Smart Money Concepts emphasize the identification of institutional trading activity to predict market trends, focusing on liquidity zones and price manipulation. Order Block Theory concentrates on pinpointing specific price areas where large institutions place significant orders, creating supply and demand imbalances. Explore more to understand how these advanced trading techniques can enhance strategy precision and market insights.

Why it is important

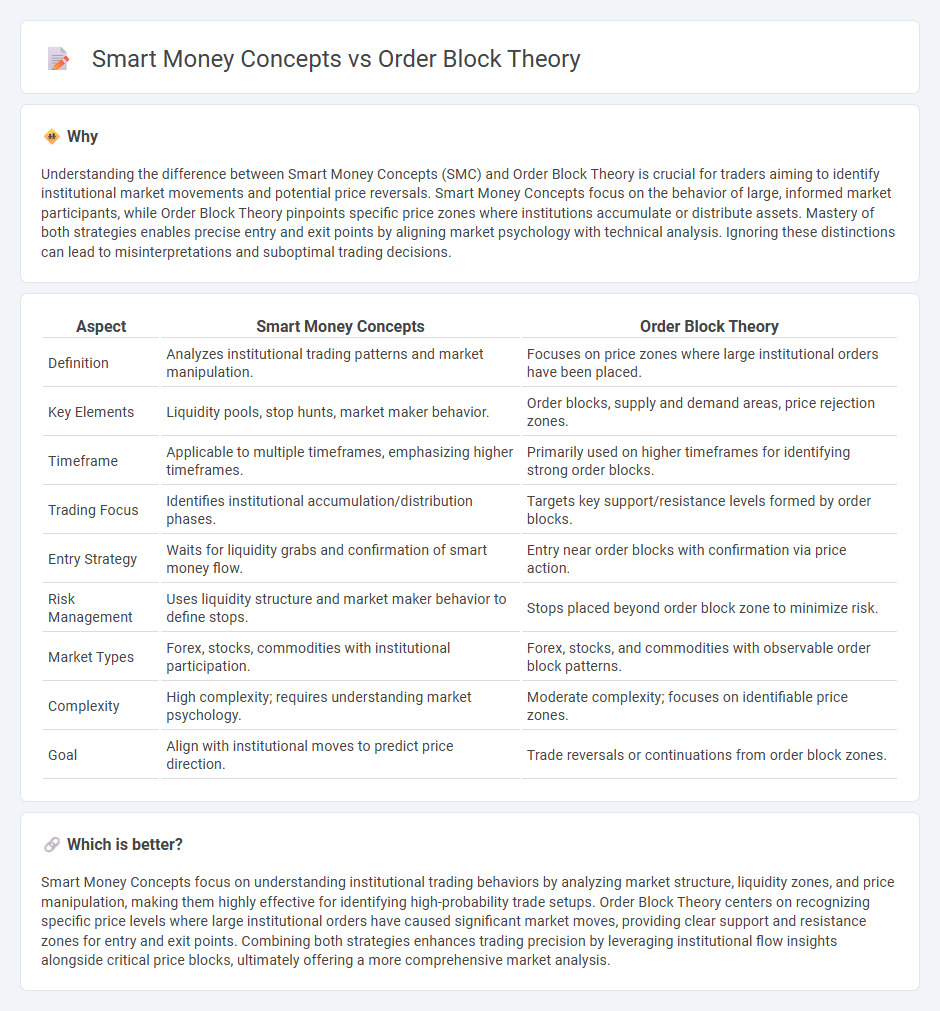

Understanding the difference between Smart Money Concepts (SMC) and Order Block Theory is crucial for traders aiming to identify institutional market movements and potential price reversals. Smart Money Concepts focus on the behavior of large, informed market participants, while Order Block Theory pinpoints specific price zones where institutions accumulate or distribute assets. Mastery of both strategies enables precise entry and exit points by aligning market psychology with technical analysis. Ignoring these distinctions can lead to misinterpretations and suboptimal trading decisions.

Comparison Table

| Aspect | Smart Money Concepts | Order Block Theory |

|---|---|---|

| Definition | Analyzes institutional trading patterns and market manipulation. | Focuses on price zones where large institutional orders have been placed. |

| Key Elements | Liquidity pools, stop hunts, market maker behavior. | Order blocks, supply and demand areas, price rejection zones. |

| Timeframe | Applicable to multiple timeframes, emphasizing higher timeframes. | Primarily used on higher timeframes for identifying strong order blocks. |

| Trading Focus | Identifies institutional accumulation/distribution phases. | Targets key support/resistance levels formed by order blocks. |

| Entry Strategy | Waits for liquidity grabs and confirmation of smart money flow. | Entry near order blocks with confirmation via price action. |

| Risk Management | Uses liquidity structure and market maker behavior to define stops. | Stops placed beyond order block zone to minimize risk. |

| Market Types | Forex, stocks, commodities with institutional participation. | Forex, stocks, and commodities with observable order block patterns. |

| Complexity | High complexity; requires understanding market psychology. | Moderate complexity; focuses on identifiable price zones. |

| Goal | Align with institutional moves to predict price direction. | Trade reversals or continuations from order block zones. |

Which is better?

Smart Money Concepts focus on understanding institutional trading behaviors by analyzing market structure, liquidity zones, and price manipulation, making them highly effective for identifying high-probability trade setups. Order Block Theory centers on recognizing specific price levels where large institutional orders have caused significant market moves, providing clear support and resistance zones for entry and exit points. Combining both strategies enhances trading precision by leveraging institutional flow insights alongside critical price blocks, ultimately offering a more comprehensive market analysis.

Connection

Smart Money Concepts focus on identifying large institutional traders' intentions by analyzing market structure and volume patterns, while Order Block Theory pinpoints specific price zones where these institutions place significant buy or sell orders. These order blocks act as supply and demand zones that smart money uses to initiate strong market moves, confirming institutional participation. Understanding the interplay between smart money footprints and order blocks enhances precision in predicting market reversals and trend continuations.

Key Terms

Order Block Theory:

Order Block Theory identifies specific price zones where institutional traders place significant buy or sell orders, leading to strong support or resistance levels in the market. These order blocks often precede major price reversals or breakouts, making them essential for traders aiming to predict market movements based on institutional activity. Explore further to understand how Order Block Theory can enhance your trading strategy with precise entry and exit points.

Order Block

Order Block Theory identifies specific price zones where institutional traders place significant buy or sell orders, influencing market direction through supply and demand imbalances. These order blocks serve as key support and resistance levels, often signaling potential reversals or continuation patterns within smart money trading strategies. Explore deeper insights into how order blocks shape market dynamics and enhance trading decisions.

Institutional Candle

Order Block Theory identifies key price zones where institutional traders place large orders, often marked by significant candlestick patterns such as institutional candles characterized by long bodies and minimal wicks. Smart Money Concepts emphasize market manipulation by these large players, highlighting how institutional candles signal strong buying or selling pressure, indicating potential market reversals or continuations. Explore how combining Order Block Theory with Smart Money Concepts can enhance your trading strategy and market timing precision.

Source and External Links

Order Blocks in Forex Trading: How to Spot Them - Order blocks are specific price areas where large institutional traders place multiple small buy or sell orders to accumulate or distribute assets without causing sharp price moves, often visible as consolidation zones before a reversal in trend.

Mastering Order Blocks: The Ultimate Guide for Traders - An order block is a price zone marking institutional buying or selling before a significant market move, with bullish order blocks showing accumulation in a downtrend and bearish order blocks indicating distribution in an uptrend, used to anticipate future price movements by trading with institutional footprints.

What Are Order Blocks and Breaker Blocks in Trading? - Order blocks are identified as last bearish candles before a sharp up move (bullish order block) or last bullish candles before a down move (bearish order block), typically forming at consolidation areas with high institutional trading activity and serving as supply or demand zones on higher timeframes.

dowidth.com

dowidth.com