Order flow footprint charts provide detailed insights into market transactions by displaying executed buy and sell orders at specific price levels, helping traders identify imbalances and potential support or resistance zones. Bookmap offers an advanced visualization of market depth and liquidity through real-time heatmaps, allowing traders to track order book dynamics and detect hidden liquidity or spoofing activities. Explore the differences between order flow footprint and Bookmap to enhance your trading strategy and market analysis.

Why it is important

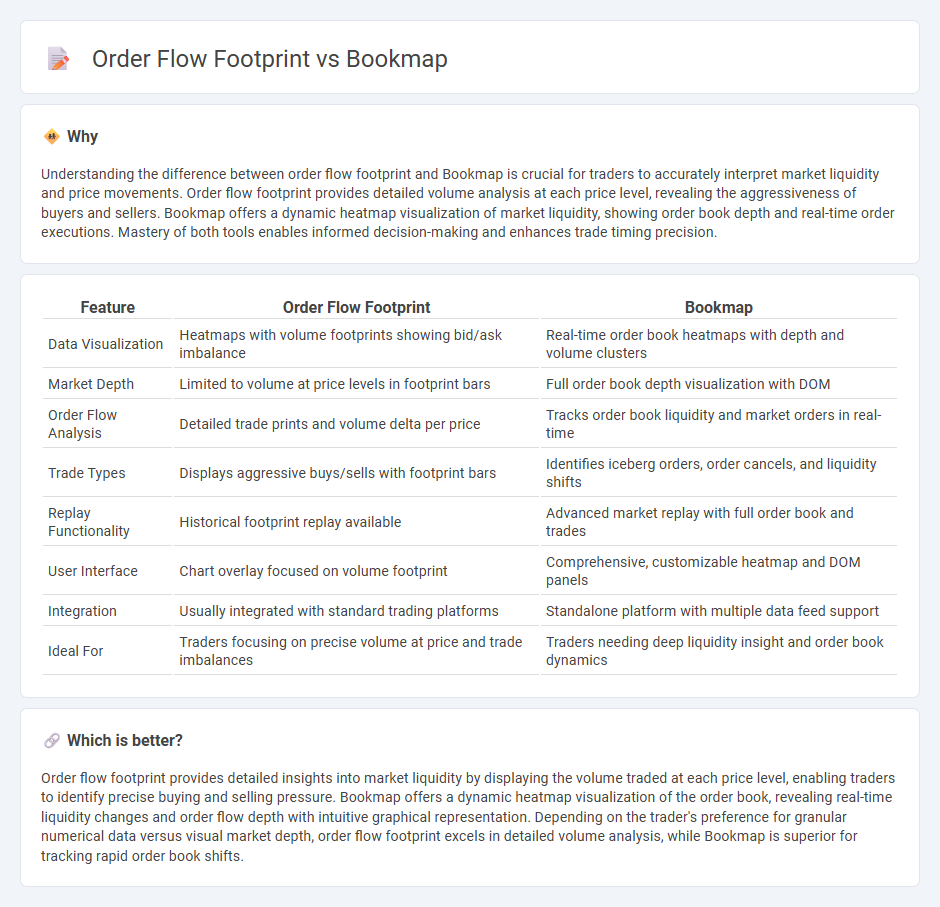

Understanding the difference between order flow footprint and Bookmap is crucial for traders to accurately interpret market liquidity and price movements. Order flow footprint provides detailed volume analysis at each price level, revealing the aggressiveness of buyers and sellers. Bookmap offers a dynamic heatmap visualization of market liquidity, showing order book depth and real-time order executions. Mastery of both tools enables informed decision-making and enhances trade timing precision.

Comparison Table

| Feature | Order Flow Footprint | Bookmap |

|---|---|---|

| Data Visualization | Heatmaps with volume footprints showing bid/ask imbalance | Real-time order book heatmaps with depth and volume clusters |

| Market Depth | Limited to volume at price levels in footprint bars | Full order book depth visualization with DOM |

| Order Flow Analysis | Detailed trade prints and volume delta per price | Tracks order book liquidity and market orders in real-time |

| Trade Types | Displays aggressive buys/sells with footprint bars | Identifies iceberg orders, order cancels, and liquidity shifts |

| Replay Functionality | Historical footprint replay available | Advanced market replay with full order book and trades |

| User Interface | Chart overlay focused on volume footprint | Comprehensive, customizable heatmap and DOM panels |

| Integration | Usually integrated with standard trading platforms | Standalone platform with multiple data feed support |

| Ideal For | Traders focusing on precise volume at price and trade imbalances | Traders needing deep liquidity insight and order book dynamics |

Which is better?

Order flow footprint provides detailed insights into market liquidity by displaying the volume traded at each price level, enabling traders to identify precise buying and selling pressure. Bookmap offers a dynamic heatmap visualization of the order book, revealing real-time liquidity changes and order flow depth with intuitive graphical representation. Depending on the trader's preference for granular numerical data versus visual market depth, order flow footprint excels in detailed volume analysis, while Bookmap is superior for tracking rapid order book shifts.

Connection

Order flow footprint charts provide detailed volume and price action insights at each price level, revealing buying and selling pressure within the market. Bookmap visualizes this data in real-time, mapping the order book's liquidity and order flow dynamics through a heatmap and volume dots. Combining order flow footprint with Bookmap allows traders to precisely analyze market depth, track order execution, and identify potential support and resistance zones based on actual order flow activity.

Key Terms

Liquidity Heatmap

Bookmap excels in visualizing market liquidity through its dynamic heatmap, enabling traders to identify real-time order book depth and iceberg orders effectively. In contrast, order flow footprint charts provide detailed volume profiles at each price level, highlighting aggressive buying and selling patterns without emphasizing order book liquidity heat. Explore the strengths and applications of liquidity heatmaps with an in-depth comparison to enhance your trading strategies.

Volume Imbalance

Volume imbalance is a critical metric in both Bookmap and order flow footprint charts, revealing areas where buy and sell orders significantly differ, indicating potential support or resistance zones. Bookmap visualizes volume imbalance through heatmaps that highlight liquidity clusters and order book changes in real-time, while order flow footprint provides detailed bid and ask volume at each price level, making it easier to interpret trader aggression and market sentiment. Explore how mastering volume imbalance analysis with these tools can enhance your trading decisions.

Bid-Ask Delta

Bid-Ask Delta is a critical indicator in both Bookmap and Order Flow Footprint tools, reflecting the real-time imbalance between buy and sell orders by measuring aggressive market participant behavior at the bid and ask prices. Bookmap provides a dynamic heatmap visualization combined with precise volume ladder insights, while Order Flow Footprint charts deliver detailed price-level footprint data with cumulative Bid-Ask Delta values. Explore the nuances of Bid-Ask Delta precision and visualization methods to enhance your order flow trading strategies.

Source and External Links

Bookmap : Online Futures Trading Platform | Live Stock Futures - Bookmap is a cutting-edge trading platform that lets you visualize market liquidity and gain incredible insight into the order book for more informed trading decisions.

Using Bookmap on thinkorswim | Charles Schwab - Bookmap integrates price data with Level II order book information, displaying volume pressure and order flow through heatmaps and unique dot charts to reveal market liquidity and potential support/resistance levels.

Bookmap Review: A Complete Guide - Warrior Trading - Bookmap offers high-frequency charting with streaming data refreshed every 30 milliseconds, featuring a heatmap visualization of order book liquidity and customizable color schemes to enhance market clarity.

dowidth.com

dowidth.com