Execution algorithms focus on minimizing market impact and achieving optimal trade prices by breaking orders into smaller, strategically timed trades. Participation algorithms dynamically adjust order placement based on real-time market volumes and liquidity to maintain a targeted participation rate. Explore how execution and participation algorithms enhance trading efficiency and decision-making.

Why it is important

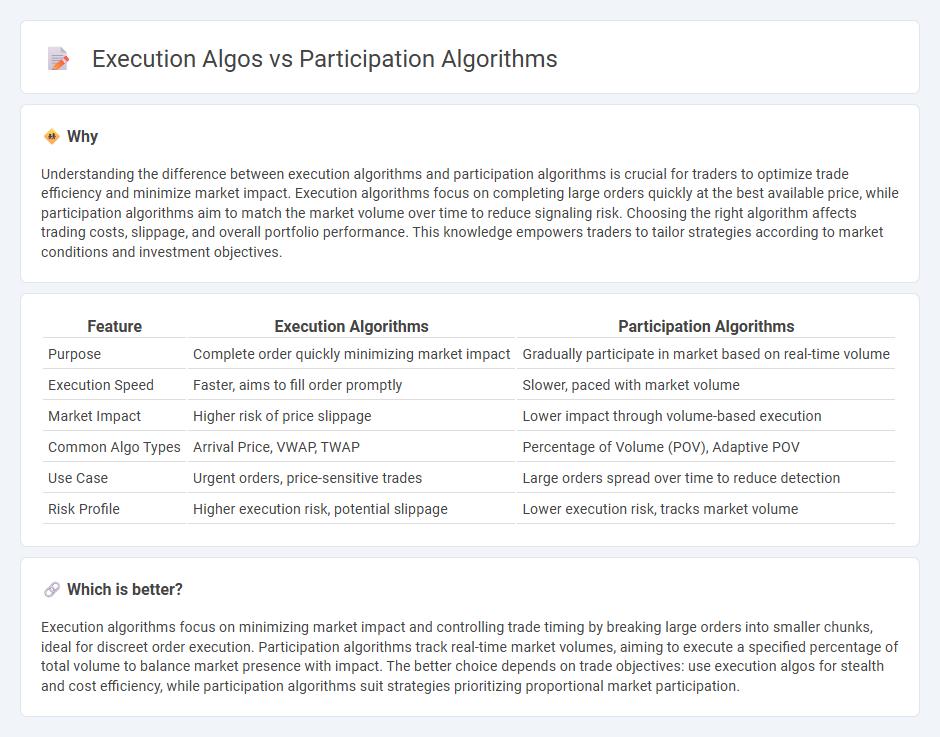

Understanding the difference between execution algorithms and participation algorithms is crucial for traders to optimize trade efficiency and minimize market impact. Execution algorithms focus on completing large orders quickly at the best available price, while participation algorithms aim to match the market volume over time to reduce signaling risk. Choosing the right algorithm affects trading costs, slippage, and overall portfolio performance. This knowledge empowers traders to tailor strategies according to market conditions and investment objectives.

Comparison Table

| Feature | Execution Algorithms | Participation Algorithms |

|---|---|---|

| Purpose | Complete order quickly minimizing market impact | Gradually participate in market based on real-time volume |

| Execution Speed | Faster, aims to fill order promptly | Slower, paced with market volume |

| Market Impact | Higher risk of price slippage | Lower impact through volume-based execution |

| Common Algo Types | Arrival Price, VWAP, TWAP | Percentage of Volume (POV), Adaptive POV |

| Use Case | Urgent orders, price-sensitive trades | Large orders spread over time to reduce detection |

| Risk Profile | Higher execution risk, potential slippage | Lower execution risk, tracks market volume |

Which is better?

Execution algorithms focus on minimizing market impact and controlling trade timing by breaking large orders into smaller chunks, ideal for discreet order execution. Participation algorithms track real-time market volumes, aiming to execute a specified percentage of total volume to balance market presence with impact. The better choice depends on trade objectives: use execution algos for stealth and cost efficiency, while participation algorithms suit strategies prioritizing proportional market participation.

Connection

Execution algorithms and participation algorithms are interconnected as both aim to optimize trade execution by minimizing market impact and slippage. Execution algorithms use participation algorithms to dynamically adjust order placement based on real-time market participation rates, ensuring orders are executed in line with overall market volume. This integration enhances trade efficiency by balancing liquidity consumption and price stability during order execution.

Key Terms

VWAP (Volume Weighted Average Price)

Participation algorithms dynamically adjust trade execution rates to match a target percentage of market volume, minimizing market impact and signaling risk. Execution algorithms such as VWAP focus on executing orders close to the Volume Weighted Average Price, optimizing trade timing based on historical and real-time volume patterns to achieve efficient price execution. Explore detailed comparisons to understand how VWAP integrates within various algorithmic strategies for optimal trade performance.

POV (Percentage of Volume)

Participation algorithms seek to execute trades by targeting a specific Percentage of Volume (POV) within the market, dynamically adjusting order sizes to match real-time trading volume. Execution algorithms, on the other hand, prioritize minimizing market impact and execution costs through strategies like VWAP or TWAP, often without a direct focus on POV. Understanding the differences enhances trading efficiency; explore how POV-driven participation algorithms can optimize your order execution strategy.

TWAP (Time Weighted Average Price)

Participation algorithms allocate trades proportionally to market volume to minimize market impact and improve order execution quality, often adjusting dynamically to real-time volume patterns. Execution algorithms like TWAP aim to execute large orders evenly over a set time period, reducing the risk of price volatility by spreading trades uniformly. Explore the nuances between participation and execution algorithms to optimize trading strategies and enhance portfolio performance.

Source and External Links

Participation Weighted Price (PWP) - CEED.trading - The Participation Weighted Price (PWP) algorithm executes orders by targeting a defined participation rate of market volume, dynamically adjusting trades to align execution price with average market prices and minimizing market impact during the order's execution period.

Trade Execution - CFA, FRM, and Actuarial Exams Study Notes - Participation algorithms (POV) trade a fixed percentage of market volume in real time, increasing or decreasing their trading activity with liquidity, but risk higher transaction costs if prices move adversely during execution.

The POV (Percentage of Volume) Algorithm - Siddharth's Blog - The POV algorithm adaptively trades a specified percentage of total market volume, updating the trading schedule tick-by-tick to maintain consistent market participation based on live trading flows.

dowidth.com

dowidth.com