Delta neutral strategy involves creating a portfolio where the overall delta value, measuring sensitivity to price changes in the underlying asset, is zero, minimizing directional market risk. Pairs trading focuses on exploiting relative price movements between two correlated securities by going long on the underperforming asset and short on the outperforming one, aiming for profit regardless of market direction. Explore in-depth analysis and examples to understand how these strategies can enhance trading performance.

Why it is important

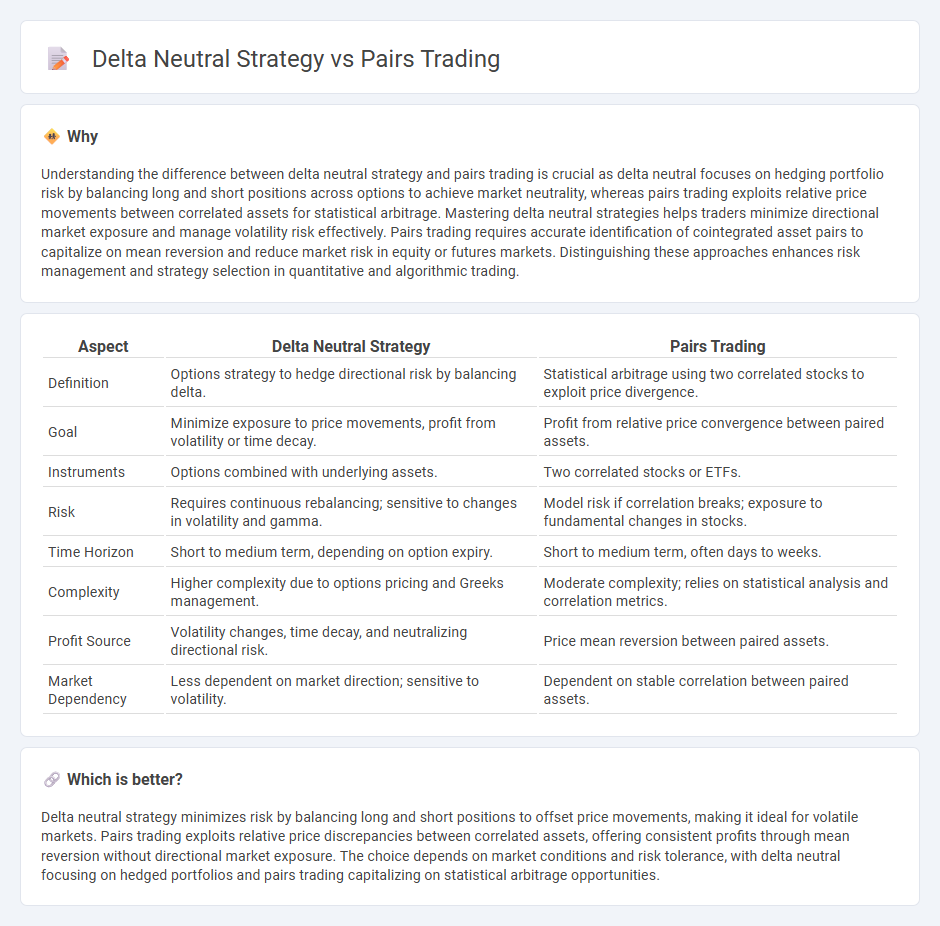

Understanding the difference between delta neutral strategy and pairs trading is crucial as delta neutral focuses on hedging portfolio risk by balancing long and short positions across options to achieve market neutrality, whereas pairs trading exploits relative price movements between correlated assets for statistical arbitrage. Mastering delta neutral strategies helps traders minimize directional market exposure and manage volatility risk effectively. Pairs trading requires accurate identification of cointegrated asset pairs to capitalize on mean reversion and reduce market risk in equity or futures markets. Distinguishing these approaches enhances risk management and strategy selection in quantitative and algorithmic trading.

Comparison Table

| Aspect | Delta Neutral Strategy | Pairs Trading |

|---|---|---|

| Definition | Options strategy to hedge directional risk by balancing delta. | Statistical arbitrage using two correlated stocks to exploit price divergence. |

| Goal | Minimize exposure to price movements, profit from volatility or time decay. | Profit from relative price convergence between paired assets. |

| Instruments | Options combined with underlying assets. | Two correlated stocks or ETFs. |

| Risk | Requires continuous rebalancing; sensitive to changes in volatility and gamma. | Model risk if correlation breaks; exposure to fundamental changes in stocks. |

| Time Horizon | Short to medium term, depending on option expiry. | Short to medium term, often days to weeks. |

| Complexity | Higher complexity due to options pricing and Greeks management. | Moderate complexity; relies on statistical analysis and correlation metrics. |

| Profit Source | Volatility changes, time decay, and neutralizing directional risk. | Price mean reversion between paired assets. |

| Market Dependency | Less dependent on market direction; sensitive to volatility. | Dependent on stable correlation between paired assets. |

Which is better?

Delta neutral strategy minimizes risk by balancing long and short positions to offset price movements, making it ideal for volatile markets. Pairs trading exploits relative price discrepancies between correlated assets, offering consistent profits through mean reversion without directional market exposure. The choice depends on market conditions and risk tolerance, with delta neutral focusing on hedged portfolios and pairs trading capitalizing on statistical arbitrage opportunities.

Connection

Delta neutral strategy and pairs trading both aim to minimize market risk by balancing positions in correlated assets. Delta neutral strategies adjust option and stock holdings to offset price movements, while pairs trading exploits the relative price divergence between two historically correlated stocks. Together, these approaches use statistical arbitrage to maintain market neutrality and generate profits regardless of overall market direction.

Key Terms

**Pairs Trading:**

Pairs trading capitalizes on the statistical correlation between two historically related assets, exploiting temporary divergences from their typical price relationship to generate profits. This market-neutral approach reduces exposure to directional market risk by simultaneously buying undervalued and selling overvalued securities within a matched pair. Explore our detailed guide to harness the full potential of pairs trading strategies and enhance your portfolio's risk-adjusted returns.

Cointegration

Pairs trading relies on cointegration to identify statistically linked asset pairs with mean-reverting price spreads, enabling traders to profit from temporary divergences. Delta neutral strategies hedge directional market risk by balancing positive and negative delta positions, but may or may not incorporate cointegration depending on the specific approach. Explore the nuances of cointegration's role in pairs trading versus delta neutral setups to enhance your market strategies.

Spread

Pairs trading involves taking long and short positions in two correlated assets to capitalize on the spread's mean reversion, aiming to profit from price divergence while maintaining market neutrality. The delta neutral strategy focuses on balancing options and underlying asset positions to maintain minimal directional market risk, often using the spread between option prices and the underlying to hedge. Explore more about optimizing spread management techniques in pairs trading and delta neutral strategies for enhanced portfolio performance.

Source and External Links

Pairs trade - Wikipedia - Pairs trading is a market neutral strategy that profits from the convergence of price spreads between two historically correlated securities by shorting the outperforming and going long the underperforming security, pioneered in the 1980s and categorized as statistical arbitrage.

What Is Pairs Trading? - Fidelity - Pairs trading identifies two correlated financial instruments to exploit temporary divergences in their price relationship using statistical and fundamental analysis, aiming to profit from the eventual correction of this imbalance.

The Comprehensive Introduction to Pairs Trading - Pairs trading involves taking a long position in one asset and short in a co-moving asset, betting on price convergence without forecasting future market direction, leveraging the mean-reverting spread between them.

dowidth.com

dowidth.com