Delta neutral strategy involves balancing positions to maintain a net delta of zero, minimizing exposure to directional market movements and focusing on volatility or time decay profits. Butterfly spread is an options trading strategy using multiple strike prices to limit risk and profit from low volatility by exploiting price stability within a defined range. Explore the unique advantages and risk profiles of delta neutral strategies versus butterfly spreads to enhance your trading approach.

Why it is important

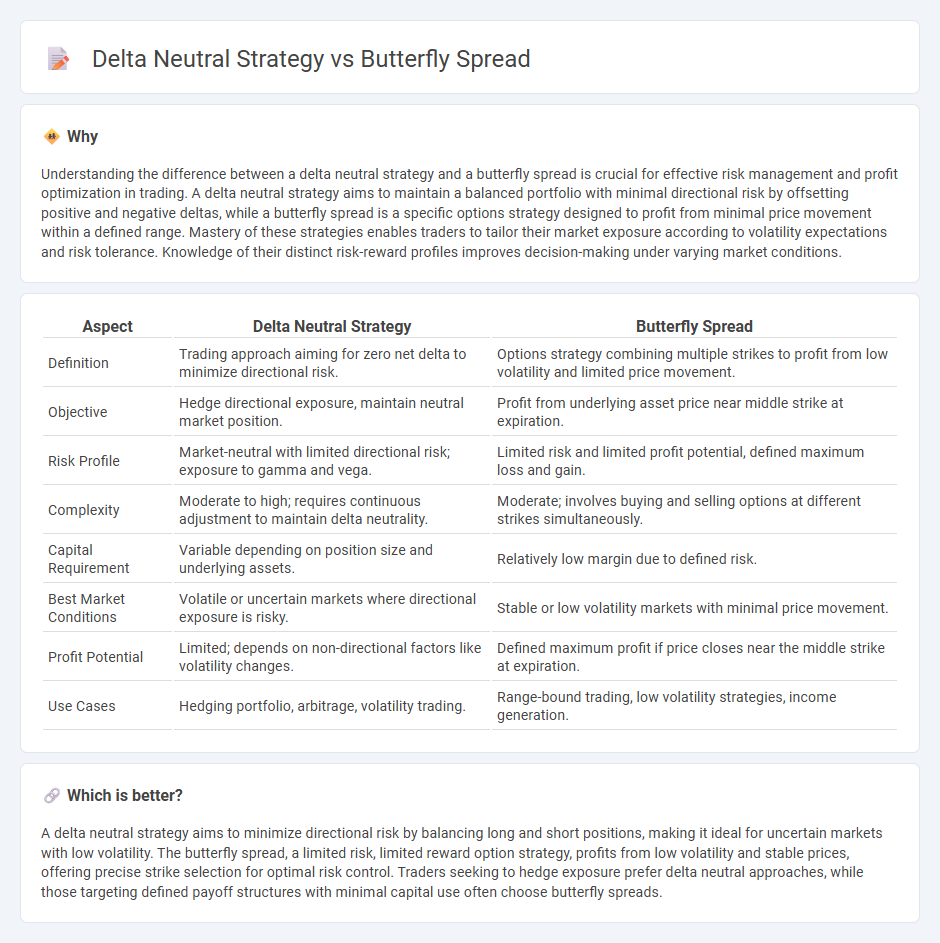

Understanding the difference between a delta neutral strategy and a butterfly spread is crucial for effective risk management and profit optimization in trading. A delta neutral strategy aims to maintain a balanced portfolio with minimal directional risk by offsetting positive and negative deltas, while a butterfly spread is a specific options strategy designed to profit from minimal price movement within a defined range. Mastery of these strategies enables traders to tailor their market exposure according to volatility expectations and risk tolerance. Knowledge of their distinct risk-reward profiles improves decision-making under varying market conditions.

Comparison Table

| Aspect | Delta Neutral Strategy | Butterfly Spread |

|---|---|---|

| Definition | Trading approach aiming for zero net delta to minimize directional risk. | Options strategy combining multiple strikes to profit from low volatility and limited price movement. |

| Objective | Hedge directional exposure, maintain neutral market position. | Profit from underlying asset price near middle strike at expiration. |

| Risk Profile | Market-neutral with limited directional risk; exposure to gamma and vega. | Limited risk and limited profit potential, defined maximum loss and gain. |

| Complexity | Moderate to high; requires continuous adjustment to maintain delta neutrality. | Moderate; involves buying and selling options at different strikes simultaneously. |

| Capital Requirement | Variable depending on position size and underlying assets. | Relatively low margin due to defined risk. |

| Best Market Conditions | Volatile or uncertain markets where directional exposure is risky. | Stable or low volatility markets with minimal price movement. |

| Profit Potential | Limited; depends on non-directional factors like volatility changes. | Defined maximum profit if price closes near the middle strike at expiration. |

| Use Cases | Hedging portfolio, arbitrage, volatility trading. | Range-bound trading, low volatility strategies, income generation. |

Which is better?

A delta neutral strategy aims to minimize directional risk by balancing long and short positions, making it ideal for uncertain markets with low volatility. The butterfly spread, a limited risk, limited reward option strategy, profits from low volatility and stable prices, offering precise strike selection for optimal risk control. Traders seeking to hedge exposure prefer delta neutral approaches, while those targeting defined payoff structures with minimal capital use often choose butterfly spreads.

Connection

Delta neutral strategy and butterfly spread are connected through their focus on minimizing directional risk in options trading by balancing positive and negative delta positions. A butterfly spread, which involves buying and selling options at three different strike prices, inherently creates a delta neutral position around the middle strike price, aiming to profit from low volatility and minimal price movement. This strategy helps traders limit potential losses while capturing gains from time decay and minimal underlying asset price fluctuations.

Key Terms

Strike Prices

Butterfly spread involves selecting three strike prices: a lower strike, a middle strike, and a higher strike, with the middle strike typically at-the-money, creating a position that profits from minimal price movement near the middle strike price. Delta neutral strategy aims to balance the options and underlying asset positions so the overall portfolio delta is close to zero, often involving dynamically adjusting strikes and quantities to manage risk regardless of price direction. Explore detailed strike price selections and adjustments in advanced option strategies for deeper insights.

Delta Exposure

A butterfly spread involves options positions that create a limited risk and limited profit profile with minimal delta exposure near the strike price, making it ideal for traders expecting low volatility. In contrast, a delta neutral strategy continuously adjusts option and stock positions to maintain an overall delta close to zero, reducing sensitivity to price movements of the underlying asset. Explore more to understand how these strategies manage delta exposure in different market conditions.

Risk/Reward Profile

Butterfly spread strategy offers limited risk with potentially high reward by using three strike prices to capitalize on low volatility and minimal price movement in the underlying asset. Delta neutral strategy aims for balanced exposure to price changes by offsetting positive and negative deltas, reducing directional risk but also capping profit potential. Explore detailed comparisons and applications to tailor your options trading approach effectively.

Source and External Links

Understanding the butterfly spread option strategy - Saxo Bank - A butterfly spread is an advanced options strategy using three strike prices to create a low-risk, targeted-profit position, profiting most when the underlying asset's price remains stable at the middle strike price at expiration, with limited losses on either side.

Mastering Butterfly Spread - This options trading strategy involves buying and selling options at three different strike prices, designed to profit from the underlying asset staying within a specific price range, with long and short butterfly spread variations depending on expected price movement.

Long Butterfly Spread - A long butterfly spread profits most when the underlying price is exactly at the middle strike price at expiration; it involves buying the wings and selling twice the middle strike options, with limited maximum loss occurring at the wings.

dowidth.com

dowidth.com