Airdrop farming involves actively seeking and claiming free cryptocurrency tokens distributed by blockchain projects to promote adoption, offering potential gains without capital investment. Portfolio rebalancing, in contrast, is the strategic adjustment of asset allocations to maintain desired risk levels and optimize returns in a trading portfolio. Discover the advantages and risks of airdrop farming versus portfolio rebalancing to enhance your trading strategy.

Why it is important

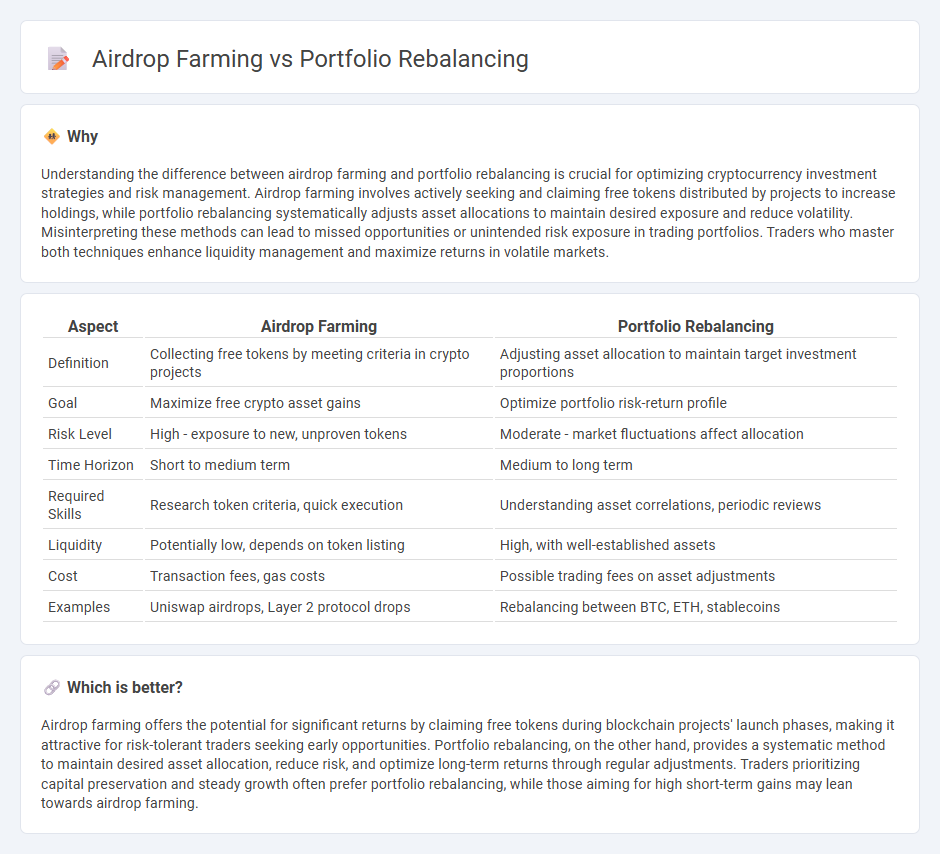

Understanding the difference between airdrop farming and portfolio rebalancing is crucial for optimizing cryptocurrency investment strategies and risk management. Airdrop farming involves actively seeking and claiming free tokens distributed by projects to increase holdings, while portfolio rebalancing systematically adjusts asset allocations to maintain desired exposure and reduce volatility. Misinterpreting these methods can lead to missed opportunities or unintended risk exposure in trading portfolios. Traders who master both techniques enhance liquidity management and maximize returns in volatile markets.

Comparison Table

| Aspect | Airdrop Farming | Portfolio Rebalancing |

|---|---|---|

| Definition | Collecting free tokens by meeting criteria in crypto projects | Adjusting asset allocation to maintain target investment proportions |

| Goal | Maximize free crypto asset gains | Optimize portfolio risk-return profile |

| Risk Level | High - exposure to new, unproven tokens | Moderate - market fluctuations affect allocation |

| Time Horizon | Short to medium term | Medium to long term |

| Required Skills | Research token criteria, quick execution | Understanding asset correlations, periodic reviews |

| Liquidity | Potentially low, depends on token listing | High, with well-established assets |

| Cost | Transaction fees, gas costs | Possible trading fees on asset adjustments |

| Examples | Uniswap airdrops, Layer 2 protocol drops | Rebalancing between BTC, ETH, stablecoins |

Which is better?

Airdrop farming offers the potential for significant returns by claiming free tokens during blockchain projects' launch phases, making it attractive for risk-tolerant traders seeking early opportunities. Portfolio rebalancing, on the other hand, provides a systematic method to maintain desired asset allocation, reduce risk, and optimize long-term returns through regular adjustments. Traders prioritizing capital preservation and steady growth often prefer portfolio rebalancing, while those aiming for high short-term gains may lean towards airdrop farming.

Connection

Airdrop farming involves strategically holding and interacting with specific cryptocurrencies to qualify for token distributions, which can alter the asset allocation within a portfolio. Portfolio rebalancing adjusts these allocations by buying or selling assets to maintain desired risk levels and investment goals. Combining airdrop farming with rebalancing helps traders optimize returns by integrating newly acquired tokens while preserving a balanced investment strategy.

Key Terms

**Portfolio Rebalancing:**

Portfolio rebalancing involves adjusting the weight of assets in an investment portfolio to maintain a desired risk level and optimize returns by systematically buying or selling assets, which reduces exposure to market volatility. This strategy ensures alignment with long-term financial goals and risk tolerance by periodically realigning asset allocations, often based on predefined thresholds or time intervals. Explore how portfolio rebalancing can enhance your investment strategy and improve financial outcomes.

Asset Allocation

Portfolio rebalancing involves systematically adjusting asset weights to maintain a desired risk-return profile, optimizing long-term growth and mitigating volatility. Airdrop farming focuses on acquiring free tokens from blockchain projects, often prioritizing short-term gains but introducing higher risk and liquidity challenges. Explore detailed strategies and risk factors to enhance your asset allocation approach effectively.

Risk Tolerance

Portfolio rebalancing involves adjusting asset allocations to maintain a desired risk level, ensuring consistent alignment with an investor's risk tolerance. Airdrop farming targets high-reward, speculative tokens, presenting elevated risk due to market volatility and unverified project legitimacy. Explore deeper insights on balancing risk tolerance between strategic rebalancing and opportunistic airdrop farming.

Source and External Links

What is Portfolio Rebalancing and Why Should You Care? - E*Trade - Portfolio rebalancing involves selling some assets and buying others to maintain your target asset allocation, ensuring your portfolio stays aligned with your risk tolerance and overall investing goals amid market changes.

Rebalancing investments - Wikipedia - Rebalancing is a strategy to bring a deviated portfolio back to its target allocation, with various methods such as periodic rebalancing, threshold-based rebalancing, and over-rebalancing to enhance returns or control risk.

Rebalancing in Action | Charles Schwab - Rebalancing keeps your portfolio's asset allocation and risk level consistent over time by adjusting holdings when market movements cause deviations from target weights.

dowidth.com

dowidth.com