Order flow analysis examines real-time market transactions to identify buying and selling pressure, providing traders with insights into immediate supply and demand dynamics. Statistical arbitrage uses quantitative models to detect pricing inefficiencies across correlated assets, relying on historical data and mean-reversion strategies. Explore how combining these approaches can enhance trading performance and risk management.

Why it is important

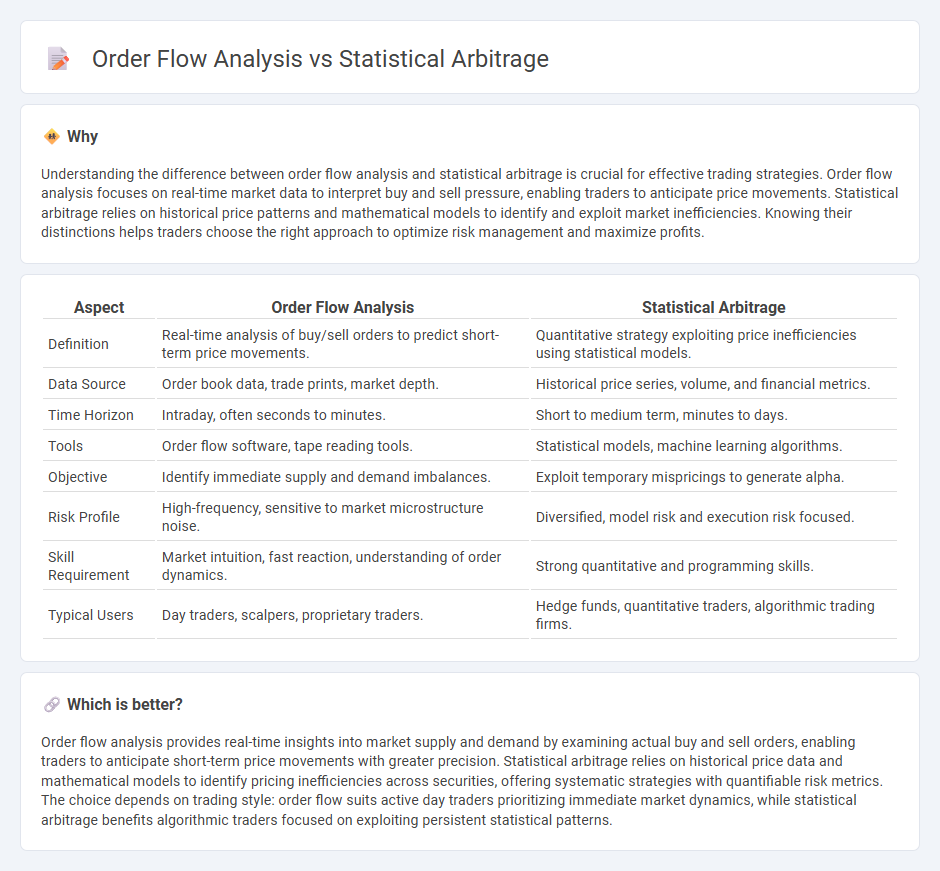

Understanding the difference between order flow analysis and statistical arbitrage is crucial for effective trading strategies. Order flow analysis focuses on real-time market data to interpret buy and sell pressure, enabling traders to anticipate price movements. Statistical arbitrage relies on historical price patterns and mathematical models to identify and exploit market inefficiencies. Knowing their distinctions helps traders choose the right approach to optimize risk management and maximize profits.

Comparison Table

| Aspect | Order Flow Analysis | Statistical Arbitrage |

|---|---|---|

| Definition | Real-time analysis of buy/sell orders to predict short-term price movements. | Quantitative strategy exploiting price inefficiencies using statistical models. |

| Data Source | Order book data, trade prints, market depth. | Historical price series, volume, and financial metrics. |

| Time Horizon | Intraday, often seconds to minutes. | Short to medium term, minutes to days. |

| Tools | Order flow software, tape reading tools. | Statistical models, machine learning algorithms. |

| Objective | Identify immediate supply and demand imbalances. | Exploit temporary mispricings to generate alpha. |

| Risk Profile | High-frequency, sensitive to market microstructure noise. | Diversified, model risk and execution risk focused. |

| Skill Requirement | Market intuition, fast reaction, understanding of order dynamics. | Strong quantitative and programming skills. |

| Typical Users | Day traders, scalpers, proprietary traders. | Hedge funds, quantitative traders, algorithmic trading firms. |

Which is better?

Order flow analysis provides real-time insights into market supply and demand by examining actual buy and sell orders, enabling traders to anticipate short-term price movements with greater precision. Statistical arbitrage relies on historical price data and mathematical models to identify pricing inefficiencies across securities, offering systematic strategies with quantifiable risk metrics. The choice depends on trading style: order flow suits active day traders prioritizing immediate market dynamics, while statistical arbitrage benefits algorithmic traders focused on exploiting persistent statistical patterns.

Connection

Order flow analysis enhances precision in identifying market liquidity and price movements by examining real-time transaction data, which feeds into statistical arbitrage models for improved predictive accuracy. Statistical arbitrage leverages patterns detected through order flow insights to exploit pricing inefficiencies between correlated securities. Integrating order flow analysis enables statistical arbitrage strategies to execute trades with optimal timing, minimizing risk and maximizing returns in high-frequency trading environments.

Key Terms

**Statistical Arbitrage:**

Statistical arbitrage leverages quantitative models and historical price data to identify mispricings between securities, enabling traders to execute mean-reversion strategies with statistically significant edge. This method relies heavily on high-frequency data, machine learning algorithms, and co-integration techniques to capture temporary price divergences across correlated assets. Explore more about how statistical arbitrage strategies can optimize portfolio returns and reduce market risk exposure.

Mean Reversion

Statistical arbitrage leverages mean reversion by identifying price discrepancies from historical averages, aiming to profit as prices revert to their mean. Order flow analysis focuses on real-time market data, interpreting buy and sell orders to predict short-term price movements driven by liquidity imbalances. Explore how integrating these strategies enhances trading precision and risk management.

Cointegration

Statistical arbitrage leverages cointegration by identifying pairs of assets whose price movements maintain a stable equilibrium relationship, enabling traders to exploit temporary deviations for profit. Order flow analysis examines the real-time buying and selling pressure reflected in market orders, providing granular insight into short-term price dynamics that may influence cointegrated pairs. Explore deeper techniques to combine cointegration with order flow data for enhanced trading strategies.

Source and External Links

The Power of Statistical Arbitrage in Finance - Statistical arbitrage (stat arb) is a quantitative trading strategy using statistical models to exploit temporary price discrepancies between related financial instruments based on mean reversion, involving data analysis, model development, and trade execution.

Statistical arbitrage - Wikipedia - Statistical arbitrage is a short-term, beta-neutral trading strategy employing mean reversion and statistical techniques across large, diversified portfolios for small, quick profits, often automated and widely used by hedge funds and investment banks.

What is Statistical Arbitrage? | CQF Blog - Statistical arbitrage is a quantitative trading method that identifies and exploits pricing inefficiencies or deviations from expected price relationships among financial instruments.

dowidth.com

dowidth.com