Algorithmic arbitrage exploits price discrepancies across markets by executing high-speed trades to secure risk-free profits, leveraging advanced algorithms and real-time data feeds. Volatility trading focuses on capitalizing on price fluctuations using derivatives such as options and volatility indices to hedge or speculate on market movements. Explore the nuances of these strategies to enhance your trading approach.

Why it is important

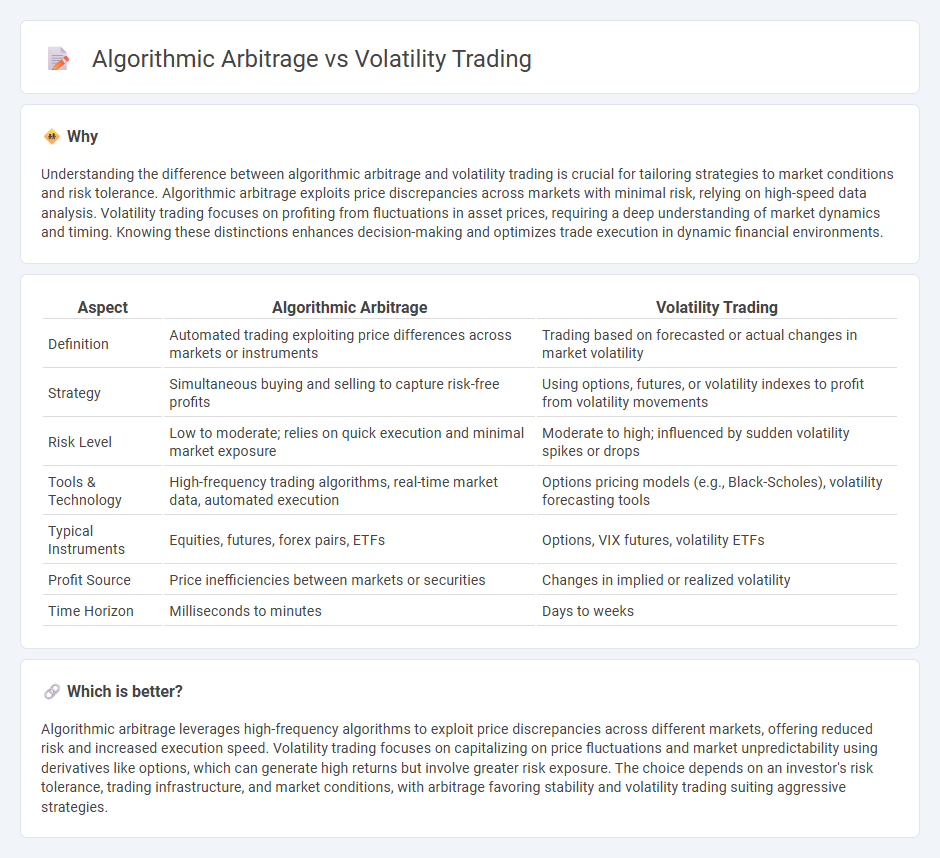

Understanding the difference between algorithmic arbitrage and volatility trading is crucial for tailoring strategies to market conditions and risk tolerance. Algorithmic arbitrage exploits price discrepancies across markets with minimal risk, relying on high-speed data analysis. Volatility trading focuses on profiting from fluctuations in asset prices, requiring a deep understanding of market dynamics and timing. Knowing these distinctions enhances decision-making and optimizes trade execution in dynamic financial environments.

Comparison Table

| Aspect | Algorithmic Arbitrage | Volatility Trading |

|---|---|---|

| Definition | Automated trading exploiting price differences across markets or instruments | Trading based on forecasted or actual changes in market volatility |

| Strategy | Simultaneous buying and selling to capture risk-free profits | Using options, futures, or volatility indexes to profit from volatility movements |

| Risk Level | Low to moderate; relies on quick execution and minimal market exposure | Moderate to high; influenced by sudden volatility spikes or drops |

| Tools & Technology | High-frequency trading algorithms, real-time market data, automated execution | Options pricing models (e.g., Black-Scholes), volatility forecasting tools |

| Typical Instruments | Equities, futures, forex pairs, ETFs | Options, VIX futures, volatility ETFs |

| Profit Source | Price inefficiencies between markets or securities | Changes in implied or realized volatility |

| Time Horizon | Milliseconds to minutes | Days to weeks |

Which is better?

Algorithmic arbitrage leverages high-frequency algorithms to exploit price discrepancies across different markets, offering reduced risk and increased execution speed. Volatility trading focuses on capitalizing on price fluctuations and market unpredictability using derivatives like options, which can generate high returns but involve greater risk exposure. The choice depends on an investor's risk tolerance, trading infrastructure, and market conditions, with arbitrage favoring stability and volatility trading suiting aggressive strategies.

Connection

Algorithmic arbitrage leverages advanced algorithms to identify and exploit price discrepancies across multiple markets, while volatility trading focuses on capitalizing on price fluctuations. The connection lies in the use of real-time data analysis and automated execution systems to react swiftly to market inefficiencies caused by volatility. High-frequency trading platforms integrate both strategies to optimize profit opportunities through rapid, precise trade execution during volatile market conditions.

Key Terms

**Volatility Trading:**

Volatility trading exploits price fluctuations in options and other derivatives to profit from market uncertainty and shifts in implied volatility, using tools like the VIX index and options Greeks such as Vega. Key strategies include straddles, strangles, and volatility spreads that capitalize on volatility spikes or contractions without reliance on price direction. Discover detailed techniques and risk management approaches in volatility trading to enhance your trading performance.

Implied Volatility

Implied volatility plays a critical role in volatility trading by indicating market expectations of future price fluctuations, allowing traders to price options and hedge risk effectively. Algorithmic arbitrage exploits discrepancies in implied volatility across different markets or instruments, leveraging automated systems to execute high-frequency trades that capture price inefficiencies. Explore how mastering implied volatility can enhance your strategies in both volatility trading and algorithmic arbitrage.

Vega

Volatility trading concentrates on exploiting changes in volatility, particularly Vega exposure, which measures sensitivity to volatility fluctuations in options pricing. Algorithmic arbitrage leverages automated strategies to identify and capitalize on price discrepancies across markets, often incorporating Vega-neutral approaches to minimize risk from volatility shifts. Explore how mastering Vega dynamics enhances both volatility trading and algorithmic arbitrage strategies.

Source and External Links

Volatility Trading: Best Strategies & Indicators - Volatility trading involves leveraging the measure of price fluctuation over time, using strategies like trading volatile assets, tracking volatility changes, and incorporating volatility-based indicators across markets such as shares, forex, and commodities.

Volatility Trading - The VIX Index measures expected 30-day volatility of the US stock market, shows an inverse correlation with the S&P 500, is mean-reverting, and its futures and options serve as tools to hedge or manage risk but are not suited for long-term buy-and-hold strategies.

Volatility Trading by Euan Sinclair - This resource explores detailed volatility measurement methods, forecasting volatility, and sophisticated trading strategies based on volatility's mean-reversion and sizing models, emphasizing systematic approaches to gain an edge in options and derivatives trading.

dowidth.com

dowidth.com