Stop hunting exploits clustered stop-loss orders to trigger automatic selling, causing sharp price declines exploited by traders for profit. Flash crashes involve sudden, extreme price drops due to algorithmic trading errors or liquidity gaps, often recovering quickly. Explore these market phenomena to understand their impact on trading strategies and risk management.

Why it is important

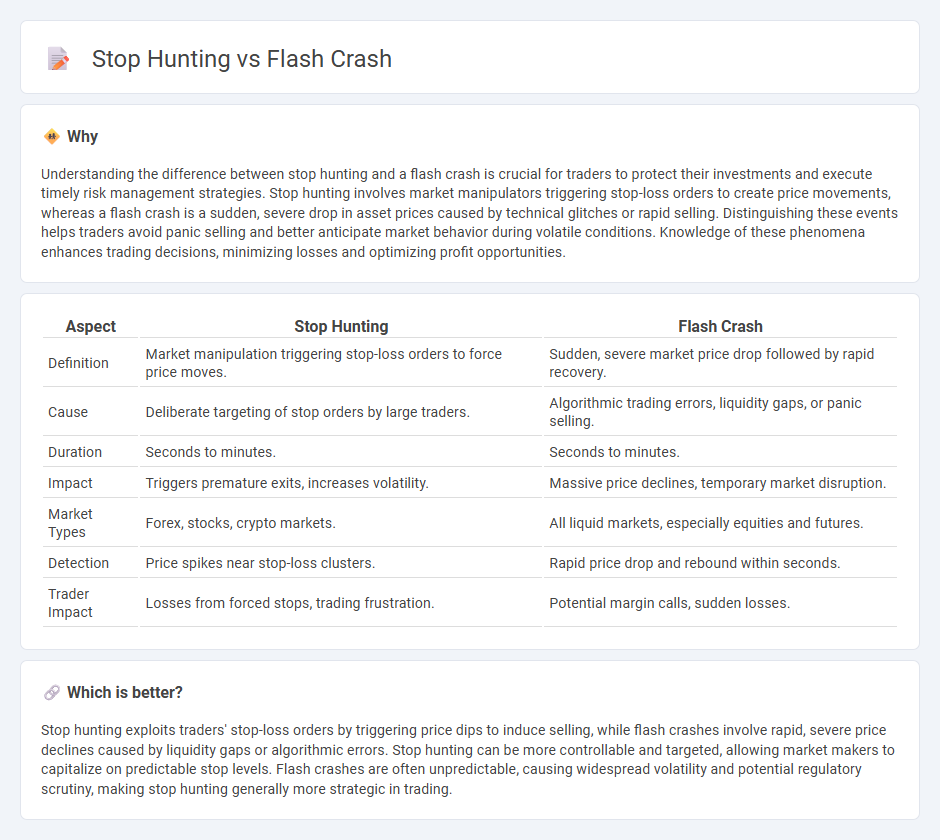

Understanding the difference between stop hunting and a flash crash is crucial for traders to protect their investments and execute timely risk management strategies. Stop hunting involves market manipulators triggering stop-loss orders to create price movements, whereas a flash crash is a sudden, severe drop in asset prices caused by technical glitches or rapid selling. Distinguishing these events helps traders avoid panic selling and better anticipate market behavior during volatile conditions. Knowledge of these phenomena enhances trading decisions, minimizing losses and optimizing profit opportunities.

Comparison Table

| Aspect | Stop Hunting | Flash Crash |

|---|---|---|

| Definition | Market manipulation triggering stop-loss orders to force price moves. | Sudden, severe market price drop followed by rapid recovery. |

| Cause | Deliberate targeting of stop orders by large traders. | Algorithmic trading errors, liquidity gaps, or panic selling. |

| Duration | Seconds to minutes. | Seconds to minutes. |

| Impact | Triggers premature exits, increases volatility. | Massive price declines, temporary market disruption. |

| Market Types | Forex, stocks, crypto markets. | All liquid markets, especially equities and futures. |

| Detection | Price spikes near stop-loss clusters. | Rapid price drop and rebound within seconds. |

| Trader Impact | Losses from forced stops, trading frustration. | Potential margin calls, sudden losses. |

Which is better?

Stop hunting exploits traders' stop-loss orders by triggering price dips to induce selling, while flash crashes involve rapid, severe price declines caused by liquidity gaps or algorithmic errors. Stop hunting can be more controllable and targeted, allowing market makers to capitalize on predictable stop levels. Flash crashes are often unpredictable, causing widespread volatility and potential regulatory scrutiny, making stop hunting generally more strategic in trading.

Connection

Stop hunting and flash crashes are interconnected phenomena in trading where aggressive traders target stop-loss orders to trigger rapid sell-offs, causing sudden price drops. This induced liquidity vacuum can escalate into a flash crash, characterized by extreme, swift market declines and automated algorithmic trades amplifying the impact. Understanding the relationship between these tactics is crucial for market participants to mitigate risks and improve trading strategies.

Key Terms

Flash Crash:

Flash Crash refers to a sudden, severe drop in asset prices within minutes, caused by a rapid sell-off triggered by automated trading algorithms and lack of liquidity. Unlike stop hunting, which targets and triggers stop-loss orders for profit, Flash Crashes result from systemic market imbalances and high-frequency trading errors. Discover more about Flash Crash dynamics and how they impact financial markets.

Liquidity

Flash crashes occur due to sudden, extreme drops in asset prices caused by rapid withdrawals of liquidity, leading to market dislocations and sharp volatility spikes. Stop hunting targets liquidity by triggering stop-loss orders placed by traders, thereby exploiting clustered stops to induce price movements favorable to large market participants. Explore the dynamics of liquidity to understand how market mechanics contribute to these phenomena.

Algorithmic Trading

Flash crashes in algorithmic trading are sudden, deep, and rapid price declines caused by automated sell orders triggered by market anomalies. Stop hunting involves algorithms targeting stop-loss orders to create artificial price movements, profiting from forced liquidations. Explore the mechanics and impacts of these phenomena in high-frequency trading environments to enhance your market strategies.

Source and External Links

Flash Crashes - Overview, Causes, and Past examples - Flash crashes are sudden, rapid plunges in asset prices, followed by a quick recovery, often caused by trading algorithms reacting to selling pressure and creating a snowball effect in seconds.

Flash crash - Wikipedia - A flash crash is a very rapid, deep, and volatile fall in security prices that happens within a short time and is quickly reversed, frequently linked to algorithmic and high-frequency trading pulling liquidity from the market temporarily.

2010 Flash Crash - Overview, Main Events, Investigation - The 2010 Flash Crash saw major US stock indices plunge within minutes due to large aggressive selling orders and high-frequency trading algorithms, erasing about $1 trillion in market value before a rebound and leading to regulatory reforms like circuit breakers.

dowidth.com

dowidth.com