arbitrage approaches enhance algorithmic trading performance in dynamic markets.

Z-score

Mean reversion strategies rely on the Z-score to identify when a stock price deviates significantly from its historical average, signaling a potential reversal. Algorithmic arbitrage uses Z-score thresholds to detect mispriced assets between related securities, enabling automated trading to exploit temporary inefficiencies. Explore how integrating Z-score analysis enhances precision in both mean reversion and algorithmic arbitrage techniques.

Execution Speed

Execution speed is crucial in mean reversion and algorithmic arbitrage strategies, with low latency systems significantly enhancing profitability by enabling rapid trade entry and exit. Mean reversion strategies rely on identifying price deviations and executing trades swiftly before prices revert, while algorithmic arbitrage demands ultra-fast execution to exploit minute price differences across markets. Explore the latest technologies and techniques to optimize execution speed for these trading strategies.

Source and External Links

Mean Reversion Strategies: Introduction, Trading ... - Mean reversion is a financial theory where asset prices tend to return to their long-term mean, and trading strategies exploit deviations from this mean by buying when prices are below and selling when above it, often identified using moving averages like EMA, WMA, or SMA.

Mean reversion (finance) - Mean reversion assumes an asset's price will converge to its historical average over time, enabling timing strategies that identify buy points when prices fall below the average and sell points when above, using statistical averages rather than chart interpretations.

Mean Reversion - Overview, Trading, Impact of Catalysts - Mean reversion theory implies asset prices move toward their long-term mean and traders exploit this by analyzing deviations to determine buying below the mean and selling above, also considering catalysts that affect price movements.

dowidth.com

dowidth.com