Options flow data provides real-time insights into market sentiment by tracking large, unusual options trades, often indicating institutional activity and potential price movements. Dark pool data reveals hidden liquidity and large block trades executed away from public exchanges, offering a behind-the-scenes view of market dynamics that traditional data may miss. Explore the nuances of options flow versus dark pool data to enhance your trading strategies and market understanding.

Why it is important

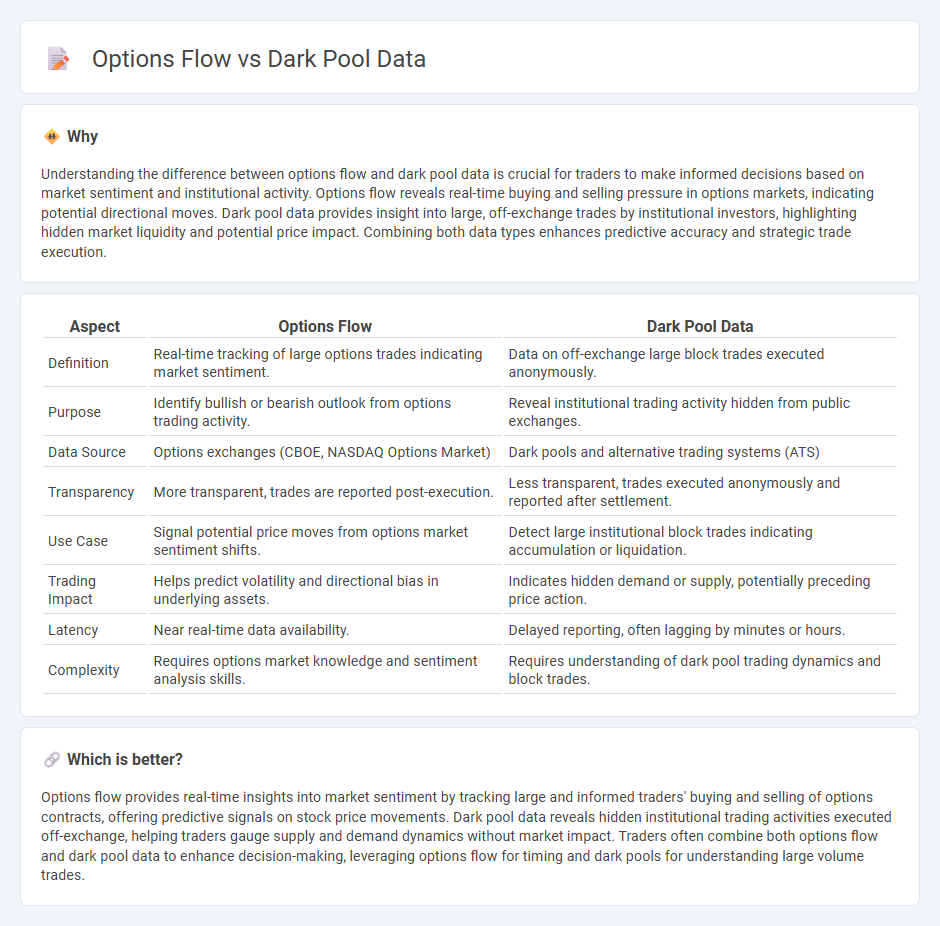

Understanding the difference between options flow and dark pool data is crucial for traders to make informed decisions based on market sentiment and institutional activity. Options flow reveals real-time buying and selling pressure in options markets, indicating potential directional moves. Dark pool data provides insight into large, off-exchange trades by institutional investors, highlighting hidden market liquidity and potential price impact. Combining both data types enhances predictive accuracy and strategic trade execution.

Comparison Table

| Aspect | Options Flow | Dark Pool Data |

|---|---|---|

| Definition | Real-time tracking of large options trades indicating market sentiment. | Data on off-exchange large block trades executed anonymously. |

| Purpose | Identify bullish or bearish outlook from options trading activity. | Reveal institutional trading activity hidden from public exchanges. |

| Data Source | Options exchanges (CBOE, NASDAQ Options Market) | Dark pools and alternative trading systems (ATS) |

| Transparency | More transparent, trades are reported post-execution. | Less transparent, trades executed anonymously and reported after settlement. |

| Use Case | Signal potential price moves from options market sentiment shifts. | Detect large institutional block trades indicating accumulation or liquidation. |

| Trading Impact | Helps predict volatility and directional bias in underlying assets. | Indicates hidden demand or supply, potentially preceding price action. |

| Latency | Near real-time data availability. | Delayed reporting, often lagging by minutes or hours. |

| Complexity | Requires options market knowledge and sentiment analysis skills. | Requires understanding of dark pool trading dynamics and block trades. |

Which is better?

Options flow provides real-time insights into market sentiment by tracking large and informed traders' buying and selling of options contracts, offering predictive signals on stock price movements. Dark pool data reveals hidden institutional trading activities executed off-exchange, helping traders gauge supply and demand dynamics without market impact. Traders often combine both options flow and dark pool data to enhance decision-making, leveraging options flow for timing and dark pools for understanding large volume trades.

Connection

Options flow and dark pool data reveal hidden market sentiment by tracking large, non-public trades often executed by institutional investors. Analyzing options flow helps identify unusual buying or selling activities, while dark pool data uncovers opaque block trades that influence price movements before they appear on public exchanges. Combining these insights enhances traders' ability to predict market direction and spot potential price volatility.

Key Terms

Liquidity

Dark pool data reveals hidden liquidity by capturing large block trades executed away from public exchanges, providing insights into institutional activity and market sentiment. Options flow highlights real-time trading interest and hedging strategies through options contracts, indicating potential price movements and volatility. Explore these data sources to deepen your understanding of liquidity dynamics and enhance trading decisions.

Order Flow

Dark pool data reveals large block trades executed away from public exchanges, offering insights into institutional buying and selling pressure hidden from the open market. Options flow highlights real-time trade activity in the derivatives market, showcasing bullish or bearish sentiment through volume, open interest, and unusual trades that often precede significant price moves. Explore how combining dark pool data with options flow can enhance understanding of order flow dynamics and improve trading strategies.

Transparency

Dark pool data provides insights into large, non-public equity trades executed away from traditional exchanges, revealing hidden market sentiment and institutional activity. Options flow tracks the real-time buying and selling of options contracts, offering transparency on market participants' expectations and potential price movements. Explore how combining dark pool data and options flow enhances transparency for smarter trading decisions.

Source and External Links

Dark Pool Transactions | How to See Dark Pool Trades - Dark pool data is private and hides large trades from public order books, making it difficult to monitor in real-time, but platforms like Bookmap allow traders to detect unusual market activity indicating dark pool trades by analyzing liquidity shifts and heatmaps.

Why, How, and Where to Get Dark Pool Data - Over 50% of trading happens off-exchange in dark pools, and dark pool data can be accessed via licensed feeds from vendors like Bloomberg or more affordable providers offering APIs, websocket, and bulk downloads for real-time usage.

Can You Swim in a Dark Pool? - Dark pools allow institutional investors to execute large trades anonymously to avoid price impact, but they reduce market transparency and do not contribute to price discovery compared to traditional exchanges.

dowidth.com

dowidth.com