Quantitative momentum trading focuses on selecting stocks that exhibit strong recent price trends, leveraging statistical models to capitalize on persistent upward or downward movements. Quantitative value trading, on the other hand, emphasizes identifying undervalued stocks by analyzing financial ratios and fundamentals to capture long-term mean reversion. Explore the nuances of these strategies to enhance your trading approach and optimize portfolio performance.

Why it is important

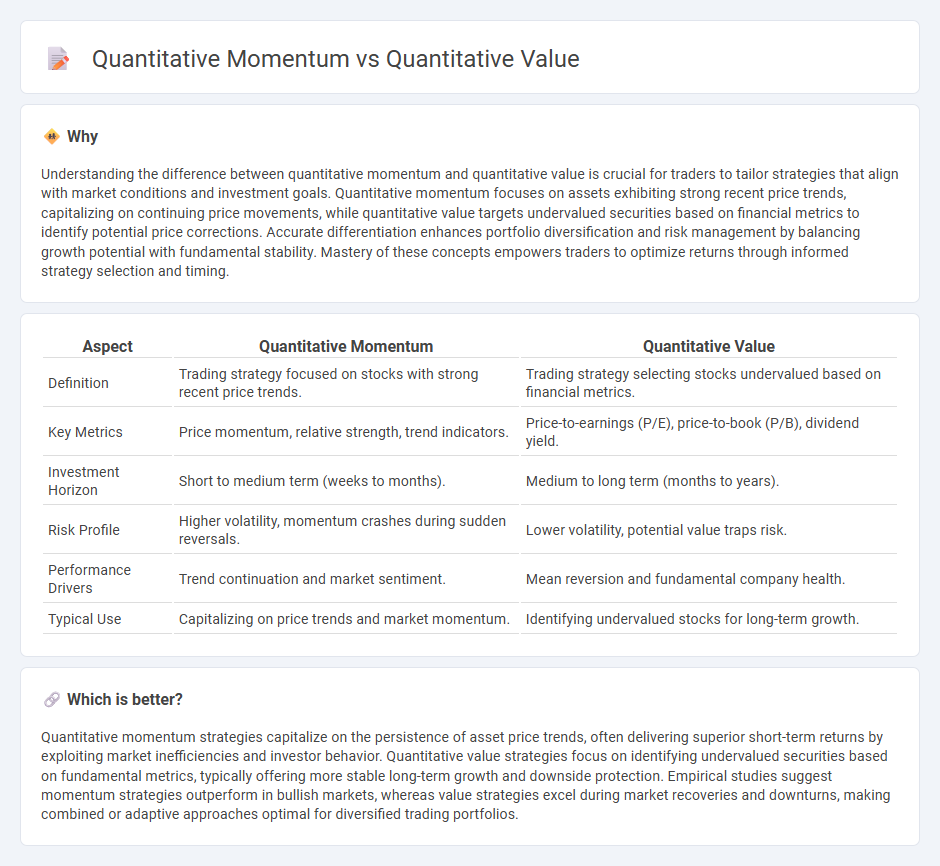

Understanding the difference between quantitative momentum and quantitative value is crucial for traders to tailor strategies that align with market conditions and investment goals. Quantitative momentum focuses on assets exhibiting strong recent price trends, capitalizing on continuing price movements, while quantitative value targets undervalued securities based on financial metrics to identify potential price corrections. Accurate differentiation enhances portfolio diversification and risk management by balancing growth potential with fundamental stability. Mastery of these concepts empowers traders to optimize returns through informed strategy selection and timing.

Comparison Table

| Aspect | Quantitative Momentum | Quantitative Value |

|---|---|---|

| Definition | Trading strategy focused on stocks with strong recent price trends. | Trading strategy selecting stocks undervalued based on financial metrics. |

| Key Metrics | Price momentum, relative strength, trend indicators. | Price-to-earnings (P/E), price-to-book (P/B), dividend yield. |

| Investment Horizon | Short to medium term (weeks to months). | Medium to long term (months to years). |

| Risk Profile | Higher volatility, momentum crashes during sudden reversals. | Lower volatility, potential value traps risk. |

| Performance Drivers | Trend continuation and market sentiment. | Mean reversion and fundamental company health. |

| Typical Use | Capitalizing on price trends and market momentum. | Identifying undervalued stocks for long-term growth. |

Which is better?

Quantitative momentum strategies capitalize on the persistence of asset price trends, often delivering superior short-term returns by exploiting market inefficiencies and investor behavior. Quantitative value strategies focus on identifying undervalued securities based on fundamental metrics, typically offering more stable long-term growth and downside protection. Empirical studies suggest momentum strategies outperform in bullish markets, whereas value strategies excel during market recoveries and downturns, making combined or adaptive approaches optimal for diversified trading portfolios.

Connection

Quantitative momentum and quantitative value are connected through their complementary roles in systematic trading strategies that harness different market inefficiencies. Momentum strategies capitalize on the continuation of asset price trends based on past performance, while value strategies focus on identifying undervalued securities relative to fundamental metrics like earnings, book value, or cash flow. Blending quantitative momentum with quantitative value enhances portfolio diversification, risk-adjusted returns, and reduces factor-specific drawdowns by combining trend-following signals with fundamental valuation signals.

Key Terms

Factor Investing

Quantitative value emphasizes investing in stocks undervalued based on metrics like price-to-earnings and book-to-market ratios, aiming to capitalize on market inefficiencies. Quantitative momentum prioritizes stocks exhibiting strong recent price trends, leveraging behavioral biases and market persistence to generate returns. Explore detailed strategies and empirical research to understand the nuances of factor investing better.

Backtesting

Quantitative value strategies prioritize selecting stocks based on fundamental metrics such as low price-to-earnings ratios or high book-to-market values, while quantitative momentum strategies emphasize recent price trends and momentum indicators to identify outperforming assets. Backtesting these approaches involves simulating historical performance to evaluate risk-adjusted returns, drawdowns, and consistency across various market conditions, with momentum often exhibiting stronger short-term gains but higher volatility compared to value's typically steadier, long-term returns. Explore detailed backtesting methodologies and comparative analytics to optimize portfolio strategies further.

Alpha Generation

Quantitative value strategies identify undervalued stocks based on financial metrics like price-to-earnings ratios, aiming to capture returns from mean reversion in asset prices. Quantitative momentum strategies exploit trends by selecting stocks with strong recent price performance, leveraging persistence in market behavior to generate alpha. Explore detailed analyses and empirical studies to understand how combining these factors can enhance alpha generation.

Source and External Links

Quantitative Data: What It Is, Types & Examples - QuestionPro - A quantitative value refers to data expressed as numerical counts or measurements with unique numerical values used in mathematical calculations and statistical analysis for decision-making, such as number of items, weights, percentages, or dollar amounts.

Qualitative vs. Quantitative Data in Research: The Difference | Fullstory - A quantitative value is a measurable numeric value associated with a data set, allowing statistical operations like averages, comparisons, and predictions, providing objective and generalizable research results.

Quant Magic: A Book Review of Quantitative Value, by Wesley Gray ... - In investing, quantitative value refers to the systematic use of numerical, rule-based metrics to identify undervalued stocks with the goal of outperforming the market by eliminating behavioral biases.

dowidth.com

dowidth.com