Liquidity sweeps execute large market orders to absorb available liquidity across multiple price levels, ensuring quick order fulfillment without leaving visible traces on the order book. Peg orders continuously adjust their price to maintain a set distance from a reference price, providing passive liquidity and reducing market impact. Explore the key differences between liquidity sweeps and peg orders to enhance your trading strategy.

Why it is important

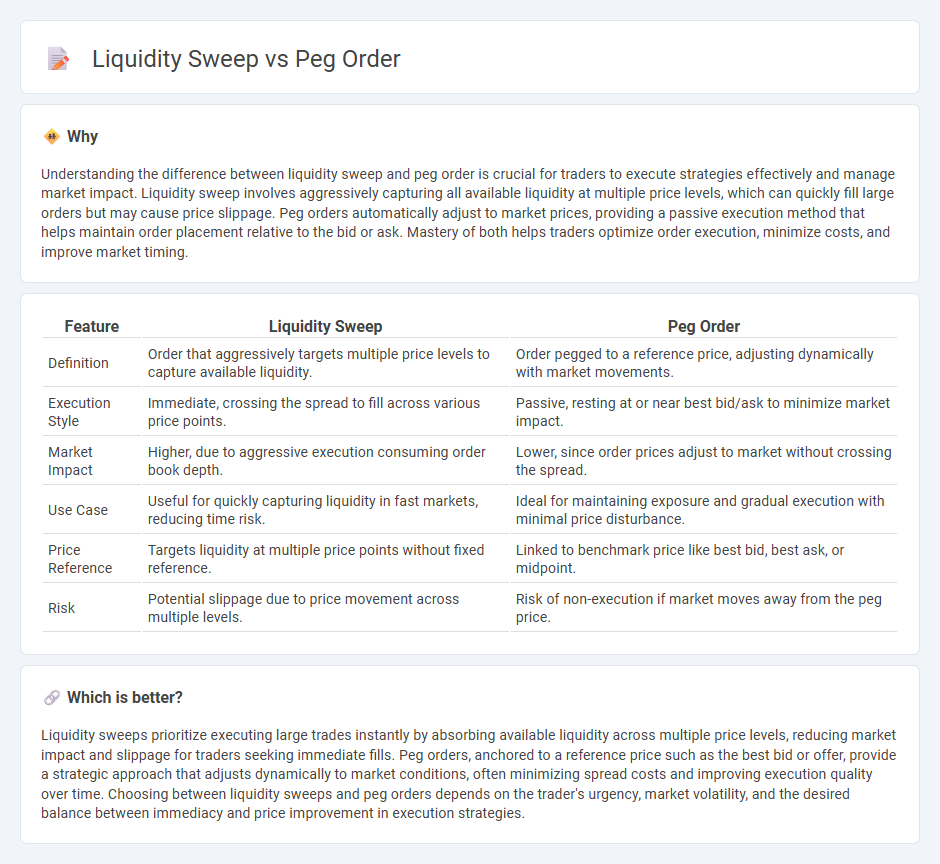

Understanding the difference between liquidity sweep and peg order is crucial for traders to execute strategies effectively and manage market impact. Liquidity sweep involves aggressively capturing all available liquidity at multiple price levels, which can quickly fill large orders but may cause price slippage. Peg orders automatically adjust to market prices, providing a passive execution method that helps maintain order placement relative to the bid or ask. Mastery of both helps traders optimize order execution, minimize costs, and improve market timing.

Comparison Table

| Feature | Liquidity Sweep | Peg Order |

|---|---|---|

| Definition | Order that aggressively targets multiple price levels to capture available liquidity. | Order pegged to a reference price, adjusting dynamically with market movements. |

| Execution Style | Immediate, crossing the spread to fill across various price points. | Passive, resting at or near best bid/ask to minimize market impact. |

| Market Impact | Higher, due to aggressive execution consuming order book depth. | Lower, since order prices adjust to market without crossing the spread. |

| Use Case | Useful for quickly capturing liquidity in fast markets, reducing time risk. | Ideal for maintaining exposure and gradual execution with minimal price disturbance. |

| Price Reference | Targets liquidity at multiple price points without fixed reference. | Linked to benchmark price like best bid, best ask, or midpoint. |

| Risk | Potential slippage due to price movement across multiple levels. | Risk of non-execution if market moves away from the peg price. |

Which is better?

Liquidity sweeps prioritize executing large trades instantly by absorbing available liquidity across multiple price levels, reducing market impact and slippage for traders seeking immediate fills. Peg orders, anchored to a reference price such as the best bid or offer, provide a strategic approach that adjusts dynamically to market conditions, often minimizing spread costs and improving execution quality over time. Choosing between liquidity sweeps and peg orders depends on the trader's urgency, market volatility, and the desired balance between immediacy and price improvement in execution strategies.

Connection

Liquidity sweeps and peg orders are interconnected trading strategies that enhance market efficiency by optimizing order execution. A liquidity sweep aggressively targets available liquidity across multiple price levels to fill large orders without significant market impact, while peg orders automatically adjust their price relative to a benchmark, such as the best bid or offer, to maintain favorable positioning. Using peg orders during a liquidity sweep ensures continuous participation at competitive prices, thus minimizing slippage and improving execution quality in high-frequency and algorithmic trading environments.

Key Terms

Peg Order

Peg orders automatically adjust a limit order's price to a reference point, such as the market best bid, offer, or mid-price, optimizing trade execution in fast-moving markets. They enable traders to maintain competitive positioning without constant manual price updates, enhancing order visibility while managing price impact. Explore more insights on how peg orders strategically improve trading efficiency and execution outcomes.

Liquidity Sweep Order

A Liquidity Sweep Order is an advanced trading instruction designed to rapidly execute large volume trades by capturing available liquidity across multiple price levels without significantly moving the market. Unlike Peg Orders, which peg execution to a reference price like the best bid or offer, Liquidity Sweeps aim to minimize market impact by systematically sweeping through order book layers. Explore more about how Liquidity Sweep Orders optimize execution strategies and improve trading efficiency.

Order Book

A peg order is a type of limit order that automatically adjusts its price to track a reference price in the order book, commonly the best bid or best offer, aiming to maintain priority and improve execution chances. In contrast, a liquidity sweep aggressively targets multiple price levels across the order book to quickly consume available liquidity, often leading to immediate fills but potentially at less favorable prices. Explore the nuances and strategic use cases of peg orders versus liquidity sweeps to optimize your trading approach.

Source and External Links

Pegged Orders - QuestDB - Pegged orders are automated trading instructions that dynamically adjust their price relative to a reference point in the market such as best bid, best offer, midpoint, or last trade price, enabling traders to maintain optimal market positions without manual updates.

Pegged Order - What Is It, Types, Examples, How To Place? - A pegged order links its buy or sell price to a specific market index like the national best bid or offer, automatically adjusting in response to market fluctuations to help traders tap into the best available prices.

Pegged Order: Definition, Meaning And Example - Pegged orders adjust automatically to market benchmarks to offer competitive execution and minimize the risks of overpaying or underselling, with types such as pegged-to-best, midpoint pegged, and market pegged orders designed for different strategies.

dowidth.com

dowidth.com