Smart Money Concepts focus on identifying institutional investor intentions through price action and order flow patterns, while Volume Spread Analysis examines the relationship between volume and price spread to gauge market strength and potential reversals. Both methodologies provide critical insights into market dynamics by analyzing supply and demand forces with a focus on different technical indicators. Explore these approaches to enhance your trading strategy and gain a deeper understanding of market behavior.

Why it is important

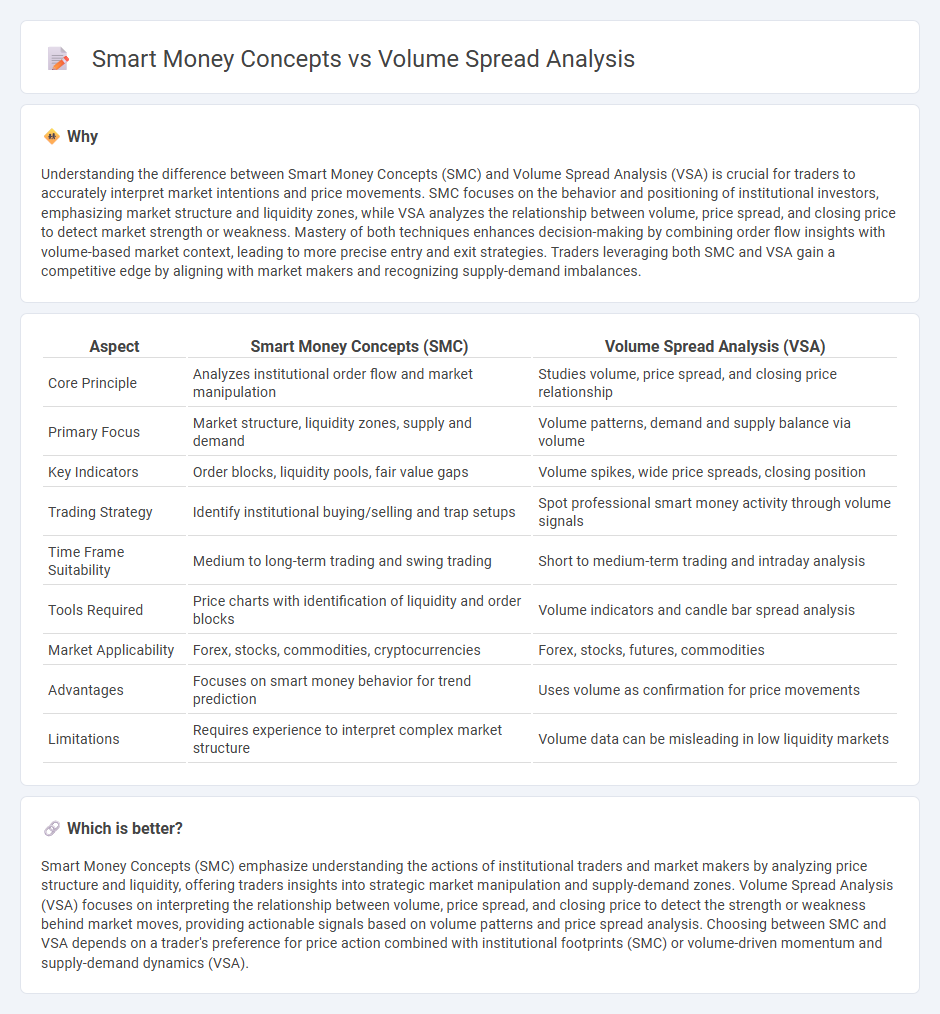

Understanding the difference between Smart Money Concepts (SMC) and Volume Spread Analysis (VSA) is crucial for traders to accurately interpret market intentions and price movements. SMC focuses on the behavior and positioning of institutional investors, emphasizing market structure and liquidity zones, while VSA analyzes the relationship between volume, price spread, and closing price to detect market strength or weakness. Mastery of both techniques enhances decision-making by combining order flow insights with volume-based market context, leading to more precise entry and exit strategies. Traders leveraging both SMC and VSA gain a competitive edge by aligning with market makers and recognizing supply-demand imbalances.

Comparison Table

| Aspect | Smart Money Concepts (SMC) | Volume Spread Analysis (VSA) |

|---|---|---|

| Core Principle | Analyzes institutional order flow and market manipulation | Studies volume, price spread, and closing price relationship |

| Primary Focus | Market structure, liquidity zones, supply and demand | Volume patterns, demand and supply balance via volume |

| Key Indicators | Order blocks, liquidity pools, fair value gaps | Volume spikes, wide price spreads, closing position |

| Trading Strategy | Identify institutional buying/selling and trap setups | Spot professional smart money activity through volume signals |

| Time Frame Suitability | Medium to long-term trading and swing trading | Short to medium-term trading and intraday analysis |

| Tools Required | Price charts with identification of liquidity and order blocks | Volume indicators and candle bar spread analysis |

| Market Applicability | Forex, stocks, commodities, cryptocurrencies | Forex, stocks, futures, commodities |

| Advantages | Focuses on smart money behavior for trend prediction | Uses volume as confirmation for price movements |

| Limitations | Requires experience to interpret complex market structure | Volume data can be misleading in low liquidity markets |

Which is better?

Smart Money Concepts (SMC) emphasize understanding the actions of institutional traders and market makers by analyzing price structure and liquidity, offering traders insights into strategic market manipulation and supply-demand zones. Volume Spread Analysis (VSA) focuses on interpreting the relationship between volume, price spread, and closing price to detect the strength or weakness behind market moves, providing actionable signals based on volume patterns and price spread analysis. Choosing between SMC and VSA depends on a trader's preference for price action combined with institutional footprints (SMC) or volume-driven momentum and supply-demand dynamics (VSA).

Connection

Smart Money Concepts focus on identifying the behavior and intentions of institutional traders, while Volume Spread Analysis (VSA) examines price action and trading volume to reveal market strength or weakness. Together, they provide traders with insights into market manipulation and accumulation or distribution phases, enhancing the accuracy of trade entries and exits. This combination helps uncover underlying supply and demand dynamics driven by professional money flows.

Key Terms

Volume Spread Analysis (VSA):

Volume Spread Analysis (VSA) examines the relationship between volume, price spread, and closing price to identify market strength or weakness by detecting buying and selling pressure. Unlike Smart Money Concepts, which emphasize institutional order flow and market manipulation, VSA focuses on analyzing supply and demand dynamics through price and volume interplay. Explore deeper insights into VSA to enhance your market entry and exit strategies effectively.

Volume

Volume Spread Analysis (VSA) emphasizes the relationship between volume, price spread, and closing price to identify market manipulation by smart money, focusing on imbalances between supply and demand. Smart Money Concepts (SMC) utilize volume data to track institutional traders' footprints, highlighting areas of liquidity and accumulation or distribution phases. Explore these methodologies further to enhance your market timing and trading precision.

Price Spread

Volume Spread Analysis (VSA) emphasizes the relationship between volume, price spread, and closing price to identify supply and demand imbalances in the market. Smart Money Concepts focus on the behavior of institutional traders by analyzing order flow, liquidity areas, and price spread to predict market manipulation and trend reversals. Explore in-depth insights into how price spread acts as a critical indicator in both trading strategies to enhance your market analysis skills.

Source and External Links

Volume Spread Analysis [TANHEF] - TradingView - Volume Spread Analysis (VSA) is a tool that interprets volume and price spread together to identify market trends and intentions, based on three core laws: supply and demand, cause and effect, and effort versus result, developed from Richard Wyckoff's principles.

Understanding Volume Spread Analysis For Trading - Timothy Sykes - VSA uses volume, price range, and closing price per candle to detect phases like accumulation (smart money buying) and distribution (smart money selling), helping traders recognize market shifts and the balance of supply and demand.

Volume Spread Analysis: Master Smart Money Moves ... - TradeFundrr - VSA reveals institutional trading behavior by observing volume patterns, price spreads, and close locations, distinguishing accumulation and distribution phases with specific volume and price spread signals reflecting smart money activity.

dowidth.com

dowidth.com