Options flow reveals real-time trading activity through the volume and direction of option contracts, indicating institutional sentiment and potential price movements. Market breadth measures the overall health of the stock market by analyzing the number of advancing versus declining stocks, helping investors gauge market momentum and strength. Explore these tools further to enhance your trading strategy and market insight.

Why it is important

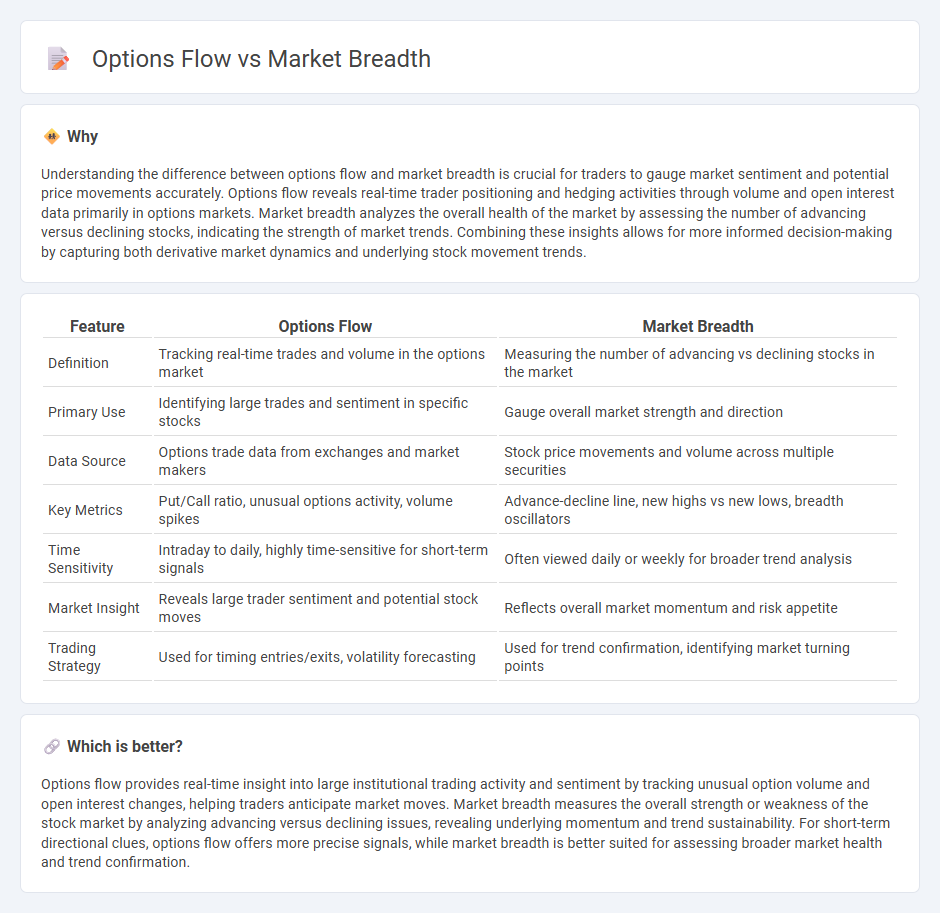

Understanding the difference between options flow and market breadth is crucial for traders to gauge market sentiment and potential price movements accurately. Options flow reveals real-time trader positioning and hedging activities through volume and open interest data primarily in options markets. Market breadth analyzes the overall health of the market by assessing the number of advancing versus declining stocks, indicating the strength of market trends. Combining these insights allows for more informed decision-making by capturing both derivative market dynamics and underlying stock movement trends.

Comparison Table

| Feature | Options Flow | Market Breadth |

|---|---|---|

| Definition | Tracking real-time trades and volume in the options market | Measuring the number of advancing vs declining stocks in the market |

| Primary Use | Identifying large trades and sentiment in specific stocks | Gauge overall market strength and direction |

| Data Source | Options trade data from exchanges and market makers | Stock price movements and volume across multiple securities |

| Key Metrics | Put/Call ratio, unusual options activity, volume spikes | Advance-decline line, new highs vs new lows, breadth oscillators |

| Time Sensitivity | Intraday to daily, highly time-sensitive for short-term signals | Often viewed daily or weekly for broader trend analysis |

| Market Insight | Reveals large trader sentiment and potential stock moves | Reflects overall market momentum and risk appetite |

| Trading Strategy | Used for timing entries/exits, volatility forecasting | Used for trend confirmation, identifying market turning points |

Which is better?

Options flow provides real-time insight into large institutional trading activity and sentiment by tracking unusual option volume and open interest changes, helping traders anticipate market moves. Market breadth measures the overall strength or weakness of the stock market by analyzing advancing versus declining issues, revealing underlying momentum and trend sustainability. For short-term directional clues, options flow offers more precise signals, while market breadth is better suited for assessing broader market health and trend confirmation.

Connection

Options flow reflects real-time investor sentiment and trading activity in the derivatives market, providing insights into potential price movements. Market breadth analyzes the overall market's strength by measuring the number of advancing versus declining stocks, revealing the underlying momentum. Monitoring options flow alongside market breadth indicators helps traders gauge market direction, anticipate trend reversals, and identify high-probability trading opportunities.

Key Terms

Advancers/Decliners Ratio

The Advancers/Decliners Ratio provides a clear snapshot of market breadth by comparing the number of stocks advancing versus declining, reflecting overall market sentiment and strength. Options flow data offers real-time insights into trader sentiment and potential price movements by tracking large volume call and put options activity. Explore how integrating Advancers/Decliners Ratio with options flow analysis can enhance your trading strategy and market timing accuracy.

Put/Call Ratio

Market breadth evaluates the overall health of the stock market by measuring the number of advancing versus declining stocks, providing insight into the strength of market trends. Options flow, particularly the Put/Call Ratio, highlights investor sentiment by comparing the volume of put options to call options, signaling potential bearish or bullish outlooks. Explore detailed analyses of these metrics to enhance your trading strategies and market predictions.

Volume

Market breadth measures the number of advancing versus declining stocks, providing insight into overall market sentiment and strength. Options flow tracks the volume and sentiment of option trades, revealing where significant market participants place their bets. Explore how combining market breadth data with options volume analysis can enhance your trading strategy insights.

Source and External Links

Market Breadth | Library of Technical & Fundamental ... - Market breadth analysis evaluates how many stocks in an index are advancing versus declining to determine the strength or weakness of the overall market trend, helping identify if a market move is broad-based or driven by few stocks.

Market Breadth - Definition, Indicators, Types - Market breadth refers to technical indicators that assess price movements of stocks within an index, used to gauge overall market health and provide early signals of potential trend reversals.

Breadth Check: Strength and Weakness Trend Tracker - Market breadth acts as a sentiment gauge by measuring the extent of participation across stocks in market rallies or declines, indicating whether a market move is broad and healthy or narrow and vulnerable.

dowidth.com

dowidth.com