Volume profile reading reveals the distribution of traded volume at specific price levels, highlighting key support and resistance zones essential for traders' decision-making. Market depth offers a real-time view of buy and sell orders, indicating liquidity and potential price movements based on order book dynamics. Explore these tools further to gain a comprehensive understanding of market behavior and enhance trading strategies.

Why it is important

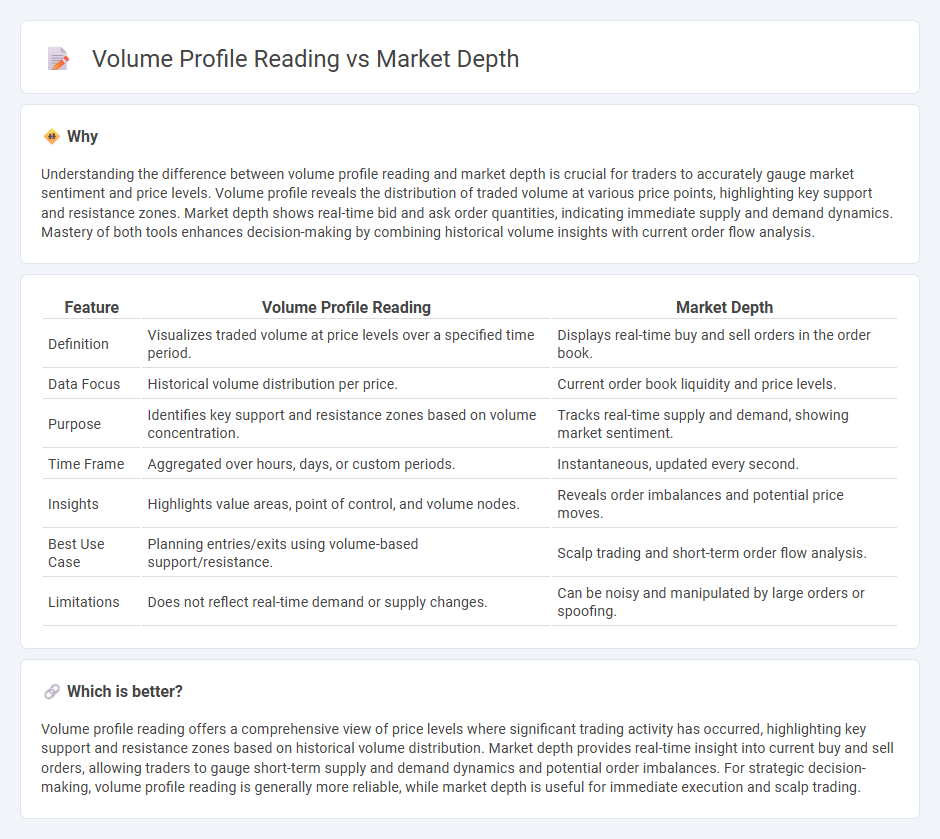

Understanding the difference between volume profile reading and market depth is crucial for traders to accurately gauge market sentiment and price levels. Volume profile reveals the distribution of traded volume at various price points, highlighting key support and resistance zones. Market depth shows real-time bid and ask order quantities, indicating immediate supply and demand dynamics. Mastery of both tools enhances decision-making by combining historical volume insights with current order flow analysis.

Comparison Table

| Feature | Volume Profile Reading | Market Depth |

|---|---|---|

| Definition | Visualizes traded volume at price levels over a specified time period. | Displays real-time buy and sell orders in the order book. |

| Data Focus | Historical volume distribution per price. | Current order book liquidity and price levels. |

| Purpose | Identifies key support and resistance zones based on volume concentration. | Tracks real-time supply and demand, showing market sentiment. |

| Time Frame | Aggregated over hours, days, or custom periods. | Instantaneous, updated every second. |

| Insights | Highlights value areas, point of control, and volume nodes. | Reveals order imbalances and potential price moves. |

| Best Use Case | Planning entries/exits using volume-based support/resistance. | Scalp trading and short-term order flow analysis. |

| Limitations | Does not reflect real-time demand or supply changes. | Can be noisy and manipulated by large orders or spoofing. |

Which is better?

Volume profile reading offers a comprehensive view of price levels where significant trading activity has occurred, highlighting key support and resistance zones based on historical volume distribution. Market depth provides real-time insight into current buy and sell orders, allowing traders to gauge short-term supply and demand dynamics and potential order imbalances. For strategic decision-making, volume profile reading is generally more reliable, while market depth is useful for immediate execution and scalp trading.

Connection

Volume profile reading analyzes the distribution of traded volumes at specific price levels to identify key support and resistance zones. Market depth reveals real-time order book data, showing buy and sell orders that indicate liquidity and potential price movement. Combining volume profile insights with market depth data enhances traders' ability to anticipate price reactions and optimize entry and exit points.

Key Terms

Order Book

Market depth reflects real-time order book dynamics, displaying pending buy and sell orders at various price levels, crucial for assessing liquidity and potential price movement. Volume profile reading aggregates executed trades at each price level, highlighting areas of high trading activity and identifying support and resistance zones. Explore more to master the nuances of order book analysis and enhance your trading strategy.

Bid-Ask Levels

Market depth reveals real-time Bid-Ask levels, showcasing the quantity of buy and sell orders across price points to gauge supply and demand. Volume profile reading aggregates traded volume at various prices over a time period, highlighting key support and resistance zones based on actual market activity. Explore in-depth insights on distinguishing these tools to enhance your trading precision and strategic decisions.

Volume Nodes

Market depth reveals real-time order book data, showing pending buy and sell orders at various price levels, while volume profile aggregates traded volumes to highlight significant price areas. Volume nodes within the volume profile identify price regions where high trading activity occurred, serving as key support and resistance levels. Explore how leveraging volume nodes enhances strategic decision-making in market analysis.

Source and External Links

Market Depth - Definition, How It's Used, Examples - Market depth refers to a market's ability to sustain large orders without impacting the security's price, indicating liquidity and showing the number of shares that can be traded at various prices without significant price changes, typically viewed via the limit order book.

Depth of market (DOM): what it is and how traders can use it - Depth of market (DOM) is a trading tool that displays the number of buy and sell orders at different price levels for an asset, providing insight into supply, demand, and market liquidity in real time.

Market Depth - thinkorswim Learning Center - Market depth shows the best bid and ask quotes for a symbol from major exchanges, giving traders detailed insight into the price levels and volume available for buying and selling, often integrated into trading platforms to assist with order entry and strategy.

dowidth.com

dowidth.com