Quantitative backtesting uses historical market data and mathematical models to simulate trading strategies, providing statistical insights into potential performance and risk metrics. Demo trading involves executing trades in a simulated live environment with real-time market conditions but without financial risk, allowing traders to practice order execution and strategy adjustments. Explore the advantages and limitations of both methods to enhance your trading proficiency.

Why it is important

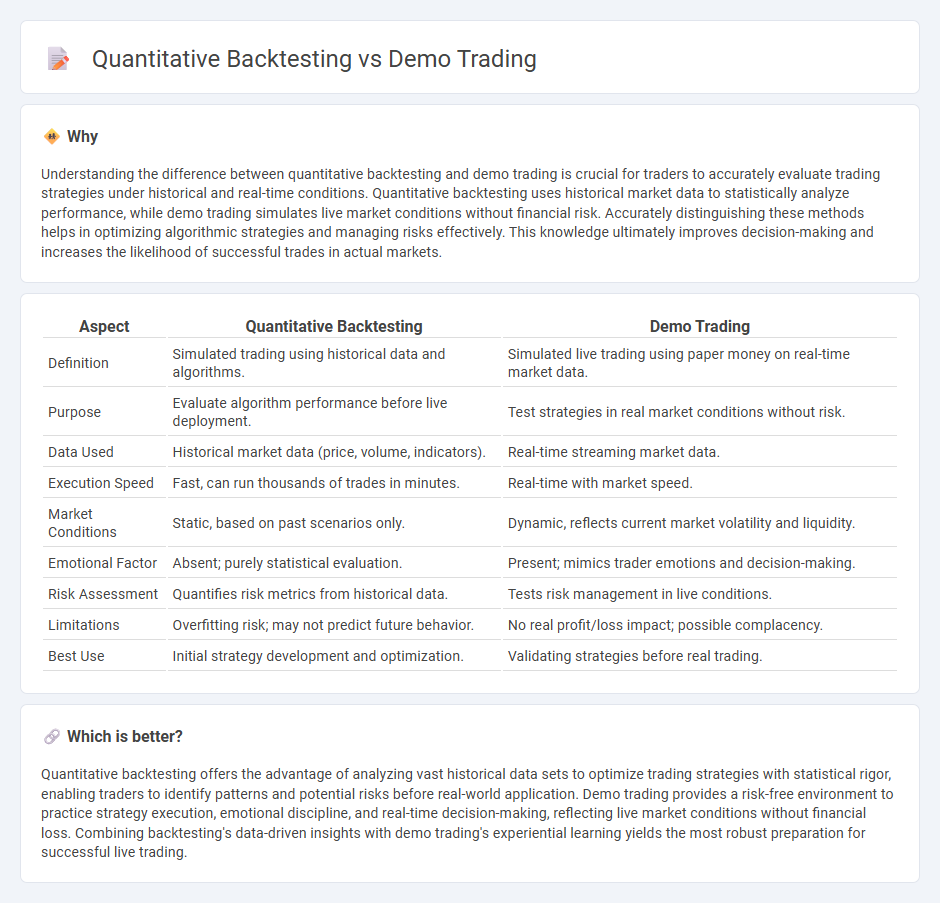

Understanding the difference between quantitative backtesting and demo trading is crucial for traders to accurately evaluate trading strategies under historical and real-time conditions. Quantitative backtesting uses historical market data to statistically analyze performance, while demo trading simulates live market conditions without financial risk. Accurately distinguishing these methods helps in optimizing algorithmic strategies and managing risks effectively. This knowledge ultimately improves decision-making and increases the likelihood of successful trades in actual markets.

Comparison Table

| Aspect | Quantitative Backtesting | Demo Trading |

|---|---|---|

| Definition | Simulated trading using historical data and algorithms. | Simulated live trading using paper money on real-time market data. |

| Purpose | Evaluate algorithm performance before live deployment. | Test strategies in real market conditions without risk. |

| Data Used | Historical market data (price, volume, indicators). | Real-time streaming market data. |

| Execution Speed | Fast, can run thousands of trades in minutes. | Real-time with market speed. |

| Market Conditions | Static, based on past scenarios only. | Dynamic, reflects current market volatility and liquidity. |

| Emotional Factor | Absent; purely statistical evaluation. | Present; mimics trader emotions and decision-making. |

| Risk Assessment | Quantifies risk metrics from historical data. | Tests risk management in live conditions. |

| Limitations | Overfitting risk; may not predict future behavior. | No real profit/loss impact; possible complacency. |

| Best Use | Initial strategy development and optimization. | Validating strategies before real trading. |

Which is better?

Quantitative backtesting offers the advantage of analyzing vast historical data sets to optimize trading strategies with statistical rigor, enabling traders to identify patterns and potential risks before real-world application. Demo trading provides a risk-free environment to practice strategy execution, emotional discipline, and real-time decision-making, reflecting live market conditions without financial loss. Combining backtesting's data-driven insights with demo trading's experiential learning yields the most robust preparation for successful live trading.

Connection

Quantitative backtesting uses historical market data to evaluate trading strategies' performance, identifying profitability and risk metrics without financial exposure. Demo trading applies those backtested strategies in real-time simulated environments, allowing traders to experience market dynamics and execution issues without monetary loss. Integrating backtesting and demo trading enhances strategy validation, ensuring robustness before live capital deployment.

Key Terms

Simulation

Demo trading offers a real-time simulation environment allowing traders to execute orders with live market data but without risking actual capital, closely mimicking psychological pressures and order execution dynamics. Quantitative backtesting uses historical data and advanced algorithms to simulate trading strategies over past market conditions, providing statistical performance metrics and identifying potential strategy weaknesses or strengths. Explore in-depth analysis to understand how both simulation methods can optimize your trading strategy development.

Historical Data

Demo trading simulates real-market conditions using live data but lacks the depth of historical analysis essential for robust strategy development. Quantitative backtesting rigorously evaluates trading strategies against extensive historical data, identifying patterns and potential weaknesses before live deployment. Explore our comprehensive guide to understand how leveraging historical data can enhance your trading success.

Risk-Free Environment

Demo trading provides a risk-free environment by simulating live market conditions without real financial exposure, allowing traders to test strategies and execution in real time. Quantitative backtesting uses historical data to evaluate trading algorithms' performance, focusing on statistical accuracy and strategy optimization but may lack real-time market dynamics. Explore deeper insights into how each method enhances risk management and strategy validation.

Source and External Links

Demo Trading Account | Binary Options Demo | No Minimum Deposit - Practice trading binary options, knock-outs, and call spreads with $10,000 in virtual funds on both desktop and mobile platforms, all risk-free.

Practice on a Demo Trading Account - Exness - Sharpen your skills and test strategies in real market conditions using various assets and platforms, including MetaTrader 4/5 and Exness Trade App, with no financial risk.

Demo Trading Account: Try IG's Paper Trading Simulator - Access over 17,000 markets, including stocks, forex, and CFDs, on a fully simulated platform to practice trading and platform navigation without real money.

dowidth.com

dowidth.com