Synthetic positions replicate the payoff of actual options using combinations of long and short options or underlying assets, providing traders with flexible risk and return profiles without owning the underlying security. Iron condors are advanced, neutral trading strategies involving four options contracts that profit from low volatility and time decay within a defined price range. Explore how these strategies differ in risk management and market outlook to enhance your trading approach.

Why it is important

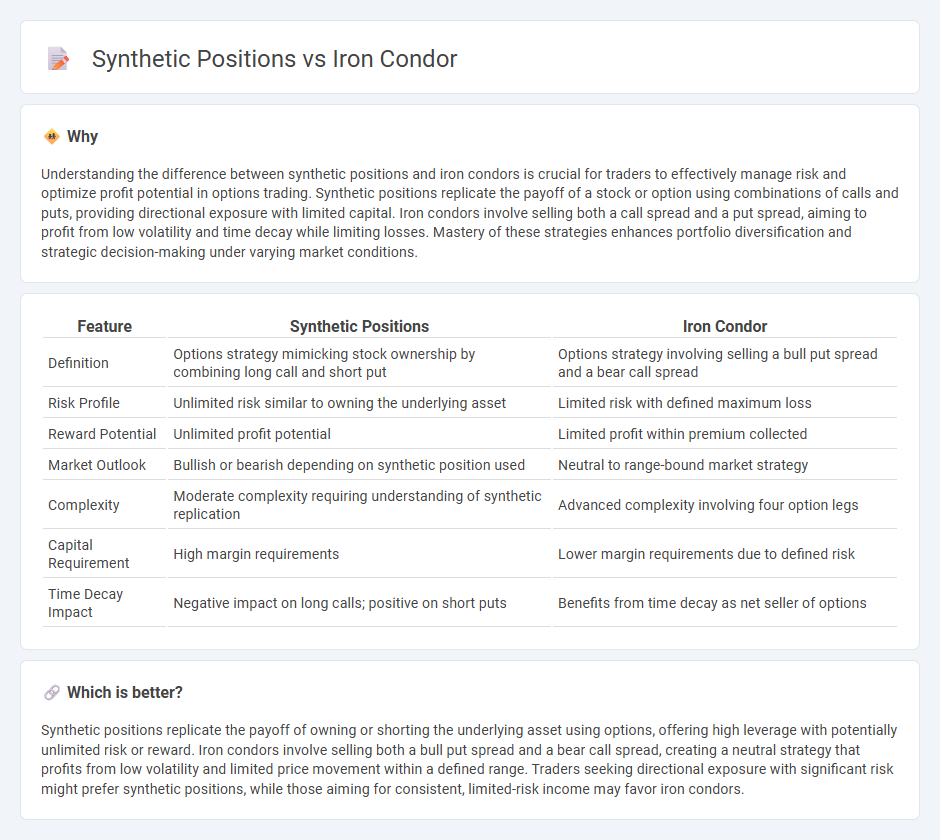

Understanding the difference between synthetic positions and iron condors is crucial for traders to effectively manage risk and optimize profit potential in options trading. Synthetic positions replicate the payoff of a stock or option using combinations of calls and puts, providing directional exposure with limited capital. Iron condors involve selling both a call spread and a put spread, aiming to profit from low volatility and time decay while limiting losses. Mastery of these strategies enhances portfolio diversification and strategic decision-making under varying market conditions.

Comparison Table

| Feature | Synthetic Positions | Iron Condor |

|---|---|---|

| Definition | Options strategy mimicking stock ownership by combining long call and short put | Options strategy involving selling a bull put spread and a bear call spread |

| Risk Profile | Unlimited risk similar to owning the underlying asset | Limited risk with defined maximum loss |

| Reward Potential | Unlimited profit potential | Limited profit within premium collected |

| Market Outlook | Bullish or bearish depending on synthetic position used | Neutral to range-bound market strategy |

| Complexity | Moderate complexity requiring understanding of synthetic replication | Advanced complexity involving four option legs |

| Capital Requirement | High margin requirements | Lower margin requirements due to defined risk |

| Time Decay Impact | Negative impact on long calls; positive on short puts | Benefits from time decay as net seller of options |

Which is better?

Synthetic positions replicate the payoff of owning or shorting the underlying asset using options, offering high leverage with potentially unlimited risk or reward. Iron condors involve selling both a bull put spread and a bear call spread, creating a neutral strategy that profits from low volatility and limited price movement within a defined range. Traders seeking directional exposure with significant risk might prefer synthetic positions, while those aiming for consistent, limited-risk income may favor iron condors.

Connection

Synthetic positions replicate the payoff of owning the underlying asset by combining options, typically involving long and short calls or puts at the same strike price and expiration. An iron condor strategy involves selling an out-of-the-money call spread and put spread simultaneously, creating a range-bound profit zone with limited risk. Both synthetic positions and iron condors utilize options to manage risk and leverage directional or neutral market views, making them essential tools for advanced trading strategies.

Key Terms

Risk profile

An iron condor option strategy features limited risk and limited profit potential by selling an out-of-the-money call spread and put spread simultaneously, enclosing the price range in which the trader expects the underlying asset to remain. Synthetic positions, such as a synthetic long stock created using options, replicate the risk and reward of holding the stock itself, exposing the trader to theoretically unlimited risk and potential reward. Explore more detailed comparisons of risk profiles and strategic uses to optimize your options trading.

Strike selection

Iron condor strike selection involves choosing out-of-the-money calls and puts to capture premium with limited risk, typically aiming for a range where the underlying is unlikely to breach. Synthetic positions require pairing options to mimic a stock position, focusing on strikes that balance delta and desired exposure, often close to the money for increased directional bias. Explore more to understand how strike selection influences risk management and profit potential in these strategies.

Margin requirements

Iron condor strategies typically require lower margin because they involve both buying and selling options that offset risk, limiting potential losses and capital exposure. Synthetic positions, created by combining options to mimic underlying assets, often demand higher margin due to increased risk and potential for unlimited loss. Explore detailed margin requirement comparisons and risk profiles to optimize your options trading strategy.

Source and External Links

Iron Condor options strategy - The iron condor is a limited-risk, limited-profit options strategy that profits from low volatility and generates a credit premium by combining out-of-the-money put and call spreads, aiming for the underlying to remain within a set price range until expiration.

Iron Condor Options Trading Strategy - This strategy is directionally neutral and defined risk, consisting of a short put credit spread and a short call credit spread executed simultaneously, profiting when the stock trades within a range and benefiting from time decay and falling implied volatility.

Iron Condors & Butterflies Explained - Iron condors involve selling two out-of-the-money credit spreads, with profit coming from premiums if options expire worthless; risk is limited by the difference between strikes less premium received, making it a safer alternative to a short strangle.

dowidth.com

dowidth.com