Social copy trading enables investors to automatically replicate the trades of experienced traders in real time, offering hands-free market participation and learning opportunities. Signal-based trading relies on alerts generated by algorithms or experts to inform buy or sell decisions, requiring individuals to manually execute trades based on those signals. Explore the key differences and benefits of both strategies to optimize your trading approach.

Why it is important

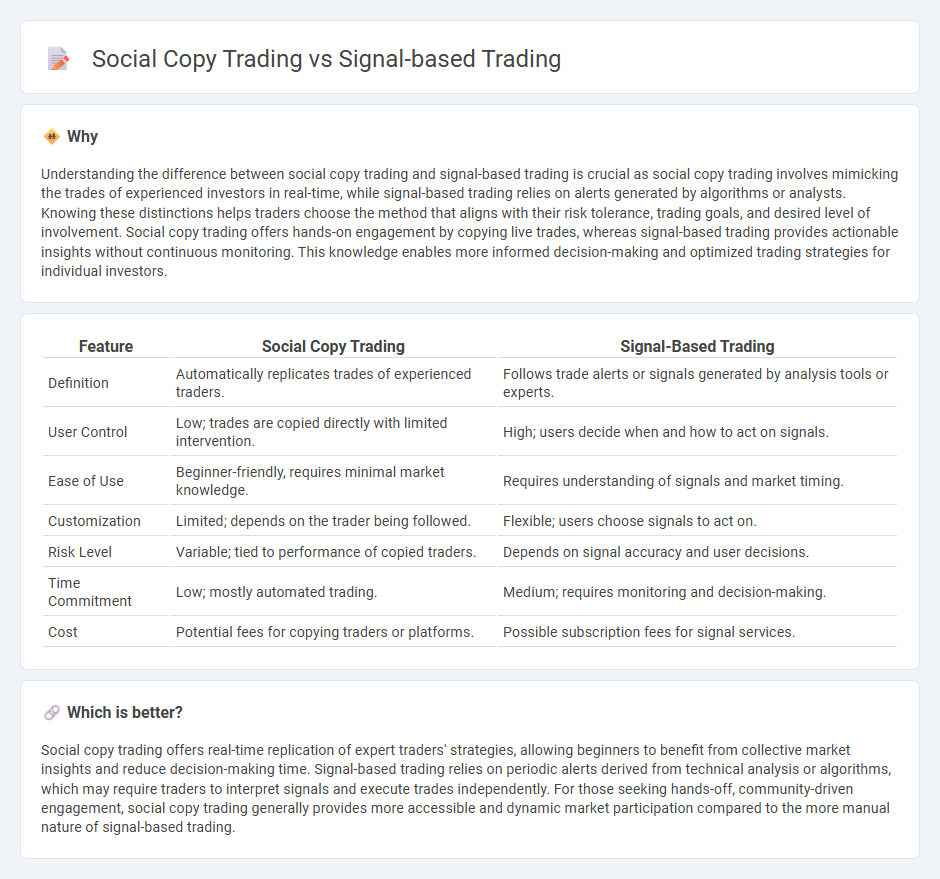

Understanding the difference between social copy trading and signal-based trading is crucial as social copy trading involves mimicking the trades of experienced investors in real-time, while signal-based trading relies on alerts generated by algorithms or analysts. Knowing these distinctions helps traders choose the method that aligns with their risk tolerance, trading goals, and desired level of involvement. Social copy trading offers hands-on engagement by copying live trades, whereas signal-based trading provides actionable insights without continuous monitoring. This knowledge enables more informed decision-making and optimized trading strategies for individual investors.

Comparison Table

| Feature | Social Copy Trading | Signal-Based Trading |

|---|---|---|

| Definition | Automatically replicates trades of experienced traders. | Follows trade alerts or signals generated by analysis tools or experts. |

| User Control | Low; trades are copied directly with limited intervention. | High; users decide when and how to act on signals. |

| Ease of Use | Beginner-friendly, requires minimal market knowledge. | Requires understanding of signals and market timing. |

| Customization | Limited; depends on the trader being followed. | Flexible; users choose signals to act on. |

| Risk Level | Variable; tied to performance of copied traders. | Depends on signal accuracy and user decisions. |

| Time Commitment | Low; mostly automated trading. | Medium; requires monitoring and decision-making. |

| Cost | Potential fees for copying traders or platforms. | Possible subscription fees for signal services. |

Which is better?

Social copy trading offers real-time replication of expert traders' strategies, allowing beginners to benefit from collective market insights and reduce decision-making time. Signal-based trading relies on periodic alerts derived from technical analysis or algorithms, which may require traders to interpret signals and execute trades independently. For those seeking hands-off, community-driven engagement, social copy trading generally provides more accessible and dynamic market participation compared to the more manual nature of signal-based trading.

Connection

Social copy trading and signal-based trading are intrinsically connected through their reliance on real-time market data and trader insights to inform investment decisions. Social copy trading allows investors to automatically replicate the trades of experienced traders, often guided by signal-based trading systems that generate buy or sell alerts using technical analysis algorithms. The integration of these methods enhances trading efficiency by combining collective intelligence with data-driven signals, optimizing portfolio performance.

Key Terms

Trade Signals

Trade signals are algorithmically generated alerts based on market analysis, providing precise entry and exit points for traders to optimize their strategies. In signal-based trading, these signals guide decisions without requiring emotional input, offering a data-driven approach compared to social copy trading, which mirrors the actions of experienced traders in real time. Explore the effectiveness of trade signals to enhance your trading accuracy and profitability.

Copy Trading Platform

Signal-based trading relies on algorithm-generated trade alerts to guide investment decisions, while social copy trading platforms enable users to replicate trades from experienced investors in real-time. Copy trading platforms offer dynamic interaction, transparency, and community insights, enhancing decision accuracy compared to standalone signal services. Explore comprehensive features of top copy trading platforms to optimize your investment strategy.

Strategy Provider

Signal-based trading relies on expert-generated trade alerts that traders can manually execute, emphasizing precise, algorithm-driven market signals from Strategy Providers. Social copy trading allows followers to automatically replicate the trades of selected Strategy Providers in real time, creating a seamless, hands-off trading experience. Explore the differences and benefits of each approach to find the best Strategy Provider fit for your trading goals.

Source and External Links

Trading Signal - Coinmetro - A trading signal is a recommendation indicating when to buy or sell an asset, generated through technical analysis, fundamental analysis, or a combination, helping traders identify optimal entry and exit points.

Trading Signals and Technical Indicators for Effective Market Scanning - Trading signals are algorithmic alerts based on market data such as price and volume that highlight opportune moments for trades, often leveraging technical indicators like moving averages and RSI to remove emotion from decision-making.

What Are Trading Signals & How Do They Work? - AvaTrade - Trading signals provide specific trade recommendations derived from advanced algorithms and human inputs, with types ranging from manual to automated, and covering various asset classes to suit different trading styles and risk profiles.

dowidth.com

dowidth.com