Microstructure modeling examines the detailed processes and mechanisms within financial markets, focusing on order book dynamics, bid-ask spreads, and trade execution. Market impact modeling quantifies how large trades influence asset prices, highlighting the relationship between trade size and price movement. Explore deeper insights to understand how these models optimize trading strategies and minimize costs.

Why it is important

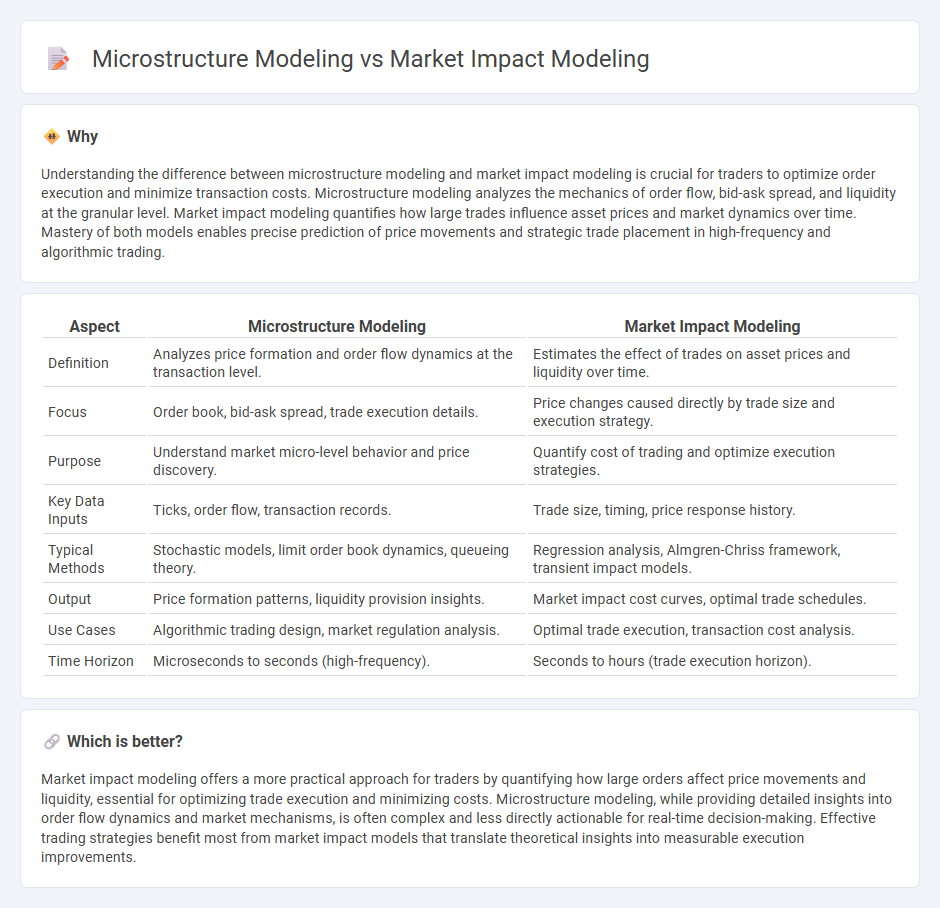

Understanding the difference between microstructure modeling and market impact modeling is crucial for traders to optimize order execution and minimize transaction costs. Microstructure modeling analyzes the mechanics of order flow, bid-ask spread, and liquidity at the granular level. Market impact modeling quantifies how large trades influence asset prices and market dynamics over time. Mastery of both models enables precise prediction of price movements and strategic trade placement in high-frequency and algorithmic trading.

Comparison Table

| Aspect | Microstructure Modeling | Market Impact Modeling |

|---|---|---|

| Definition | Analyzes price formation and order flow dynamics at the transaction level. | Estimates the effect of trades on asset prices and liquidity over time. |

| Focus | Order book, bid-ask spread, trade execution details. | Price changes caused directly by trade size and execution strategy. |

| Purpose | Understand market micro-level behavior and price discovery. | Quantify cost of trading and optimize execution strategies. |

| Key Data Inputs | Ticks, order flow, transaction records. | Trade size, timing, price response history. |

| Typical Methods | Stochastic models, limit order book dynamics, queueing theory. | Regression analysis, Almgren-Chriss framework, transient impact models. |

| Output | Price formation patterns, liquidity provision insights. | Market impact cost curves, optimal trade schedules. |

| Use Cases | Algorithmic trading design, market regulation analysis. | Optimal trade execution, transaction cost analysis. |

| Time Horizon | Microseconds to seconds (high-frequency). | Seconds to hours (trade execution horizon). |

Which is better?

Market impact modeling offers a more practical approach for traders by quantifying how large orders affect price movements and liquidity, essential for optimizing trade execution and minimizing costs. Microstructure modeling, while providing detailed insights into order flow dynamics and market mechanisms, is often complex and less directly actionable for real-time decision-making. Effective trading strategies benefit most from market impact models that translate theoretical insights into measurable execution improvements.

Connection

Microstructure modeling analyzes the intricate mechanisms of order flow, bid-ask spreads, and price formation within financial markets, providing insights into how trades execute over time. Market impact modeling quantifies the effect of large orders on price movements, capturing temporary and permanent price shifts caused by trading activity. The connection lies in microstructure frameworks supplying the foundational data and dynamics needed for accurate estimation of market impact, enabling traders to optimize execution strategies and minimize transaction costs.

Key Terms

**Market Impact Modeling:**

Market impact modeling quantifies the price changes caused by large trades, emphasizing factors like trade size, market liquidity, and timing. It utilizes statistical methods and historical data to predict execution costs and optimize trade strategies, crucial for minimizing slippage in algorithmic trading. Explore deeper insights into market impact modeling techniques and applications to enhance your trading performance.

Price Impact Function

Market impact modeling analyzes how trades influence asset prices, focusing on estimating the Price Impact Function, which quantifies price changes relative to trade size and execution strategies. Microstructure modeling delves into the mechanisms of order flow, bid-ask spread dynamics, and liquidity, providing a granular view of how trades affect prices at the transaction level. Explore further to understand the nuances between market impact and microstructure modeling in optimizing trading strategies.

Order Size

Market impact modeling quantifies the price change resulting from executing large order sizes, emphasizing how liquidity consumption influences market prices. Microstructure modeling analyzes the granular mechanisms of order book dynamics and trade execution affected by order size, detailing order placement, cancellation, and matching processes. Explore these approaches further to optimize trading strategies and minimize market impact costs.

Source and External Links

Market Impact Models | QuestDB - Market impact models mathematically estimate how trading activity affects asset prices, balancing execution speed and price deterioration, and include temporary and permanent impact components often modeled with square root or linear functions of order size.

shubhamcodez/Market-Impact-Model - GitHub - This project builds a market impact model for algorithmic trading by using trading volume, price movements, and stock liquidity data, employing nonlinear regression on preprocessed financial data to estimate temporary impact parameters.

The market impact of large trading orders - Berkeley Haas - The study explores how large order executions affect price changes, showing asymmetry in price response to buys versus sells and emphasizing the role of order flow predictability in shaping market impact.

dowidth.com

dowidth.com