Quantitative sentiment analysis leverages vast datasets and natural language processing to gauge market emotions and predict price movements based on social media, news, and financial reports. Event-driven trading focuses on exploiting price volatility triggered by specific corporate actions or macroeconomic occurrences such as earnings releases, mergers, or policy announcements. Discover how these sophisticated strategies can reshape your trading approach.

Why it is important

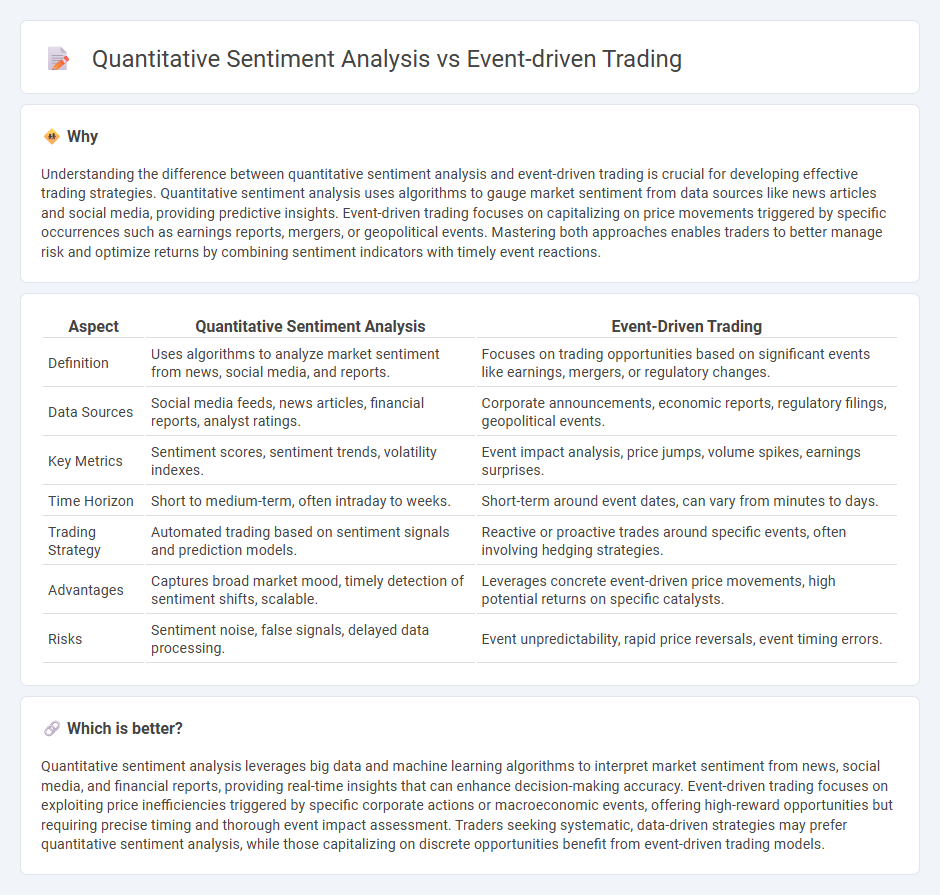

Understanding the difference between quantitative sentiment analysis and event-driven trading is crucial for developing effective trading strategies. Quantitative sentiment analysis uses algorithms to gauge market sentiment from data sources like news articles and social media, providing predictive insights. Event-driven trading focuses on capitalizing on price movements triggered by specific occurrences such as earnings reports, mergers, or geopolitical events. Mastering both approaches enables traders to better manage risk and optimize returns by combining sentiment indicators with timely event reactions.

Comparison Table

| Aspect | Quantitative Sentiment Analysis | Event-Driven Trading |

|---|---|---|

| Definition | Uses algorithms to analyze market sentiment from news, social media, and reports. | Focuses on trading opportunities based on significant events like earnings, mergers, or regulatory changes. |

| Data Sources | Social media feeds, news articles, financial reports, analyst ratings. | Corporate announcements, economic reports, regulatory filings, geopolitical events. |

| Key Metrics | Sentiment scores, sentiment trends, volatility indexes. | Event impact analysis, price jumps, volume spikes, earnings surprises. |

| Time Horizon | Short to medium-term, often intraday to weeks. | Short-term around event dates, can vary from minutes to days. |

| Trading Strategy | Automated trading based on sentiment signals and prediction models. | Reactive or proactive trades around specific events, often involving hedging strategies. |

| Advantages | Captures broad market mood, timely detection of sentiment shifts, scalable. | Leverages concrete event-driven price movements, high potential returns on specific catalysts. |

| Risks | Sentiment noise, false signals, delayed data processing. | Event unpredictability, rapid price reversals, event timing errors. |

Which is better?

Quantitative sentiment analysis leverages big data and machine learning algorithms to interpret market sentiment from news, social media, and financial reports, providing real-time insights that can enhance decision-making accuracy. Event-driven trading focuses on exploiting price inefficiencies triggered by specific corporate actions or macroeconomic events, offering high-reward opportunities but requiring precise timing and thorough event impact assessment. Traders seeking systematic, data-driven strategies may prefer quantitative sentiment analysis, while those capitalizing on discrete opportunities benefit from event-driven trading models.

Connection

Quantitative sentiment analysis interprets market sentiment from news, social media, and financial reports using algorithmic models to gauge investor emotions and trends. Event-driven trading leverages these insights by executing trades based on detected market-moving events, such as earnings releases or geopolitical developments. Integrating sentiment data with event detection enhances predictive accuracy, enabling traders to capitalize on short-term price volatility.

Key Terms

Catalyst

Event-driven trading centers on exploiting market-moving events such as earnings reports, mergers, or regulatory changes to capture short-term price discrepancies. Quantitative sentiment analysis utilizes natural language processing algorithms to gauge market sentiment from news, social media, and analyst reports, quantifying qualitative data into actionable trading signals. Explore how Catalyst integrates real-time event detection with advanced sentiment analysis to enhance predictive accuracy and trading performance.

Algorithm

Algorithm-driven event trading leverages real-time data from news events and market reactions to execute timely trades, emphasizing speed and precision. Quantitative sentiment analysis algorithms process vast textual data from social media, news, and reports to gauge market sentiment indicators and predict price movements. Explore how advanced algorithms integrate diverse data streams to optimize trading strategies.

Market sentiment

Event-driven trading capitalizes on market-moving news and corporate actions to predict price changes, leveraging sentiment shifts around specific events. Quantitative sentiment analysis employs natural language processing algorithms to systematically analyze social media, news, and financial reports, quantifying market sentiment on a broader scale. Explore how integrating these strategies can enhance predictive accuracy and optimize trading performance.

Source and External Links

Event Driven Trading Strategies: How They Work and Why They Matter - Event-driven trading involves identifying market-moving corporate events like earnings announcements or mergers, analyzing their impact on valuation, then establishing trading positions accordingly, while actively managing risks like liquidity and regulatory changes.

Event-Driven Investing | Fund Strategy + Examples - Wall Street Prep - Event-driven investing capitalizes on pricing inefficiencies caused by corporate events such as mergers, acquisitions, spin-offs, and bankruptcies, with common strategies including merger arbitrage and distressed investing that perform differently depending on economic conditions.

What is Event-Driven Investing: Common Strategies & Examples - This investment strategy exploits volatility and temporary mispricing arising from significant corporate events, requiring careful analysis to predict outcomes like regulatory impact and financial restructuring to position investments profitably.

dowidth.com

dowidth.com