Gamma squeeze occurs when rapid option buying forces market makers to purchase underlying stocks aggressively, causing sharp price surges, while flash crashes involve sudden, severe price drops triggered by algorithmic errors or liquidity shortages. Both phenomena highlight extreme volatility conditions but differ in their market catalysts and mechanisms. Explore the detailed mechanics of gamma squeezes and flash crashes to better understand their impact on trading strategies.

Why it is important

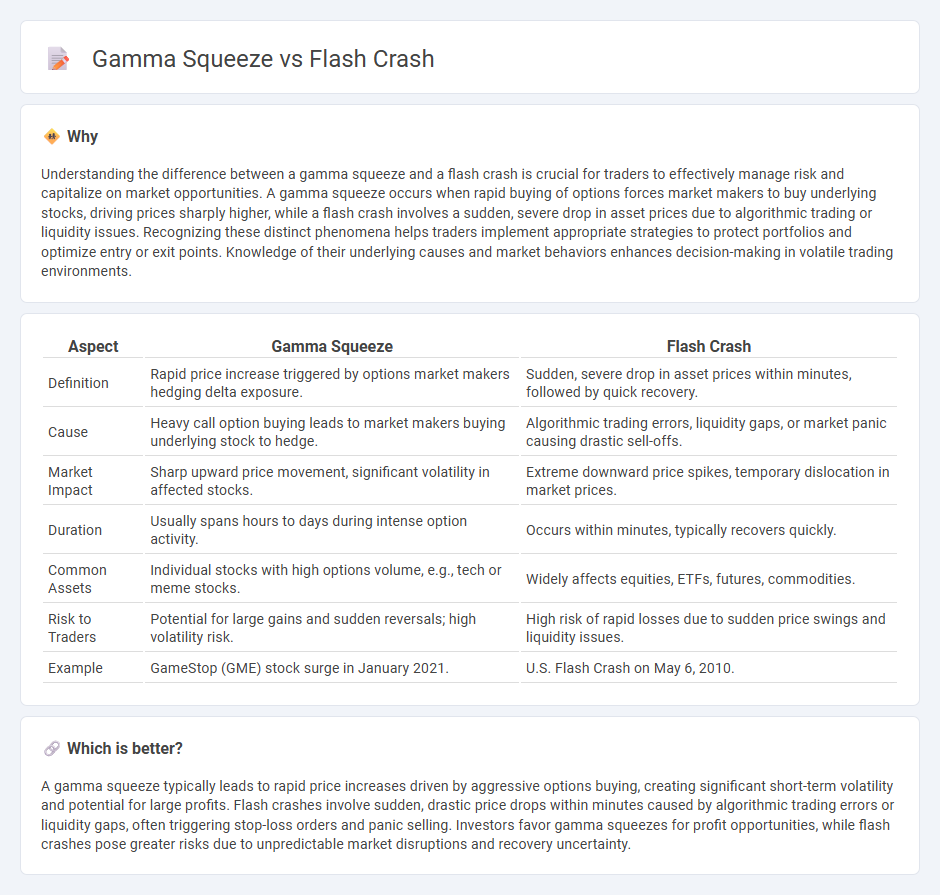

Understanding the difference between a gamma squeeze and a flash crash is crucial for traders to effectively manage risk and capitalize on market opportunities. A gamma squeeze occurs when rapid buying of options forces market makers to buy underlying stocks, driving prices sharply higher, while a flash crash involves a sudden, severe drop in asset prices due to algorithmic trading or liquidity issues. Recognizing these distinct phenomena helps traders implement appropriate strategies to protect portfolios and optimize entry or exit points. Knowledge of their underlying causes and market behaviors enhances decision-making in volatile trading environments.

Comparison Table

| Aspect | Gamma Squeeze | Flash Crash |

|---|---|---|

| Definition | Rapid price increase triggered by options market makers hedging delta exposure. | Sudden, severe drop in asset prices within minutes, followed by quick recovery. |

| Cause | Heavy call option buying leads to market makers buying underlying stock to hedge. | Algorithmic trading errors, liquidity gaps, or market panic causing drastic sell-offs. |

| Market Impact | Sharp upward price movement, significant volatility in affected stocks. | Extreme downward price spikes, temporary dislocation in market prices. |

| Duration | Usually spans hours to days during intense option activity. | Occurs within minutes, typically recovers quickly. |

| Common Assets | Individual stocks with high options volume, e.g., tech or meme stocks. | Widely affects equities, ETFs, futures, commodities. |

| Risk to Traders | Potential for large gains and sudden reversals; high volatility risk. | High risk of rapid losses due to sudden price swings and liquidity issues. |

| Example | GameStop (GME) stock surge in January 2021. | U.S. Flash Crash on May 6, 2010. |

Which is better?

A gamma squeeze typically leads to rapid price increases driven by aggressive options buying, creating significant short-term volatility and potential for large profits. Flash crashes involve sudden, drastic price drops within minutes caused by algorithmic trading errors or liquidity gaps, often triggering stop-loss orders and panic selling. Investors favor gamma squeezes for profit opportunities, while flash crashes pose greater risks due to unpredictable market disruptions and recovery uncertainty.

Connection

A gamma squeeze occurs when rising options buying forces traders to buy underlying stocks rapidly to hedge, creating sharp price increases that can trigger sudden market sell-offs or flash crashes. Flash crashes represent rapid, deep declines in stock prices caused by imbalances in liquidity, often exacerbated by automated trading algorithms reacting to unexpected price volatility during events like gamma squeezes. The interplay between intense options activity during a gamma squeeze and algorithmic trading responses can destabilize markets, linking these phenomena through abrupt and extreme price movements.

Key Terms

**Flash Crash:**

A Flash Crash is a sudden, deep, and volatile drop in security prices within a very short time frame, often triggered by automated trading algorithms reacting to market anomalies. This rapid plunge can lead to widespread panic and significant liquidity imbalances, impacting indices, ETFs, and individual stocks simultaneously. Explore how Flash Crashes disrupt market stability and the mechanisms in place to prevent future occurrences.

Liquidity

Flash crashes occur due to sudden liquidity withdrawals triggering rapid price drops, while gamma squeezes involve options market dynamics causing increased hedging demand that reduces liquidity. Liquidity evaporation during flash crashes intensifies price volatility, whereas gamma squeezes typically sustain liquidity but shift it through aggressive market maker adjustments. Explore how these distinct liquidity mechanisms shape market stability and trading strategies.

High-Frequency Trading

Flash crashes are rapid, deep, and volatile price drops often triggered by algorithmic trading systems in high-frequency trading (HFT) environments, where large volumes of automated orders overwhelm the market. Gamma squeezes occur when options market makers hedge their positions by buying underlying stocks, causing accelerated price spikes driven by escalating demand and volatility, frequently amplified by HFT algorithms exploiting these dynamics. Explore the intricate relationship between flash crashes, gamma squeezes, and high-frequency trading strategies for a deeper understanding of modern market phenomena.

Source and External Links

Flash Crashes - Overview, Causes, and Past examples - Flash crashes are sudden, rapid plunges in the price of stocks, bonds, or commodities followed by quick recoveries, often caused by algorithmic trading and the snowball effect of automated selling.

Flash crash - Wikipedia - A flash crash is a very quick, deep drop in security prices followed by a rapid rebound, often linked to high-frequency and black-box trading that temporarily drains liquidity from the market.

2010 Flash Crash - Overview, Main Events, Investigation - The May 6, 2010 Flash Crash was triggered by a massive single sell order in E-Mini S&P futures combined with aggressive high-frequency trading, causing extreme volatility and a temporary loss of about $1 trillion in market value before recovery.

dowidth.com

dowidth.com