Prop firm challenges offer traders a structured evaluation process to demonstrate skills and secure funded accounts with specific risk parameters, while proprietary trading desks focus on experienced traders managing firm capital directly with advanced tools and strategies. Both approaches emphasize risk management, discipline, and consistent profitability but differ in structure and capital allocation methods. Explore the key differences between prop firm challenges and proprietary trading desks to determine the best path for your trading career.

Why it is important

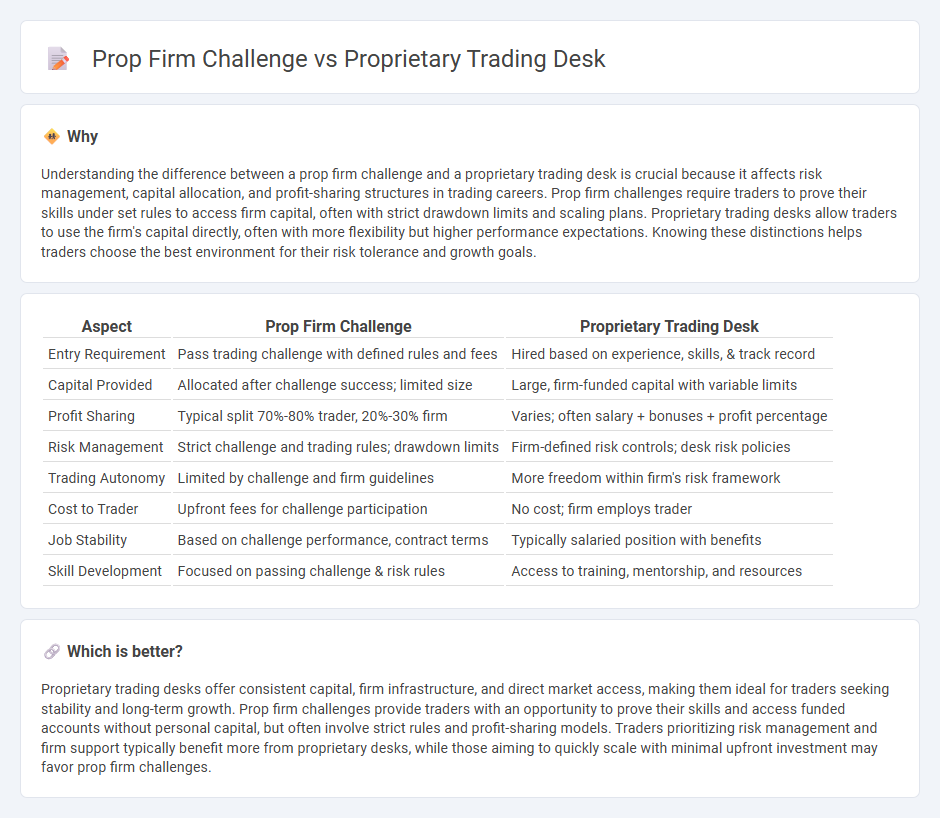

Understanding the difference between a prop firm challenge and a proprietary trading desk is crucial because it affects risk management, capital allocation, and profit-sharing structures in trading careers. Prop firm challenges require traders to prove their skills under set rules to access firm capital, often with strict drawdown limits and scaling plans. Proprietary trading desks allow traders to use the firm's capital directly, often with more flexibility but higher performance expectations. Knowing these distinctions helps traders choose the best environment for their risk tolerance and growth goals.

Comparison Table

| Aspect | Prop Firm Challenge | Proprietary Trading Desk |

|---|---|---|

| Entry Requirement | Pass trading challenge with defined rules and fees | Hired based on experience, skills, & track record |

| Capital Provided | Allocated after challenge success; limited size | Large, firm-funded capital with variable limits |

| Profit Sharing | Typical split 70%-80% trader, 20%-30% firm | Varies; often salary + bonuses + profit percentage |

| Risk Management | Strict challenge and trading rules; drawdown limits | Firm-defined risk controls; desk risk policies |

| Trading Autonomy | Limited by challenge and firm guidelines | More freedom within firm's risk framework |

| Cost to Trader | Upfront fees for challenge participation | No cost; firm employs trader |

| Job Stability | Based on challenge performance, contract terms | Typically salaried position with benefits |

| Skill Development | Focused on passing challenge & risk rules | Access to training, mentorship, and resources |

Which is better?

Proprietary trading desks offer consistent capital, firm infrastructure, and direct market access, making them ideal for traders seeking stability and long-term growth. Prop firm challenges provide traders with an opportunity to prove their skills and access funded accounts without personal capital, but often involve strict rules and profit-sharing models. Traders prioritizing risk management and firm support typically benefit more from proprietary desks, while those aiming to quickly scale with minimal upfront investment may favor prop firm challenges.

Connection

Prop firm challenges serve as rigorous evaluation tools that identify skilled traders for entry into proprietary trading desks, where traders utilize firm capital to execute high-frequency or algorithmic trades. Success in these challenges often leads to funded accounts, aligning trader performance with the firm's profit objectives and risk management protocols. This selection process streamlines talent acquisition, ensuring proprietary desks maintain a pipeline of proficient traders capable of generating consistent returns.

Key Terms

Capital Allocation

Proprietary trading desks utilize firm capital to execute high-frequency and algorithmic trades, allowing for direct control over significant liquidity and risk management strategies. Prop firm challenges typically require traders to demonstrate skill by trading allocated capital under predefined rules, aiming to scale successful traders into profit-sharing arrangements. Explore the intricacies of capital allocation and risk protocols to understand which model best suits your trading goals.

Risk Management

Proprietary trading desks implement rigorous risk management frameworks, utilizing advanced algorithms and real-time data to minimize losses and protect capital. Prop firm challenges emphasize stringent risk controls as candidates must demonstrate discipline in position sizing, maximum drawdown limits, and adherence to predefined risk parameters. Explore our detailed analysis to understand how risk management strategies differ between proprietary trading desks and prop firm challenges.

Payout Structure

Proprietary trading desks typically offer traders a fixed salary combined with a profit-sharing scheme, ensuring consistent income alongside performance incentives. Prop firm challenges often require traders to prove profitability within set parameters before unlocking higher payout tiers, emphasizing risk management and profit targets. Explore detailed comparisons to understand which payout structure best suits your trading goals.

Source and External Links

Proprietary Trading Desk Setup: A Step by Step Guide - A proprietary trading desk trades its own capital and requires steps like registration, market access, and arranging capital to set up properly.

Proprietary trading - Proprietary trading desk involves a trader or firm using its own money to trade stocks, bonds, derivatives, or other financial instruments to make profits, often employing advanced strategies like arbitrage or macro trading.

Proprietary Trading - What is Prop Trading & How Does It ... - Proprietary trading desks operate using the firm's own capital, enabling traders to take on more risk and keep all profits, as opposed to hedge funds which trade with clients' money and have more regulatory constraints.

dowidth.com

dowidth.com