Synthetic positions replicate the payoff of owning an asset without actually holding it, often using options such as calls and puts to mimic long or short positions. Protective puts involve buying a put option to safeguard against potential losses in a held asset, effectively serving as insurance. Explore the key differences and strategic applications to enhance your trading approach.

Why it is important

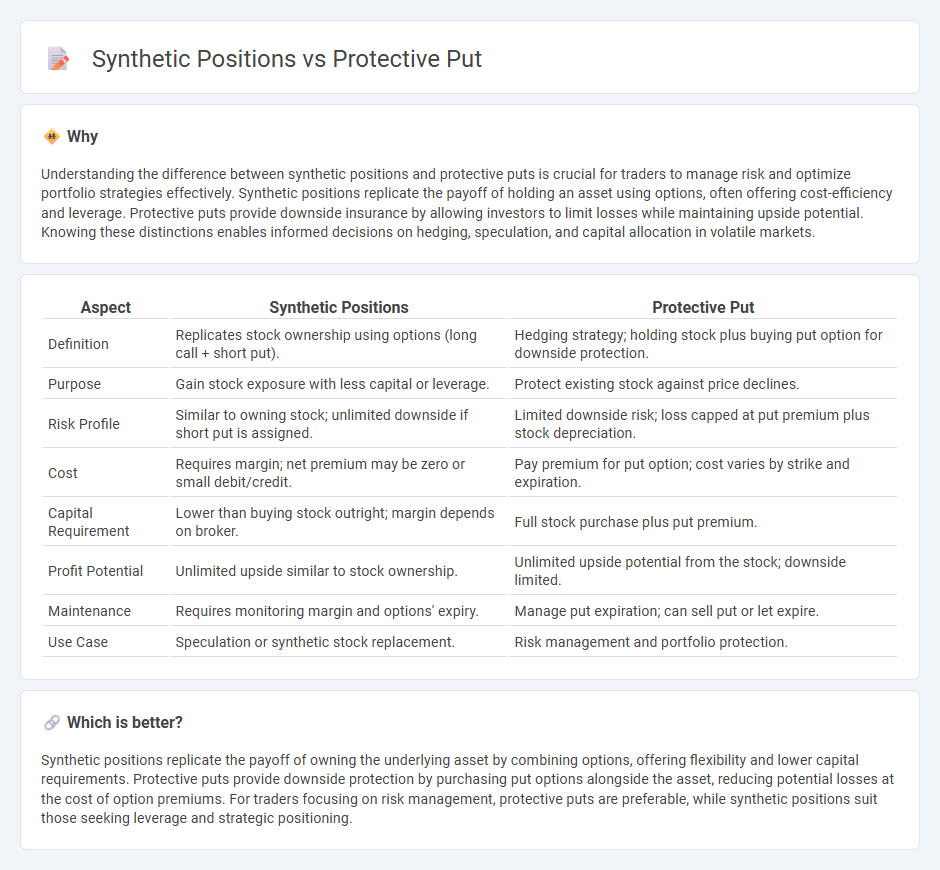

Understanding the difference between synthetic positions and protective puts is crucial for traders to manage risk and optimize portfolio strategies effectively. Synthetic positions replicate the payoff of holding an asset using options, often offering cost-efficiency and leverage. Protective puts provide downside insurance by allowing investors to limit losses while maintaining upside potential. Knowing these distinctions enables informed decisions on hedging, speculation, and capital allocation in volatile markets.

Comparison Table

| Aspect | Synthetic Positions | Protective Put |

|---|---|---|

| Definition | Replicates stock ownership using options (long call + short put). | Hedging strategy; holding stock plus buying put option for downside protection. |

| Purpose | Gain stock exposure with less capital or leverage. | Protect existing stock against price declines. |

| Risk Profile | Similar to owning stock; unlimited downside if short put is assigned. | Limited downside risk; loss capped at put premium plus stock depreciation. |

| Cost | Requires margin; net premium may be zero or small debit/credit. | Pay premium for put option; cost varies by strike and expiration. |

| Capital Requirement | Lower than buying stock outright; margin depends on broker. | Full stock purchase plus put premium. |

| Profit Potential | Unlimited upside similar to stock ownership. | Unlimited upside potential from the stock; downside limited. |

| Maintenance | Requires monitoring margin and options' expiry. | Manage put expiration; can sell put or let expire. |

| Use Case | Speculation or synthetic stock replacement. | Risk management and portfolio protection. |

Which is better?

Synthetic positions replicate the payoff of owning the underlying asset by combining options, offering flexibility and lower capital requirements. Protective puts provide downside protection by purchasing put options alongside the asset, reducing potential losses at the cost of option premiums. For traders focusing on risk management, protective puts are preferable, while synthetic positions suit those seeking leverage and strategic positioning.

Connection

Synthetic positions replicate the payoff of owning an asset using options, often combining a long call with a short put, while protective puts involve buying a put option to hedge an existing long position. Both strategies leverage options to manage risk and simulate or protect asset exposure, enhancing flexibility in trading portfolios. Traders use synthetic positions to gain market exposure without owning the underlying asset, whereas protective puts serve as insurance against downside price movements.

Key Terms

Hedging

Protective puts involve buying put options to hedge against potential declines in a stock already owned, effectively limiting downside risk while retaining upside potential. Synthetic positions replicate the payoff of owning the underlying asset through options strategies, such as combining calls and puts, offering cost-effective alternatives for hedging market exposure. Explore detailed comparisons of these strategies to optimize your portfolio's risk management.

Options (Put and Call)

Protective puts involve purchasing put options to hedge against potential downside in an owned stock, offering downside protection by locking in a sell price. Synthetic positions replicate stock ownership through options by combining calls and puts; for example, a synthetic long stock is created by buying a call and selling a put with the same strike. Explore further to understand the strategic uses and risk profiles of protective puts versus synthetic positions in options trading.

Payoff Structure

A protective put involves owning the underlying asset while purchasing a put option, limiting downside risk with a defined maximum loss and unlimited upside potential, creating a payoff similar to a guaranteed floor price. A synthetic long position replicates owning the asset by combining a long call option and a short put option, offering unlimited upside but exposing the investor to significant downside risk equal to owning the asset outright. Explore detailed payoff diagrams and real-world scenarios to better understand these strategies.

Source and External Links

Protective Put - Definition, Example, Scenarios - A protective put is a risk management strategy involving holding a long position in an asset while purchasing a put option to limit potential losses from price drops without capping profit potential, often used by bullish investors to hedge their stocks.

Protective Put Strategy: Definition, How It Works & Examples - This strategy acts as insurance for stock investors by allowing them to buy a put option to sell shares at a strike price if the stock price declines, thus minimizing potential losses while still benefiting from stock appreciation if the price rises.

Protective Put Option Strategy - Fidelity Investments - A protective put involves owning stock and buying put options to limit downside risk while maintaining upside potential, with risk limited to the difference between the stock price and strike price plus the cost of the put and commissions.

dowidth.com

dowidth.com