Algorithmic arbitrage leverages predefined rules and real-time market inefficiencies to execute rapid trades, ensuring consistent profit margins with minimal risk exposure. Machine learning trading applies advanced data-driven models to detect complex market patterns and adapt strategies dynamically, enhancing predictive accuracy and decision-making. Explore how these cutting-edge approaches revolutionize trading efficiency and profitability.

Why it is important

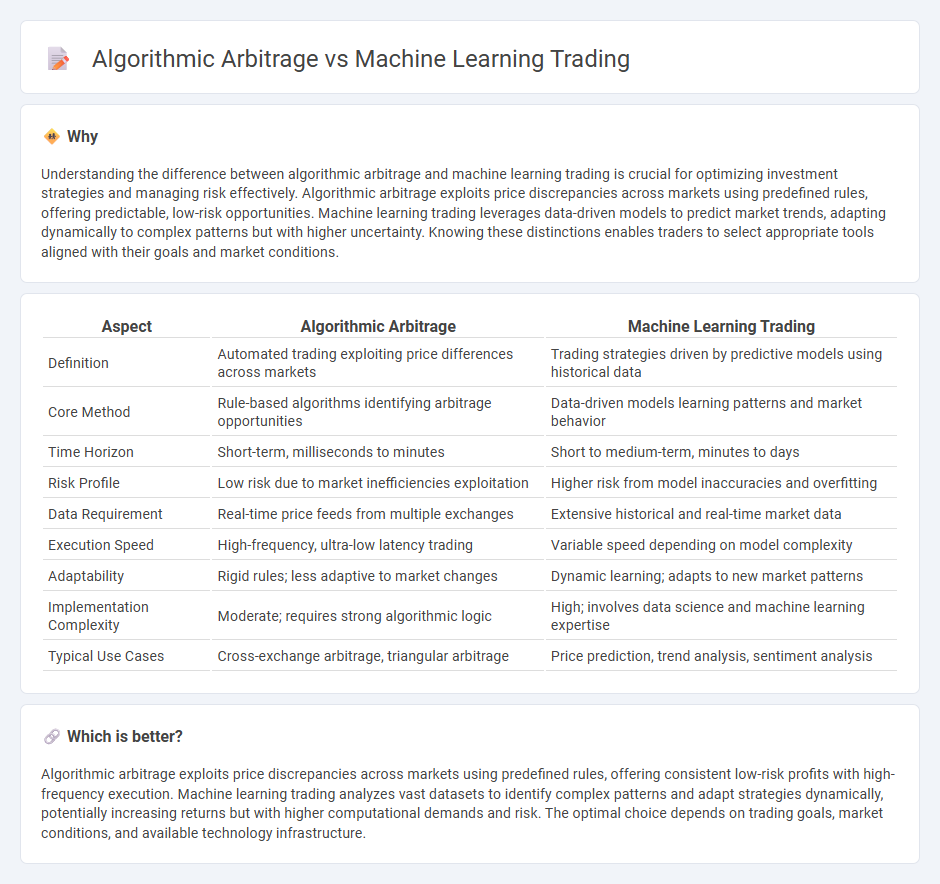

Understanding the difference between algorithmic arbitrage and machine learning trading is crucial for optimizing investment strategies and managing risk effectively. Algorithmic arbitrage exploits price discrepancies across markets using predefined rules, offering predictable, low-risk opportunities. Machine learning trading leverages data-driven models to predict market trends, adapting dynamically to complex patterns but with higher uncertainty. Knowing these distinctions enables traders to select appropriate tools aligned with their goals and market conditions.

Comparison Table

| Aspect | Algorithmic Arbitrage | Machine Learning Trading |

|---|---|---|

| Definition | Automated trading exploiting price differences across markets | Trading strategies driven by predictive models using historical data |

| Core Method | Rule-based algorithms identifying arbitrage opportunities | Data-driven models learning patterns and market behavior |

| Time Horizon | Short-term, milliseconds to minutes | Short to medium-term, minutes to days |

| Risk Profile | Low risk due to market inefficiencies exploitation | Higher risk from model inaccuracies and overfitting |

| Data Requirement | Real-time price feeds from multiple exchanges | Extensive historical and real-time market data |

| Execution Speed | High-frequency, ultra-low latency trading | Variable speed depending on model complexity |

| Adaptability | Rigid rules; less adaptive to market changes | Dynamic learning; adapts to new market patterns |

| Implementation Complexity | Moderate; requires strong algorithmic logic | High; involves data science and machine learning expertise |

| Typical Use Cases | Cross-exchange arbitrage, triangular arbitrage | Price prediction, trend analysis, sentiment analysis |

Which is better?

Algorithmic arbitrage exploits price discrepancies across markets using predefined rules, offering consistent low-risk profits with high-frequency execution. Machine learning trading analyzes vast datasets to identify complex patterns and adapt strategies dynamically, potentially increasing returns but with higher computational demands and risk. The optimal choice depends on trading goals, market conditions, and available technology infrastructure.

Connection

Algorithmic arbitrage exploits price discrepancies across markets using automated trading strategies, while machine learning enhances these algorithms by identifying complex patterns and optimizing decision-making processes. Combining algorithmic arbitrage with machine learning enables more accurate prediction of market inefficiencies and faster execution of trades, increasing profitability. This integration leverages big data analysis and adaptive models to continuously improve arbitrage opportunities in dynamic trading environments.

Key Terms

Prediction Model (Machine Learning Trading)

Machine learning trading leverages advanced prediction models, employing neural networks and deep learning algorithms to analyze vast historical market data for forecasting price movements and optimizing trade decisions. Algorithmic arbitrage, on the other hand, focuses on exploiting price discrepancies across different markets through rule-based systems without predictive modeling. Discover detailed insights into how machine learning prediction models enhance trading accuracy and market responsiveness.

Market Inefficiencies (Algorithmic Arbitrage)

Algorithmic arbitrage exploits market inefficiencies by identifying price discrepancies across different exchanges or financial instruments, enabling traders to capitalize on risk-free profits through high-frequency automated execution. Machine learning trading primarily focuses on predictive modeling and pattern recognition, leveraging historical data to anticipate market trends and make informed trading decisions rather than purely arbitrage opportunities. Discover how algorithmic arbitrage strategies uncover hidden inefficiencies and drive profitable trading in today's complex markets.

Feature Engineering (Machine Learning Trading)

Feature engineering in machine learning trading involves selecting, transforming, and creating relevant data inputs to improve predictive model accuracy, enabling traders to identify complex market patterns and trends. In contrast, algorithmic arbitrage relies on predefined rules and market inefficiencies, often without extensive feature transformation, focusing on speed and execution rather than data feature optimization. Explore how advanced feature engineering techniques can enhance machine learning trading strategies for superior market forecasts.

Source and External Links

What is Machine Learning in Trading? Examples and Types - Machine learning in trading uses supervised, unsupervised, and reinforcement learning to forecast stock prices, identify hidden patterns, and optimize buying/selling actions for profitable trading decisions on the stock market.

stefan-jansen/machine-learning-for-trading - GitHub - This resource offers an extensive practical guide on applying ML techniques such as regression, deep learning, and reinforcement learning to build, backtest, and evaluate algorithmic trading strategies with over 150 example notebooks.

Machine Learning for Trading - This book and platform provide an end-to-end workflow of ML trading strategies, covering data sourcing, feature engineering, supervised and unsupervised learning algorithms, backtesting, and leveraging deep learning for alternative data like text and images.

dowidth.com

dowidth.com